Accounting, Financial, Strategic Forces Will Drive Biotech Stocks

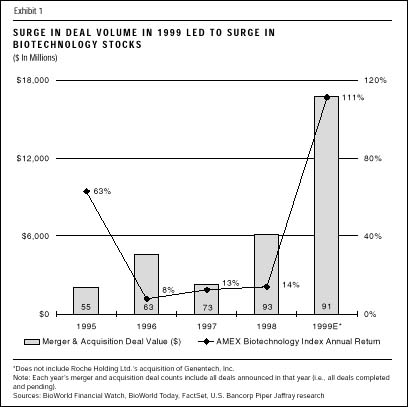

Ginsberg attributes the industry's addiction to double-digit growth as another factor accounting for the surge in mergers and acquisitions during 1999. After four straight years of "blistering stock price performance," 1999 saw American Stock Exchange pharmaceutical index dip by 10% (in contrast to the biotech index, which rose 111% during that time). Nevertheless, investors expect the top 10 pharmas to grow by 10% to 15% per year over the next five years. To fulfill these expectations, drug companies need late-stage products. The easiest way to get them is through acquisitions.

Ginsberg reports on 91 biotechnology combinations in 1999, with a total value of $16.7 billion—175% more than the value of consolidated biotechnology companies in 1998, which up to that point had been a record record year for biotech consolidation in the sector. However, the total transaction value for 1999 eclipsed that of 1998 as a result of increased deal values. Examples include the Johnson & Johnson's acquisition of Centocor and the Warner Lambert acquisition of Agournon.

Consolidation in 2000 to Outpace 1999

Ginsberg expects heavy takeover activity again in the biotechnology sector in 2000. He sites four drivers of M&A activity in 1999 that persist today:

- Pharmaceutical firms seeking to maintain double-digit earnings per share (EPS) growth rates are increasingly looking to biotech companies to energize their product portfolios in the face of patent expirations, pricing inflexibility, and weak internal pipelines.

- The success of numerous biotechnology companies in the past two years has validated the biotech concept and increased the level of competition to associate with companies in the biotech industry.

- The number of large-cap biotech companies (companies with more than $1 billion market value) has tripled from nine in 1997 to 27 at the end of 1999, creating a whole new set of potential acquirers.

- Biotechnology managements generally have become more comfortable with selling their companies as an exit strategy.

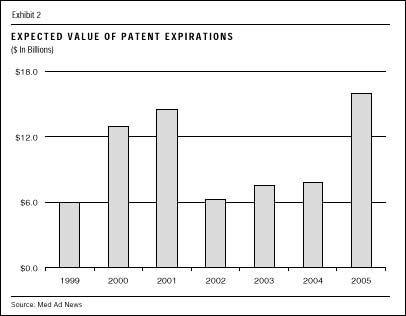

The patent picture for drug companies is especially significant. Many top drug firms are facing expirations for key products. Ginsberg estimates the value of expiring patents in 1999 at about $6 billion. He expects it to rise to $13 billion in 2000 and $16 billion by 2005. Patents for several billion-dollar products will expire within the next few years, including those for Vasotec (Merck), Prilosec (AstraZeneca), and Prozac (Eli Lilly).

Strong Stock Performance Followed Consolidation Announcements

Ginsberg projects the strong stock performance consolidated biotechnology companies experienced in 1999 to continue through 2000. "We find it worthwhile to seek out companies that are likely targets for acquisition, although assessing potential takeout valuations is somewhat speculative," Ginsberg says. According to Ginsberg, prime takeover candidates include Celgene (NASDAQ: CELG), Cephalon (CEPH), Invitrogen (IVGN), and ILEX Oncology (ILXO). Ginsberg has adjusted stock price expectations upward for these companies; most have already reached or exceeded Ginsberg's recalculated price ceilings. According to Ginsberg takeover plays may be made for Lkermes (ALKS), Biogen (BGEN), BioMarin Pharmaceutical (BMRN), Chiron (CHIR), Coulter Pharmaceutical (CLTR), Pathogenesis (PGNS), and Pharmacyclics (PCYC).

In the report Ginsberg defines several themes that ran through most of the major acquisitions in 1999, saying that these can be useful in determining the most likely candidates for acquisition in this year.

End of Pooling Accounting Could Trigger Acquisitions Before Next Year

Another reason Ginsberg predicts a surge in consolidation activity in 2000 is the upcoming elimination of pooling accounting, a tax-free method whereby the balance sheet items of the two companies are simply added together. Compared with the soon-to-be-standard "purchase acquisition" method, pooling does not result in long-term goodwill writeoffs. These writeoffs will be significant considering that on average, acquiring companies paid a 44% premium for takeover companies.

"One of the key drivers of the expected heightened mergers and acquisitions activity in 2000 is likely to be the looming expiration of pooling accounting," Ginsberg wrote. "Acquisitions announced after the new accounting standards are finalized, which is expected at the end of 2000, will require purchase accounting, thereby generating a significant negative income statement impact for the acquirer in many cases."

About U.S. Bancorp Piper Jaffray

U.S. Bancorp Piper Jaffray, a subsidiary of Minneapolis-based U.S. Bancorp, provides investment products and services to businesses, institutions and individuals. The company's investment banking business has grown exponentially in the last several years by focusing on the needs of growth companies in the health care, technology, financial institutions, consumer and industrial growth sectors. U.S. Bancorp Piper Jaffray has a national reputation for its expertise in fundamental research and equity and debt financing. U.S. Bancorp offers a comprehensive range of financial solutions through U.S. Bank, First American Asset Management, U.S. Bancorp Libra Investments and U.S. Bancorp Piper Jaffray.

For more information: Elizabeth Child, U.S. Bancorp Piper Jaffray, 222 South Ninth St., Minneapolis, MN 55402. Tel: 612-342-6594.