Pacesetters Are Product Innovators Who Embrace Digital Process Enhancement

A conversation with Jordan Schmitting, senior research analyst, The Josh Bersin Company

In November, The Josh Bersin Company released data-driven insights via the Global Workforce Intelligence: Pharma research project. The analysis was based on The Josh Bersin Company’s global HR database, Eightfold.ai’s talent intelligence database, and interviews with industry experts. The research identified pharma/biotech companies as “pacesetters” in the field. We caught up with Jordan Schmitting, senior research analyst at The Josh Bersin Company, to discuss the findings.

What are the biotechnology skills and niche research specializations necessary to be a “pacesetter” in this context?

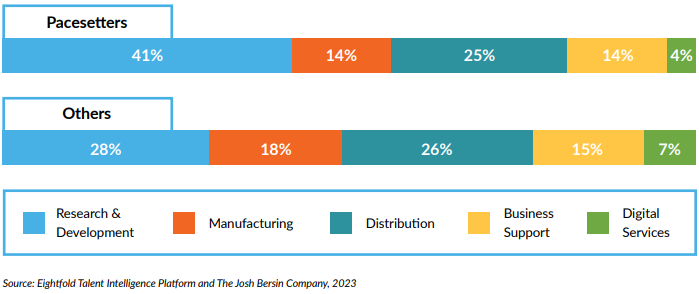

Through the Global Workforce Intelligence Project, The Josh Bersin Company conducts analyses of major industries. In every industry that we’ve examined so far, we’ve found that there is a subset of organizations, approximately one in 10, that are not only financially outperforming their peers but increasing their lead at an accelerated pace. We call these organizations “pacesetters.” The driving forces behind pacesetter success can vary by industry, but those in the pharma industry are distinguished by their investments in the capability to drive process and product innovation.

We’ve seen the pharma industry evolve several times as major breakthroughs from one decade face patent expirations in another. Over the past 10 years, the patents on many chemically derived products that treat common conditions, such as depression and diabetes, reached expiration. Presently, we’re also seeing a trend of declining profit margins on generic medications, which pressures organizations to expand their product pipelines. Notably, we’re entering an era of cell and gene therapy. However, as science advances, there will be new frontiers and specializations that bring promise of better treatments and higher profits. The organizations that are most likely to set the industry’s pace will have the leadership, culture, and talent practices to promote process and product innovation, enabling the build out of expertise in emerging specialties and the introduction of new products to market faster than their competition.

Our analysis has resulted in the identification of Moderna, Pfizer, Vertex, and Bristol Myers Squibb as pacesetters. [Editor’s Note: Due to data and privacy reasons, Schmitting is unfortunately unable to share additional examples.]

How are these pacesetters digitally enhancing their R&D workflow?

Pacesetters take a comprehensive approach to digitally enhancing their R&D workflow.

[Editor’s Note: You may note that the overall pharma talent readiness in agility is low.]

While digital skills that are rewiring how research is conducted are 1.5 times more prevalent in pacesetting organizations compared to the industry average, pacesetters are not merely adopting any digital technology that has potential to streamline workflows. Rather, pacesetters engage their employees and make them a critical element in the organizations’ process innovation journeys. Pacesetters recognize listening to employees as a key practice and create communication channels for research talent to voice concerns about process bottlenecks. These leading organizations also focus on employing engineers to work directly with researchers on process improvements, thereby fostering cross-functional collaboration that yields custom-tailored innovations. Some examples of this practice in action include the creation of software that automates measurement taking within cells and AI-embedded electronics that reduce data subjectivity.

Pacesetters are also embracing artificial intelligence by not only investing in AI-enhanced programming and data management software but upskilling their research workforces as well.

Most importantly, pacesetters’ approaches to digitization don’t ignore the human element of process innovation.

What are some examples of “digitally rewired” skills that contribute to innovation and how can smaller companies (without the resources of Big Pharma pacesetters) take action on this?

SAS programming, statistical programming, and data mining tools are just a sample of the data analysis technologies that are being rewired with artificial intelligence and machine learning capabilities. Recognizing the impact of such digital tools on research and clinical trial processes, pacesetters have prioritized hiring and upskilling talent in associated skills to streamline existing methods of conducting research.

A subset of pacesetters, including small biotechnology companies, have not just augmented their processes with digital tools but also built their organizations around digital research platforms, such as mRNA platforms that automate elements of vaccine discovery and development. Often, emerging organizations are in a position to respond to digitization with more agility than their established competitors, who must overcome the challenges of adapting existing embedded processes at scale.

How are these skills specifically suited for greater penetration into newer research modalities (cell and gene therapies, RNA therapeutics, etc.) vs. more established modalities?

Many digital skills are highly pertinent to the discovery, development, and manufacture of both biotechnology and chemically synthesized treatments, including skills related to predictive analytics, simulation tools, and process automation. Ultimately, pharma industry companies of all specialties and sizes need to consider digitization as a significant source of differentiation, as it drives both process and product innovation capabilities.

All that said, biotech companies have pioneered many digital capabilities in the pharma industry for multiple reasons. First, long-established pharma companies have become risk-averse by operating at scale in a highly regulated industry. Second, biotechnology is rooted in genetic information, which researchers now have in abundance. Digital technology, like biomolecular platforms, can navigate, analyze, and experiment with data faster than a human workforce could. Digitization in biotech product discovery alone can leverage algorithms and advanced predictive analytics to accelerate the process of identifying drug candidates while enhancing repeatability and speed. A digitized research environment enables biotech companies to bring products to market faster, with COVID-19 vaccines providing an excellent example of enhanced speed-to-market.

Are there more Big Pharma companies or smaller emerging companies ranked as pacesetters?

Yes, there are certainly smaller companies that are pacesetters in the pharma industry. In fact, our pacesetter analysis resulted in a mix of biotechnology, biopharmaceutical, and pharma companies that range in size from under 10,000 employees to tens of thousands of employees. We identify our pacesetters based on measures of financial leadership, industry leadership, talent leadership, and systemic HR leadership. The surfacing of smaller biotech companies as industry pacesetters indicates the ways in which digitization is disrupting the industry. Large pharma companies used to be able to rely on their scale to stay ahead, but size alone is no longer sufficient. The time and cost efficiencies being brought forth by digitization are enabling emerging biopharma organizations to discover, develop, and bring breakthrough treatments to market quickly. Their investments in process innovation and agility are yielding product innovation. Some large pharma companies have been able to adapt their practices to become more agile, but many still struggle to achieve agility at scale and keep up with the industry’s rate of change.

Ultimately, regardless of their size, the pacesetters we identified have their commitment to process and product innovation in common.