An Analysis Of The Global Generics Market — Trends & Opportunities

By Alan Sheppard, Principal - Global Generics, IMS Health

For several years now, the generic medicines market has grown at a faster rate than the total pharmaceutical market. This recent growth was driven by what we all know as the “patent cliff,” whereby many blockbuster molecules lost protection, generating a huge opportunity for the generic medicines industry. This trend peaked in 2012, and since then there have been fewer major patent expiries (several of which were respiratory products associated with a device) and, of course, the loss of exclusivity for biological molecules, which has driven the biosimilar market. This, in turn, has compelled pharmaceutical companies to have much broader numbers of development candidates, in order to push forward with refreshing product portfolios and maintaining revenue growth. For some, this has meant partnering with contract research and manufacturing organizations (CROs and CMOs) to meet the breadth and complexity required for the development of the new product pipeline. Procurement of external APIs, rather than vertically integrated programs, has added to the challenge — at a time when cost controls are of paramount importance.

Despite these challenges, the generic medicines industry has adapted its capabilities in formulation and delivery technology to open up new avenues of opportunity. At the same time, we have seen the introduction of several new molecules from R&D, which has rejuvenated the pipeline of many major pharmaceutical companies — the “return of the blockbusters,” as it has been said. Thus, future development programs for the generic industry look positive, with significant opportunities across a wide range of therapies. Specialization and new technology will be required in certain areas to successfully deliver generic alternatives in the fields of oncology and hepatitis, but to date this has not presented an insurmountable barrier for the industry.

Pharmerging vs. Developed Markets

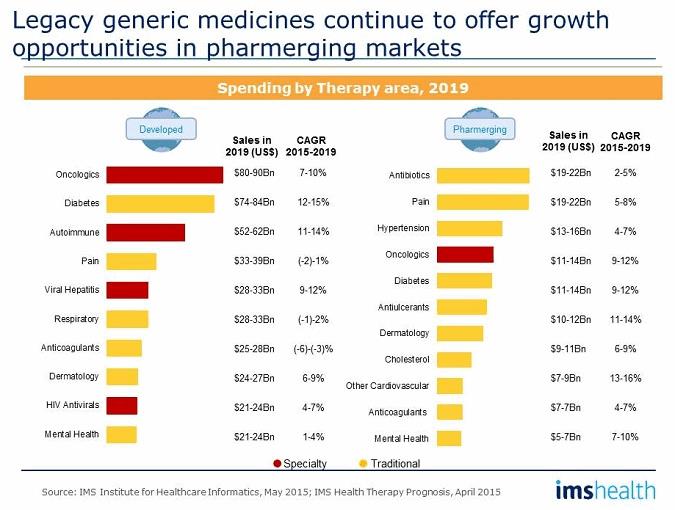

For those companies whose focus has been on small chemical molecules, the “pharmerging” markets continue to offer growth opportunities. In these markets, legacy products for the treatment of infection, pain, cardiovascular disease, and a host of other chronic primary care indications are the foundation of a generic portfolio. This is in contrast to developed markets, where the focus is on speciality areas such as oncology, autoimmune disease, and most recently hepatitis therapies. In developed markets, legacy products are under increasing competition, based on pricing and new clinical alternatives. For the pharmerging markets, affordability and access to medicines are key influencers, and with the expanded availability of clinical support and insurance schemes, we have witnessed new market opportunities open up for these older medicines. Future forecasts reflect a continuing trend, as shown in the table below.

In the developed market forecasts, there is little or no growth in the therapy areas of pain, respiratory, anticoagulants, and mental health, whereas oncology, diabetes, and autoimmune therapies show a continued focus and expenditure on specialty medicines. It should be noted that the viral hepatitis market has sprung from a low base to a major contributor in a very short span of time and is expected to continue to grow. On a separate note, the importance of anti-diabetic therapy is relevant to all markets, and the availability of generic medicines across the spectrum of alternative therapies will play a vital role in the cost-effective management of this chronic indication.

