Demand Planning For New Life Science Product Launches

By Leslie Sandberg Orne and Lindsey Acampa, Trinity Partners

Planning for the launch of a new product is one of the most difficult tasks for a forecaster, but accuracy and contingency planning are more important than ever. The forecast provides crucial information to key stakeholders throughout the organization, enabling resource planning and other decision-making for the brand. Moreover, the expectations set in the pre-launch (0-2 years prior) timeframe from a forecasting perspective provide critical bounds for the longitudinal performance of the product, against which it will be judged during launch.

The following key stakeholders use demand forecasts for launching products in different ways:

- Management – to understand appropriate priority to be placed on the product regarding investment decisions.

- Marketing and sales – to match the promotional effort to the expectations for the product and to adjust post-launch if actuals differ from expectations.

- Supply chain – to plan for producing enough product to avoid stock-outs without overproducing and risking E&O (excess and obsolete) inventory.

Accurately forecasting new launches is a tricky endeavor, much more so than strategic planning or in-line brand forecasting. Several factors contribute to the difficulty associated with this exercise: the lack of historical data to trend, unknown marketing and selling execution, as well as unpredictable market access and limited insights from market research. Nonetheless, launch forecasts are intensely scrutinized with close comparison to the actual performance of the product in terms of units and sales on a monthly, weekly, or even daily basis, providing real-time feedback on the accuracy of the forecast very early in launch phase.

The performance of a product in the marketplace results from a combination of several components, each crucial in creating accurate projections.

- Peak Penetration (i.e. market share): As pinpointing an exact number for market share of a new product is a difficult exercise given market unknowns. It is more appropriate to determine a range based on the likely range of clinical parameters for the product profile. Determining the appropriate range for peak penetration of a new product should be based on primary market research with key prescribers, patients, and payers, as well as looking at relevant historical product launches with similar market and product characteristics (i.e., analogs). In-market analogs are often the most appropriate (where they exist) given the similar market environment, prescriber base, and patient dynamics.

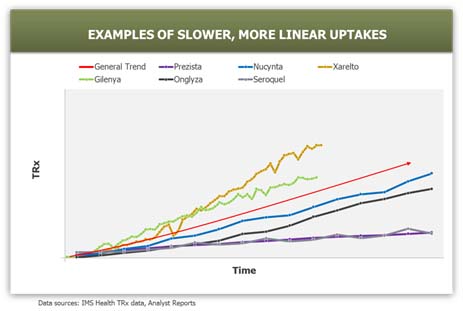

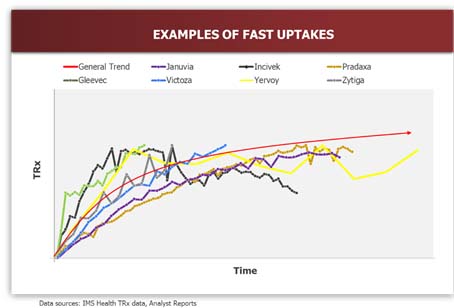

- Time To Peak Penetration (i.e. uptake speed): Duration of uptake has a significant impact on launch-phase planning. Long uptakes (i.e., greater than 4-5 years) are not abnormal, while short uptakes (2-3 years) can be due to pent-up demand for the product due to high unmet need or significant value delivered by the product.

- Uptake Curve Shape: Recent examples suggest that the majority of launched products in the industry follow either a linear or convex uptake shape. Products with no major advantages, unknown risk/benefit ratios, and/or launching into a crowded market achieve slower uptakes. Products with significant advantages that are launching into a market with high unmet needs typically achieve fast (convex) uptakes. S-shaped uptake curves are rare and only occur in the case of a major product-related event, such as approval of a new indication or formulary acceptance. The assumption made on uptake curve shape in the forecast strongly influences the expected trajectory of the product in the first few months or years as it grows towards peak market potential.

