Anticounterfeiting With 2D Code: The Secret Is In The DNA

By Zhong Li, Ph.D., MBA, president, High Throughput Biology Inc.

Are current solutions enough to tackle the growing counterfeit problem?

Counterfeit Drugs: A Growing Problem

Counterfeiting is a significant problem in almost all aspects of the worldwide economy, especially on high-value goods such as prescription drugs, military equipment, electronics, liquor, and cigarettes. For the past 10 years, the Pharmaceutical Security Institute (PSI) has collected data on counterfeiting, illegal diversion, and theft incidents related to pharmaceuticals around the globe and has shown that the number of incidents has jumped 83% between 2005 (1,123 incidents) and 2010 (2,054 incidents). Each incident usually involved large quantities (frequently millions of doses/bottles) of medicine. The United States ranked fifth by the number of total incidents in 2010 (201 incidents), while Asia ranked first with 1,073 incidents. It is widely acknowledged that the number of incidents reported only represents a tiny portion of the worldwide multibillion-dollar counterfeitdrug operations.

Counterfeiting not only escalates in numbers, but also in sophistication. It’s increasingly difficult, even for anticounterfeiting experts, to tell the difference between a counterfeit product and the real one based on label, packaging, and product appearance. Counterfeiters have also caught up with many anticounterfeiting technologies, limiting their effectiveness. Hologram is the perfect example. Since GlaxoSmithKline first used a tamper-evident hologram on its popular Zantac packs in 1989, holograms have been widely deployed by the industry. However, as the technology to make hologram spreads and becomes cheaper, holograms can be duplicated from a hologram-printing machine, which often costs less than $10,000, or from ordering a master hologram from dozens of hologram-making companies throughout the world. In response, hologram providers added advanced features such as scrambled images, micro text, UV-sensitive inks, or other specialized inks to provide second-line authentication for trained examiners equipped with appropriate decoding equipment. However, those features are often undetected by unsuspecting and untrained consumers.

Fortunately, due to effective regulatory systems and market control, current counterfeit drugs exist in a very low proportion and mainly in informal markets in the U.S. It was estimated that the percentage of counterfeit drugs in the legitimate U.S. pharmaceutical supply chain is much less than 1%. However, since billions of prescriptions are filled at pharmacies in the U.S. each year, it is possible that tens of thousands, if not millions, of prescriptions could have been filled with counterfeit drugs. One example came in March 2012, in which FDA announced that counterfeit Avastin was found in the U.S. supply chain. The counterfeit drug allegedly originated from an Egyptian distributor and passed through three distributors in three different countries before reaching a U.S. distributor.

Government Regulation And Industry Response

Alarmed by the increase of counterfeit medicine in recent years, the U.S. government has taken action. In 1988, the Prescription Drug Marketing Act (PDMA) was enacted as an effort to ensure that prescription drug products in the U.S. would be safe and effective, and to avoid an unacceptable risk that counterfeit, adulterated, misbranded, subpotent, or expired drugs were being sold to the American public. Due to delays enforcing PDMA, and the lack of specific traceability requirements in PDMA, several states also acted in recent years to ensure the security of the supply chain at the state level. In 2004, the California Board of Pharmacy passed its Pedigree Law, requiring all pharmaceutical supply-chain partners to pass along electronic pedigree (ePedigree) of a pharmaceutical product at the item level. Florida passed a similar law earlier, though paper-based. There are also signs of convergence on government regulation at the federal and state level (http://www.rxtrace.com/2012/03/california-enforcement-subcommittee-moves-to-require-fdasni. html/#more-2189).

The pharmaceutical industry also undertook several initiatives to curb the introduction of counterfeit drugs into its supply chain. Most pharmaceutical manufacturers have deployed various anticounterfeiting technologies on their high-risk products. Several trade groups that focus on anticounterfeiting have been established, including the Pharmaceutical Security Institute, the Partnership for Safe Medicines, and the Center for Safe Internet Pharmacies.

Different Stakeholders, Different Objectives

Despite the fact that everyone agrees that the safety of the U.S. drug supply chain is a critical issue, progress has been painfully slow on agreeing to and implementing an effective anticounterfeiting strategy. FDA has yet to issue a clear mandate on drug serialization and ePedigree. California was forced to delay the full implementation of its Pedigree Law until 2016. One significant contributing factor is that there are too many players with interdependency, but diverging objectives in this area, making it difficult and time-consuming to reach consensus. It does not help when rapid technological advance renders a once promising anticounterfeiting technology no longer attractive in merely a few years.

Current stakeholders to secure the drug supply chain can be categorized into three groups: the pharmaceutical companies as the manufacturers; the distributors and retail chain drug stores (retailers); and the consumers and the government. As shown in Figure 1, keeping the U.S. drugsupply chain safe is the only goal shared by all groups. However, that goal alone does not provide enough positive return on investment (ROI) to persuade all stakeholders to jump on the bandwagon. Other powerful incentives have to be offered to achieve this important goal.

Figure 1: Objectives for three groups of stakeholders to secure the pharmaceutical supply chain.