Market-Specific Analysis

Focussing in on specific market trends and therapy usage can provide indications of future needs for generic medicines. Japan, for instance, mirrors other developed markets with significant usage of both sofosbuvir and the combination of sofosbuvir/ledipasvir. Following these exceptional items comes an increased use of bevacizumab, but then expenditure is driven by primary care products rosuvastatin, clopidogrel, and esomeprazole. Completing the top 10 products are pregabalin, olmesartan/medoxomil, infliximab, and ketoprofen. The generic market is forecasted to be worth $12.5 billion by 2020. Interestingly, among the top 10 suppliers of pharmaceuticals to Japan, only four are Japanese companies, with Pfizer topping the list, followed by Takeda and Daiichi Sankyo.

In Europe the position is quite different, with a dominance of biological therapies in the top 10 products. This reflects the importance of the biosimilar industry in contributing to cost savings across a range of specialty biologic therapies that currently occupy eight of the top 10 places. The recent introduction of monoclonal antibody biosimilars has ignited a flurry of interest and changes in the positioning of these products, to the benefit of payers and patients. Although biosimilars remain a major area of interest, there have been a number of successful launches of small chemical molecules, heralding the return of the blockbuster status for some of these products. Although many are specialty products, including fingolimod, rivaroxaban, palperidone, and abiraterone, these will be the subject of development programmes and significant generic medicine launches over the longer term.

China remains an area of interest for many international companies, but with mixed fortunes. Although market growth rates have fallen (down from double-digit growth to around 6% to 8% CAGR for the next 5 years) the sheer size and future potential for this market means that it will feature in strategic growth planning for many years to come. Holding the rank of the second largest market in the world by 2020 (even excluding the traditional Chinese medicines sector), it cannot be ignored. The success of the government reform plans and access to medicines will, of course, be the deciding factor. New products are expected to enter the market earlier and cost control — with pricing as a major feature — will continue. This environment favors generic medicines, with a pool of new patients gaining access to medicines for the first time across a wide range of therapies. Generic medicines for the treatment of cardiovascular and respiratory disease, alongside diabetes treatment (it is estimated that China accounts for 25% of the world’s diabetic population), will feature strongly. Local generic companies dominate and compete aggressively on pricing.

North America is led by the U.S. market, which in 2016 is forecasted to reach $472.9 billion in sales. Growth is forecast at a CAGR of 7.6% for the next 5 years (as compared to 4.5% for Canada), with new product launches fuelling the growth. Interestingly, small molecule patent expiries will have a larger impact during the next five years ($105.9 billion from 2016 to 2020) than during the previous five ($87.2 billion from 2011 to 2015), on an absolute U.S. dollar basis. The annual impact will be $17.5 billion in 2016, rising to $23.2 billion in 2017 and $30.6 billion in 2018, as a range of major brands lose exclusivity. Thereafter, the impact moderates somewhat, falling to $20.1 billion and $13.9 billion in 2019 and 2020, respectively. The generic market is forecasted to reach $112 billion by 2020 (excluding discounts and rebates). With generics making up almost 90% of the products used, this is a very crowded and competitive market composed of manufacturers from across the globe.

