$50 Billion Monsanto, P&U Merger Creates 11th-Largest Drug Firm

MP&U will also include one of the world's leading, fully integrated agricultural businesses. Monsanto's agricultural business has a leading global position in seeds, herbicides, and biotechnology. With creation of the new company, up to 19.9% of the agricultural business will be offered in an Initial Public Offering. The agricultural business will become a separate legal entity, with a standalone board of directors and its own publicly-traded stock. MP&U's corporate offices and pharmaceutical business will be headquartered in Peapack, NJ; the agriculture business will remain in St. Louis.

Leading the combined organization as president and CEO will be Fred Hassan, currently CEO of P&U. Hassan will also have operational responsibility for the new company's core pharmaceutical business. Monsanto Chairman and CEO Robert B. Shapiro will become the non-executive chairman for a period of 18 months, after which he will be succeeded by Hassan.

MP&U's board of directors will consist of 20 members, with representation equally divided between Monsanto and Pharmacia & Upjohn. Planned key appointments include that of Monsanto's Richard U. De Schutter, as senior executive VP; Pharmacia & Upjohn's Christopher Coughlin, as executive VP and CFO; Monsanto's Philip Needleman as chief scientific officer; and Monsanto's Hendrik A. Verfaillie as CEO of the agricultural business. Further appointments will be announced during the course of the merger integration process.

Under the terms of the merger-of-equals transaction, which was unanimously approved by both boards of directors, Pharmacia & Upjohn shareowners will receive 1.19 shares of the combined enterprise for each share of Pharmacia & Upjohn they now hold. Each Monsanto share outstanding prior to the combination will represent one share in the combined company. The transaction will be tax-free to the shareowners of both companies and is expected to be accounted for as a pooling of interests. Monsanto shareowners would own approximately 51% of the combined company's shares.

MP&U's pharmaceutical business will be led by Celebrex, an arthritis drug launched in 1999 with sales to date of $1.4 billion; Xalatan, the world's top selling glaucoma Rx product; Detrol, the leading treatment for over-active bladder; Camptosar, a treatment for colorectal cancer; and Zyvox, a new antibiotic expected to be launched in 2000. MP&U's strengths will lie in including arthritis and inflammation, antibiotics, oncology, cardiovascular, CNS, ophthalmology, urology, and women's health. The company also has a strong consumer healthcare business led by key global brands, including the Nicorette family of tobacco-dependency products and the Rogaine/Regaine hair loss treatment.

The transaction is expected to close in the second quarter of 2000, subject to approval by both companies' shareholders, normal governmental reviews and other customary conditions.

Pharmaceutical Businesses Key to Merger

According to pharmaceutical market analysts Datamonitor, merging pharmaceutical divisions will greatly beneift P&U as well as Monsanto. Monsanto's forecast strong sales growth will drive MP&U's revenue growth, while significant cost savings will be generated from portfolio synergies. Monsanto will particularly benefit from the merger, as P&U's global reach creates a company that is less focused on U.S. markets than Monsanto's is today.

Revenue Growth

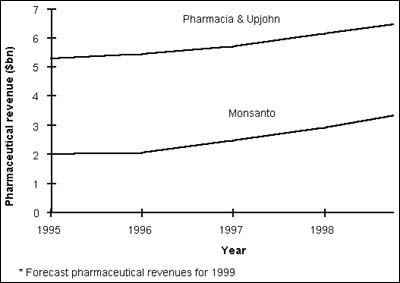

Pharmacia & Upjohn's pharmaceutical sales grew by 8.0% in 1998 to $6.1 billion. Datamonitor forecasts that they will continue to increase at about the same rate, to $6.6 billion for full year 1999. However, Monsanto's pharmaceutical revenues increased by 18.0% in 1998 to $2.9 billion and are forecast to continue their double-digit growth to $3.4bn in 1999. The strong growth which Monsanto's pharmaceuticals division has experienced is likely to be tempered by Pharmacia & Upjohn's weaker performance. However, the combined company will have stronger sales growth than Pharmacia & Upjohn alone and, therefore, the merger will be of substantial benefit to Pharmacia & Upjohn. The key benefit of the merger for Monsanto is that the combined company's increased pharmaceutical revenues will provide greater funds for pharmaceutical R&D. Monsanto's pharmaceutical revenues, currently of $2.9 billion in 1998, do not afford the company the luxury of lavishing big money on R&D, a factor that would have kept Monsanto's pharm business out of the top tier (companies with more than $6 billion in R&D).

Figure 1: Pharmaceutical revenues for Pharmacia & Upjohn and Monsanto, 1995–99

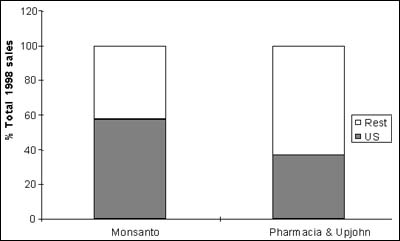

Geographic Strategy

Pharmacia & Upjohn has a strong global presence with only 37.0% of total sales derived originating from U.S. markets in 1998. This compares with Monsanto, which is more focused on its home country. Monsanto's U.S. revenues made up 57.5% of its total sales in 1998. The merger between P&U and Monsanto will significantly increase Pharmacia & Upjohn's strength in the world's largest pharmaceutical market, the US, while also increasing Monsanto's global coverage. Therefore, as a geographic expansion strategy, the merger will be of benefit to both parties.

Figure 2: Geographic split of total sales, 1998

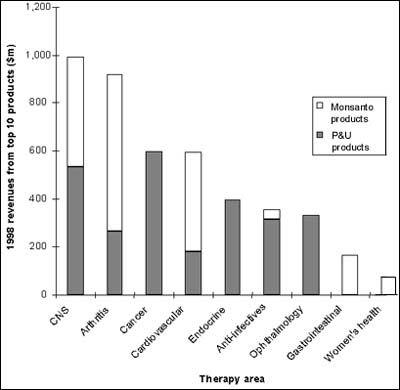

Portfolio Synergies

In terms of portfolio fit, Pharmacia & Upjohn and Monsanto have two core areas in common: CNS and arthritis. Their merger will lead to the combined company being particularly strong in the arthritis market and create synergies between the two companies' sales and R&D infrastructures. Their CNS and cardiovascular portfolios will also be substantially strengthened, which is likely to result in significant cost savings across these key areas. Pharmacia & Upjohn's other main products are in the fields of cancer, endocrine and ophthalmology and, combined with Monsanto's, will result in the merged company having a broad portfolio with little reliance on any one therapy area.

The complementary nature of Monsanto and Pharmacia & Upjohn's clinical R&D pipelines will also broaden their pipelines to cover a wide variety of therapeutic areas. This will decrease the combined company's reliance on individual therapy areas, although it will also lead to an unfocused pipeline where cost savings may not be realised due to a lack of therapeutic synergies.

Figure 3: Combined portfolios of Pharmacia & Upjohn and Monsanto, 1998

For more information: Howard Miller, PharmaVitae Manager, Datamonitor, 106 Baker St., London W1M 1LA, UK. Tel: +44-1-71-316-0001. Fax: +44-1-71-316-0002.

By Angelo DePalma