The counterfeiting and diversion of drugs represent revenue loss for pharmaceutical companies. Counterfeit drugs also have the potential to damage the brand. As a result, pharmaceutical companies have incentive to tighten controls on the supply chains for their drugs and sourced materials, so that they can protect their profit margins, their brands, and the public health. Having a serialized tracking system also gives the pharmaceutical companies product visibility throughout the supply chain, thus enabling them to respond timely to market demand, minimize inventory, and manage reverse logistics effectively. The drug distributors and retail-chain drug stores, with their high-volume and lowprofit- margin business models, are built around operation efficiency. Technologies, such as RFID that can improve their warehouse inventory management while achieving supply-chain security, suit them well. Labor-intensive operations, such as manual bar-code reading, do not. They also have major concern about potentially exposing their confidential business practices because of the visibility offered by a serialized tracking system. The consumers and the government want safe medicine, but do not want a big price tag to go with it.

In essence, a successful system to achieve U.S. drug supply chain security must have the following four requirements: (1) it cannot be circumvented by counterfeiters; (2) it has to offer control and visibility to drug manufacturers but does not reveal trade secrets of drug distributors and retailers; (3) it has to offer improvement in operation efficiency to drug distributors and retailers; and (4) it has to be cheap to implement. As a result, it has to have the following five attributes: (1) robust against counterfeiting; (2) item-level serialization; (3) customizable data-access control based on contracts; (4) minimum manual operation; and (5) low cost.

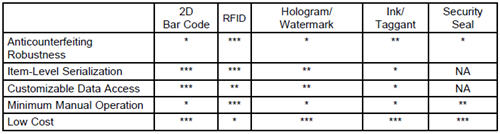

Table 1: Feature comparison among existing anticounterfeiting technologies.

Are Existing Solutions Up To The Task?

Many technologies have been developed or enhanced to prevent or deter counterfeiting (www.ispe.gr.jp/ISPE/07_public/pdf/201206_en.pdf). In general, they address pharmaceutical counterfeiting on three levels. At the first level, the integrity of primary and secondary packaging is ensured by tamper-evident features such as security seals. At the second level, pharmaceutical products are authenticated by covert or overt technologies such as holograms and color-shifting inks. At the third level, each product is identified throughout the pharmaceutical supply chain by serialization technologies such as bar code and RFID. It is widely acknowledged that an effective anticounterfeiting strategy needs solutions at all three levels. As a result, drug manufacturers frequently deploy a combination of anticounterfeiting technologies.

How do existing anticounterfeiting technologies satisfy the five attributes outlined above? Table 1 depicts my own opinion on a few leading technologies. Not surprisingly, 2D bar code and RFID are two favorites. RFID was regarded as holding a great promise on drug supply chain management a few years ago. The FDA even announced in 2005 (http://www.fda.gov/oc/initiatives/counterfeit/update2005. html) that it hoped the pharmaceutical sector would, by 2006, be using RFID tags at item level on all drugs likely to be counterfeited. Many in the pharmaceutical industry also agree that RFID would be valuable for supply-chain security. However, several issues have prevented the widespread adoption of the RFID technology in the drug supply chain management (Lefebvre, Romero et al. 2011).

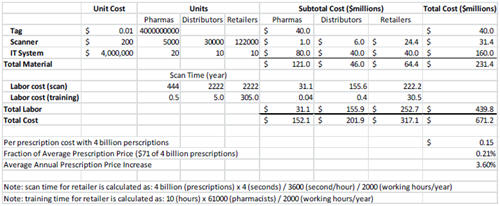

Now under the pressure of the California Pedigree Law, the industry is converging on 2D bar-code technology. Because it is a proven technology, it can take advantage of existing infrastructure, and it can be quickly deployed at low cost. However, 2D bar code suffers two significant drawbacks. First, because it is printed using commercially available printers, it can be easily reproduced. It is conceivable that a counterfeiter could copy the case/item codes from an authentic case of medicine, reproduce the codes, attach them to a counterfeit case packed with counterfeit items, send the counterfeit case back to the supply chain, and sell the authentic case in another country or through an online pharmacy. The current 2D bar-codebased serialization system will not detect such infiltration. Second, the manual scanning at the item level poses a significant resource constraint on drug distributors and retail drug chain stores. Table 2 demonstrates a simplified estimate on the recurring cost of deploying an anticounterfeiting technology that requires manual scanning at the item level. It was built on the following assumptions: (1) initial cost of deploying the technology, reduced productivity due to line reconfiguration, and likely cost for serialization validation are not included; (2) full inference is used with drug distributors and retailers until the time to pick orders; (3) there are 4 billion prescriptions per year in the U.S.; (4) each prescription is for a bottle of medicine; (5) it takes four seconds on average to scan a bottle and capture the serialized data; (6) each bottle will be scanned only once at drug distributors when it is put into totes and then once at retail drug stores to establish traceability; (7) the labor cost to the distributor or the manufacturer is $70,000/year; (8) the labor cost to the retail drug store is $100,000/year; and (9) it takes 10 hours to train personnel each year on the technology.

