Evaluating the impact of novel drug delivery systems - Part 2

Part 2 of a two-part series. Click here to read Part 1.

By F. Kermani and G. Findlay

CMR International

Table of Contents

Patent expiries

Cost containment

Outlook for the drug delivery industry

Conclusion

Patent expiries

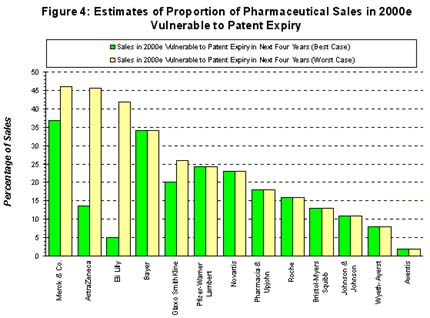

A major challenge facing pharmaceutical companies is managing the revenue stream from existing products. Indeed, the year 2000 marks the start of a highly significant period of patent expiries. By 2002, these will represent an estimated revenue loss to the industry of US$20 billion. Many of the products currently coming off patent have sales of more than US$1 billion, which will leave a significant gap in the portfolio of the companies marketing them. The surveyed pharmaceutical companies ranked impending patent expiry ranked as the most important decision point for the application of a drug delivery system (1). These companies indicated that between 1999 and 2001 the application of a drug delivery system to already-marketed products would be considered on average five years before patent expiry, two years earlier than during the period 1996 to 1998 (1).

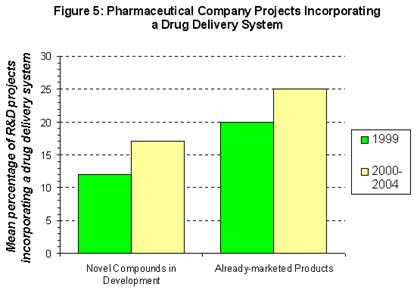

Given the importance of extending the life-cycle of already-marketed products, there is much less enthusiasm among pharmaceutical companies in applying externally-acquired drug delivery systems to novel compounds still in development. This is reflected by the finding that only 40% of projects underway within many big pharma companies incorporating drug delivery systems were focused on novel compounds (1). Furthermore, the most frequent business model operated by drug delivery companies was in applying drug delivery technology to drugs already on the market.

Drug delivery companies are interested in working on more projects involving novel compounds, but in the current circumstances have found it difficult to generate interest among the major pharmaceutical companies. A commonly expressed viewpoint among pharmaceutical company representatives at the Workshop was that "the need to use a drug delivery system implies the failure of a particular project".

Cost containment

With the focus on cost-effectiveness, the value of novelty per se for drug delivery technology is diminishing rapidly. An innovative delivery system may impress prescribing physicians or dispensing pharmacists but as they are not the ultimate payers for healthcare, they have little direct control in determining which products will ultimately succeed in the market place.

Patients may not be willing to pay a premium for the second-generation product once generic competition to the first generation product is available. Indeed, many second-generation products incorporating a drug delivery technology that are currently on the market are not having a big impact: around 50% of the US$40 billion drug delivery market is accounted for by just eight products. The second-generation products that are having an impact are those that focus on unmet needs in either reducing adverse effects or in significantly increasing convenience for patients. Therefore companies should be looking at first generation products that still leave an unmet need for patients and where the application of drug delivery technology will allow new indications for the products.

Yet this itself creates a dilemma. Although drug delivery technologies clearly offer opportunities to produce second-generation products with improved adverse event profiles, it is often very costly and difficult to conclusively demonstrate that an improvement has been made. Indeed almost by definition, the first generation product that is an attractive commercial target for the application of drug delivery technology is unlikely to show major adverse effects, otherwise it would be unlikely to have been successful in the market. Moreover, if the product in question is nearing the end of its patent life, then the drug delivery-enhanced product may well have to compete in the market place with a much lower-priced generic product.