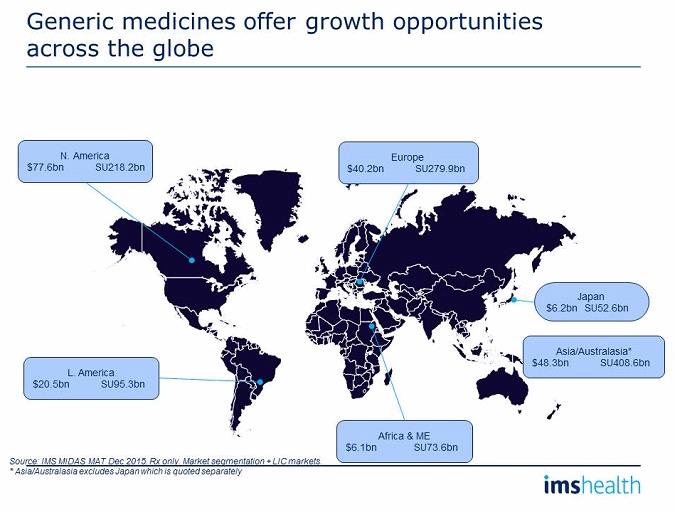

Opportunities for generics, therefore, exist across the globe, with an increasing demand for affordable, safe, and effective medicines. Each region has specific needs and opportunities that will reflect the particular, and sometimes peculiar, requirements at a country level. North America remains the most lucrative region, with Europe probably the most competitive of the developed markets. The highest volume consumption is in the Asia/Australasia region, but this is also where the lowest revenue per unit is achieved, alongside Africa and the Middle East. Japan is finally becoming a significant user of generic medicines, and the government’s objective of targeting 80% generic utilization of multisourced drugs by 2021 (up from just over 40% in 2015) could well be achieved ahead of plan. Latin America remains a growth market but with local companies dominating market shares.

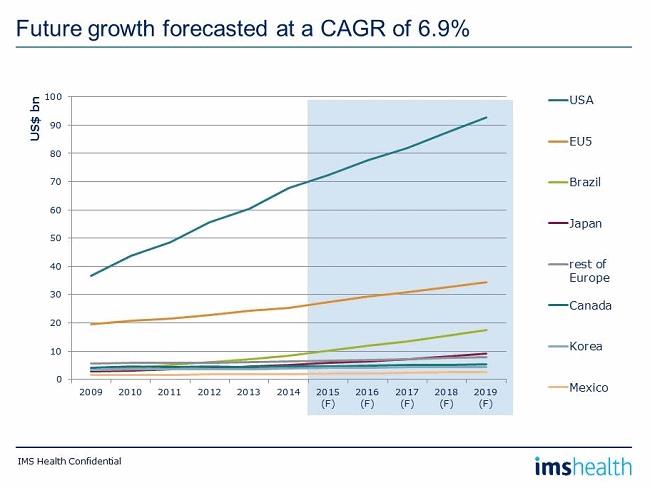

Generic medicines are forecast by IMS Health to grow at a CAGR of 6.9%, with the U.S. leading the way in the selected group of markets. Europe is still beset by economic issues, with price controls and increasing competition continuing to adversely affect the market. As mentioned, Japan is making good progress with its programme to increase generic usage, and Brazil is still an attractive market for generic medicines.

Opportunities For Generics Abound

In conclusion, the growth opportunities for generic medicines remain strong and positive. The need to control costs remains a challenge for healthcare providers around the world. The availability of cost-effective, safe generic alternatives offers a tool that can be used to balance access to and affordability of many major therapies required to maintain a healthy population of patients across multiple disease areas.

This article will be part of the CPhI 2016 Annual Report, which will be released during the CPhI Worldwide event in Barcelona (October 4-6, 2016).

About The Author:

Alan Sheppard has over 40 years of extensive experience in the healthcare industry, working with innovator R&D, generic, and OTC companies, as well as with government, law firms, venture capital companies, and industry associations.

Alan Sheppard has over 40 years of extensive experience in the healthcare industry, working with innovator R&D, generic, and OTC companies, as well as with government, law firms, venture capital companies, and industry associations.

Alan is responsible for developing services provided to the industry and its associations on generic medicines and biosimilars through consulting, information, and market analyses.

Previous senior positions include executive VP - Europe for Dr Reddy’s, VP of global corporate strategy at Pliva, GM at Rhône-Poulenc Rorer UK, European marketing director at Medeva, and chairman of the Technical Advisory Group for the Access to Medicines Foundation.

Alan is an expert witness on patent litigation and an honorary lecturer at the University of Wales.

About CPhI Worldwide:

CPhI Worldwide, together with co-located events ICSE, InnoPack, P-MEC, and FDF, hosts more than 37,000 visiting pharma professionals over three days. Over 2,500 exhibitors from more than 150 countries gather at the event to network and take advantage of more than 100 free industry seminars. For more information, visit www.cphi.com/europe.