In order to improve accuracy in demand planning for launch, it is helpful to understand the main drivers impacting uptake and utilization of a new product, summarized below as the “4Ps”:

- Product Characteristics: The degree of innovation is an intrinsic part of determining market penetration and uptake rate; more is better!

- Physician Behavior: The distribution of treaters (high versus low concentration), impact of product/brand awareness and degree of motivation to utilize new products all impact the rate of new product adoption among physicians.

- Patient Behavior: Patient churn (frequency of switching) and chronicity of treatment (shorter is faster) are proportional to time to peak; patient motivation and awareness of the new product can also impact speed and shape of the curve.

- Payer Behavior: Payer access hurdles as well as the amount of time required to achieve widespread formulary coverage for a given product also impacts the curve shape and speed.

The quantification of these levers can aid in predicting uptake more accurately, as well as providing greater understanding of where uncertainties lie. It is crucial to take these factors into account in demand planning in order to provide the most accurate estimates of future market demand to influence brand planning across stakeholder groups.

In summary, despite the inherent difficulties in projecting the future performance of a product, in the pre-launch (1-2 years prior) and launch (1-2 years after) periods, there are several resources and tools that can be utilized to provide the best chance that the actual forecast will fall within the guardrails set during this period and be the correct basis for the organization’s longer-term planning.

About The Authors

As partner, Leslie Sandberg Orne co-leads the generalist consulting group and is responsible for Trinity's pharmaceutical, biotechnology, and medical device clients. Leslie is an expert in strategic marketing, asset valuation/forecasting and assessments for pipeline and licensing/acquisition opportunities. She has particular strengths in conceptualizing and quantifying complex biopharmaceutical markets and has helped clients identify novel business opportunities to expand their businesses. Leslie has contributed to multiple billion-dollar acquisitions and major brand launches, spanning an array of therapeutic areas including virology, pulmonology, rheumatology, CNS/neurology, metabolics, gastroenterology and oncology/hematology. Leslie graduated summa cum laude and Phi Beta Kappa from Dartmouth College with a BS in Biology.

As partner, Leslie Sandberg Orne co-leads the generalist consulting group and is responsible for Trinity's pharmaceutical, biotechnology, and medical device clients. Leslie is an expert in strategic marketing, asset valuation/forecasting and assessments for pipeline and licensing/acquisition opportunities. She has particular strengths in conceptualizing and quantifying complex biopharmaceutical markets and has helped clients identify novel business opportunities to expand their businesses. Leslie has contributed to multiple billion-dollar acquisitions and major brand launches, spanning an array of therapeutic areas including virology, pulmonology, rheumatology, CNS/neurology, metabolics, gastroenterology and oncology/hematology. Leslie graduated summa cum laude and Phi Beta Kappa from Dartmouth College with a BS in Biology.

Lindsey joined Trinity’s consulting group in August 2007. Since then, she has been involved in a number of projects spanning corporate strategy, licensing and acquisitions, pipeline and portfolio optimization, and brand/launch planning. Her primary areas of expertise include forecasting, primary market research (qualitative and quantitative), and data analysis. Her therapeutic area knowledge encompasses numerous markets, including central nervous system disorders, hematology/oncology, respiratory conditions, endocrine disorders, and cardiovascular disorders. Lindsey is a graduate of Harvard College with a bachelor’s degree in the Biological Sciences.

Lindsey joined Trinity’s consulting group in August 2007. Since then, she has been involved in a number of projects spanning corporate strategy, licensing and acquisitions, pipeline and portfolio optimization, and brand/launch planning. Her primary areas of expertise include forecasting, primary market research (qualitative and quantitative), and data analysis. Her therapeutic area knowledge encompasses numerous markets, including central nervous system disorders, hematology/oncology, respiratory conditions, endocrine disorders, and cardiovascular disorders. Lindsey is a graduate of Harvard College with a bachelor’s degree in the Biological Sciences.