Job Cuts Remain Low Heading Into Final Quarter of 2010

SEPTEMBER ANNOUNCED CUTS UP SLIGHTLY TO 37,151; 113,595 QUARTERLY LAYOFFS FEWEST SINCE 2000

The pace of downsizing remained virtually unchanged in September as employers announced plans to cut 37,151 jobs during the month; a seven percent increase from the 34,768 job cuts reported in August.

The September figure is the second lowest of the year and comes on the heels of the lowest monthly job-cut total since June 2000 (17,241), according to the report released Wednesday by global outplacement consultancy Challenger, Gray & Christmas, Inc. Last month's total was 44 percent lower than the 66,404 job cuts announced in September 2009. For the quarter ending September 30, planned layoffs totaled 113,595, 53 percent fewer than the 240,333 job cuts announced the same period a year ago. The July-September total was 2.5 percent lower than the 116,494 cuts announced in the previous quarter, replacing it as the lowest quarterly job-cut total since the second quarter of 2000 (81,568).

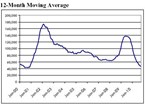

Overall, employers have announced 411,272 job cuts so far this year. That is 64 percent fewer than the 1,136,908 cuts announced by this point in 2009. The twelve-month moving average has now dropped to 46,866, the lowest since November 2000, when it stood at 43,744.

The September total would have been even lower were it not for the ongoing struggles in the government and non-profit sector, which announced another 11,091 job cuts during the month. That is the largest job-cut total for the sector since May (16,697), and brings the year-to-date total to 123,469. The next largest job cut sector is pharmaceutical, which has announced 43,334 cuts this year, including 6,069 in September.

"The low job-cut numbers we are seeing in almost every sector do not necessarily translate into increased hiring. There is hiring going on in the economy, but it is not enough make a discernable dent in the number of unemployed," said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

"Government employers – at the national, state and local levels – are typically big contributors to job creation, not only through their own hiring, but also by purchasing goods and services from the private sector. Unfortunately, this massive part of the economic engine simply is not firing on all pistons. Meanwhile, employers in the private sector have the cash to spend on new equipment and employees, but are waiting for demand to increase enough to warrant the investment," he said.

More business spending may occur in the coming months, according to one survey. In its third-quarter CEO Economic Outlook Survey, the Business Roundtable, an association of chief executive officers from the some of the nation's leading companies, found that 49 percent of its members expect their companies to increase capital expenditures in the next six months. That marks a vast improvement from a year when only 21 percent of CEOs were expecting to increase capital spending.

However, demonstrating just how tenuous the recovery is, the same survey found that 66 percent of CEOs expect their company's sales to increase in the next six months, down from 79 percent the previous quarter, and only 31 percent foresee increased hiring.

"Employers appear poised to hire. Some people have expressed concern that hiring may never take off due to the fact that companies have learned to be leaner and meaner and will simply operate with smaller workforces from now on. However, increased sales will eventually compel companies to hire or risk being unable to meet rising demand. We just are not there, yet," said Challenger.

SOURCE: Challenger, Gray, & Christmas, Inc.