Analysis from Datamonitor: The rise and fall of glucophage

Datamonitor's new report, Market Dynamics 2000: Diabetes. A market driven by innovation?, reveals that:

- Glucophage is now in the top 30 list of best selling drugs.

- Reformulations may not be enough to prevent September 2000 patent expiry from ending Glucophage's US triumph.

One of the top-selling drugs

Sales of Glucophage in the US topped $1.3bn in 1999 reflecting impressive year on year sales growth of 53% from 1998. The closest rival to Glucophage in the OHA market in 1999 was Rezulin (troglitazone) with sales of just over $600m. Rezulin, however, will not be a threat in 2000 as it was withdrawn in March.

This steep sales growth has propelled BMS's Glucophage into the top 30 best selling drugs list for 1999. Glucophage now holds position 27 on the list a move of ten places from 1998's position of 37. Of all the diabetes treatments only Novo Nordisk's Novolin (insulin) performs better, recording sales of $1.6 billion. The leading drug on the list is AstraZeneca's Prilosec/Losec (omeprazole), sales of which almost reached $6 billion in 1999, but will also fall on patent expiry.

The sales of Glucophage are based on its improved efficacy at treating type II diabetes over previous treatments, its indication for use in combination with insulin and sulphonylureas and its beneficial effect on weight gain. Obesity is a major risk factor for the development of type II diabetes and treatment of the disease often includes weight loss and exercise. While both insulin and sulphonylureas are associated with weight gain to some degree, Glucophage is associated with weight loss. This makes it an ideal drug for treating obese diabetics. Glucophage has also been recommended by the American Diabetes Association for first line treatment of adolescent type II diabetics following trial results showing the drug was efficacious in this population group.

With the diabetes market expected to continue to grow driven by increasing prevalence of the disease and increased diagnosis, sales of Glucophage are likely to increase in 2000 enabling this drug to move further up the top 30 list.

Said Datamonitor analyst Chris Donnellan, "Glucophage sales have rocketed since its launch in 1995 and have also recently benefited from the early demise of Rezulin leaving a gap in the market."

Reformulations not enough

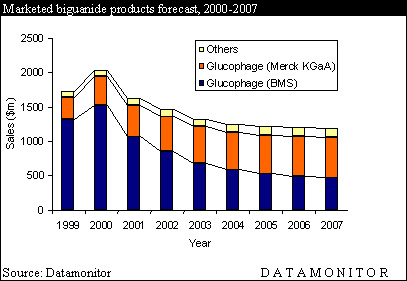

While sales of Glucophage are expected to rise in 2000, the future of the drug may not be as promising. The patent for Glucophage, extended from March 2000, expires in September and will bring with it generic competition, which could signal a turnaround in the amazing success of Glucophage in the US.

Obviously, BMS is not going to let go of the US billion-dollar market easily. With two new reformulations ready to be launched this year BMS are hoping to balance the loss of sales of Glucophage against new product sales.

The first product is a once daily version of Glucophage, which will be marketed as Glucophage XR. The once daily pill developed by BMS is expected to increase patient compliance with therapy by reducing the number of doses the patient is required to remember. Currently Glucophage is taken with meals, which can reduce compliance with the treatment leading to peaks in blood glucose. Tight blood glucose control has been recommended for diabetics to help slow the progression of the disease and reduce the onset of diabetic complications.

The second product, which is likely to be marketed strongly, is Glucovance. This new product is a one-pill combination of Glucophage and the sulphonylurea glyburide. Recent trials of the drug reported at the American Diabetes Association's 60th Scientific Sessions in San Antonio suggest that Glucovance is safe and well tolerated and is an effective first line treatment for type II diabetes.

The launch of these two products should go some way to protecting the sales of BMS, but the days of Glucophage making the top 30 global best selling drug list could end with the expiry of its patent. The steps BMS have taken, though, should see the company remain a leading player in the US diabetes market.

"The days in the top 30 for Glucophage are coming to an end," Donnellan commented. "The explosive climb to the top could be matched by the fall from on high."

Market Dynamics 2000: Diabetes is available from Datamonitor, priced at $3,995.

For more information: Elisabeth Overend-Freeman at Datamonitor. Tel: 212-686-7400, ext. 765. Fax: 212-686-2626. Email: efreeman@datamonitor.com

Edited by Angelo DePalma

Managing Editor, Pharmaceutical Online and Drug Discovery Online

Email: adepalma@vertical.net