There are a few informative findings from this exercise. First, it turned out that the labor cost of scanning a code far outweighs the cost of the hardware and software. Second, the majority of the labor cost is on distributors/retailers, thus explaining their reluctance to adopt such a system. Third, the total cost is very high, requiring a compelling case in regard to ROI, to persuade the industry to move forward. Fourth, despite the high cost, when amortized per prescription, the cost of implementing such a system pales in comparison with average annual prescription price increases.

Table 2: A simplified cost analysis on a manual scanning-based serialization technology.

What about the benefits of a serialization system? There are many benefits for the manufacturers, such as recovered revenue, brand enhancement, better capital utilization due to better inventory control, and a significant improvement on reverse logistics, such as recalls, returns, and chargebacks. For the distributors and retailers, the benefits are few, mainly on the defensive side, such as avoiding law suits or fines for being negligent to secure the drug supply chain. As a result, a balancing act might be needed to fully incentivize all stakeholders to reach consensus and act in unison.

Table 3: Feature comparison between 2D bar code and DNA 2D Code.

A DNA-Based 2D Code: A Novel Attempt To Align Stakeholder Objectives

There are two ways to break out of the current conundrum. A government mandate, especially at the federal level, will force the industry to fall behind a solution. The convergence on 2D bar code might be the effect of the looming California Pedigree Law. This approach does have its drawbacks, such as focusing on the track-and-trace aspect of 2D bar code, but ignoring its poor effectiveness of anticounterfeiting. As a result, even if the 2D bar code is fully deployed, additional tamper-evident and authentication methods have to be implemented, adding to cost and complexity. Another possibility is to develop a technology that aligns objectives of most stakeholders so that they converge naturally. The DNA 2D Code technology is a step towards this possibility.

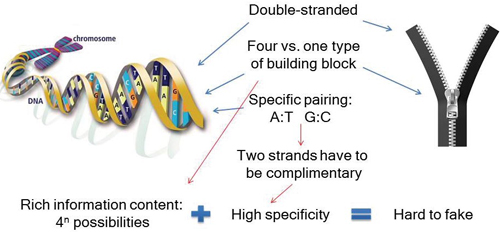

Figure 2: DNA as a better zipper.

Similar to the 2D Code technology, the DNA bar-code technology also includes a tag and a reader. The tag is a miniature DNA-containing plastic that encodes a unique 2D code. The reader is a DNA-containing handheld device that authenticates a tag in one second, recovers the unique code on the tag, and transmits the code to the client database wirelessly. When attached to the security seal of drug packaging, a DNA 2D Code tag itself provides anticounterfeiting measures at all three levels: It serves as tamper evidence because detaching it from the security seal will destroy the tag; it authenticates a product because the tag is extreme hard to copy; and it provides serialization through its unique 2D code. Furthermore, a tag does not reveal its code without a reader, making it even more difficult to circumvent. The reader is basically an augmented smart cell phone. It contains a microfluidic device to authenticate DNA 2D Code tags, and a smart cell phone app to capture the codes and transmit the code to client databases.

The strength of this DNA 2D Code technology is the specificity of DNA hybridization. As shown in Figure 2, DNA is like an advanced zipper: It is double-stranded, has four building blocks, and requires specific pairing of those building blocks. This design leads to high specificity through block pairing and rich-information content, which leads to its robustness against counterfeiting. Without knowing the sequences of DNAs used in a tag, it is nearly impossible for a counterfeiter to decipher the sequences — and then decode the tag.

When compared with 2D bar code (Table 3), DNA 2D Code offers significant improvement on anticounterfeiting effectiveness, while retaining all other features of 2D bar code. Significant advance has also been made on the “minimum manual operation” requirement.

Securing the pharmaceutical supply chain and its products is challenging. A successful implementation must satisfy different objectives of different stakeholders. To meet imminent serialization mandates, and to stay ahead of counterfeiters, it’s increasingly important for pharma companies to tailor technology for their real-world processes. An integrated solution, like DNA 2D Code technology that includes tamper-evidence, authentication, and serialization could be the best option.

Dr. Zhong Li is the president of High Throughput Biology Inc., a start-up company based in New Jersey. At High Throughput Biology Inc., Dr. Li leads the development of innovative technologies and software serving the healthcare and life-sciences industry. Before that, Dr. Li worked in both academics and the pharmaceutical/ biotech industry, in organizations such as Columbia University, GlaxoSmithKline, Medidata Solutions, and First Genetic Trust. Dr. Li received his BS from Beijing University in China, PhD from the Johns Hopkins University School of Medicine, and MBA from Columbia Business School. Dr. Li can be reached at zli@htbiology.com.

Dr. Zhong Li is the president of High Throughput Biology Inc., a start-up company based in New Jersey. At High Throughput Biology Inc., Dr. Li leads the development of innovative technologies and software serving the healthcare and life-sciences industry. Before that, Dr. Li worked in both academics and the pharmaceutical/ biotech industry, in organizations such as Columbia University, GlaxoSmithKline, Medidata Solutions, and First Genetic Trust. Dr. Li received his BS from Beijing University in China, PhD from the Johns Hopkins University School of Medicine, and MBA from Columbia Business School. Dr. Li can be reached at zli@htbiology.com.