Outlook for the drug delivery industry

At present, the drug delivery industry remains a highly fragmented industry, with companies in various stages of development, operating a range of strategies. It is estimated that there are more than 300 companies engaged in the development and licensing of new drug delivery technologies, while another 1000 pharmaceutical and medical product manufacturers participate in the drug delivery market to a lesser degree (1, 2). As a result, pharmaceutical companies are faced with a bewildering array of suppliers ranging from small start-up companies through to multi-technology suppliers.

Most Workshop participants predicted a phase of consolidation for the drug delivery industry where the future market would be dominated by a few multi-technology players. It is likely that these drug delivery companies will also seek to retain greater control over revenue by marketing their own pharmaceutical products. Most drug delivery companies currently have a royalty-driven business model, but it was questioned whether they could survive long term given the volatility of financial markets. In the future drug delivery companies need to find a balance between spreading risk through partner-sponsored programmes and by building a base of proprietary products where they can control the marketing.

Pharmaceutical companies are seeking to deal with companies with a range of technologies available, with a sound business plan and with a good knowledge of the underlying drug delivery technology. Pharmaceutical company respondents do not believe that the majority of drug delivery companies approaching them are professional enough. As no one drug delivery technology is universally applicable, drug delivery companies with more than one technology have a better chance of commercial success than those with only a single technology. This is supported by the fact that multi-technology drug delivery companies reported 60% more initiations of collaborations with pharmaceutical companies than single technology companies between 1997 and 1999 (2).

Conclusion

It appears that novel drug delivery technologies are not being taken up by the pharmaceutical industry as readily as some reports suggest. The majority of publicity surrounding novel drug delivery technologies has focused on successful alliances, but the participants at the Workshop shared experiences of failed alliances where inadequate attention had been paid to technical and business issues.

It may be considered fairly obvious that pharmaceutical companies should take a long term approach to drug delivery technologies, incorporating them into their projects only when they can truly add value to marketed products, but there is evidence that these issues are often being overlooked. In addition, these problems are compounded by internal politics within the companies and a lack of trust in working with an outside partner. Similarly, it appears that drug delivery companies need to convince pharmaceutical companies that their technologies, can add value as pharmaceutical companies are reserving the use of such technologies for already-marketed products and are more reluctant to use them for novel compounds.

The current situation illustrates that the objectives of drug delivery companies and pharmaceutical companies regarding collaborations continue to be very different. Unless both sets of companies examine the application of novel drug delivery systems in a more realistic manner, it will only have a limited impact on the drive to introduce innovative new pharmaceutical products to the market.

References

- The Results of the Survey of Pharmaceutical Companies. B. de Leeuw, G. Hadfield, E. Saunders, and G.Findlay. In The Application of Drug Delivery Systems: Current Practices and Future Strategies. CMR International. Eds. Findlay G and Kermani F. 2000.

- The Results of the Survey of Drug Delivery Companies. B. de Leeuw, M. van den Haak, G.Hadfield and G.Findlay. In The Application of Drug Delivery Systems: Current Practices and Future Strategies. CMR International. Eds. Findlay G and Kermani F. 2000.

- The Pharmaceutical R&D Compendium 2000: CMR International/Scrip's Complete Guide to Trends in R&D.

- Rossi T. 2000. Drug Delivery: A Perspective from the Pharmaceutical Industry. In The Application of Drug Delivery Systems: Current Practices and Future Strategies. CMR International.

Collaborating with the Faculty of Business, Rotterdam School of Management, Erasmus University, The Netherlands, CMR International completed parallel surveys of pharmaceutical and drug delivery companies. Leading companies in this field were brought together to discuss the results of the surveys and other topical issues. The results of this project are documented in the report "The Application of Drug Delivery Systems: Current Practices and Future Strategies."

For more information: Faiz Kermani, Research Associate, CMR International, Novellus Court, 61 South St., Epsom, Surrey KT18 7PX, UK. Tel: 44-1372-846-120. Fax: 44-1372-846-101.