Are Plant-Based APIs The Future Of Pharma And Nutraceuticals?

By Sabyasachi Ghosh, Future Market Insights

As consumer preferences for natural and organic products rise, businesses in the pharma and nutraceuticals industries are increasingly shifting to plant-based active pharmaceutical ingredients (APIs).

Post-pandemic, significant changes have reshaped how companies manufacture medications. With an increasing number of people seeking natural and organic medicines, the demand for plant-derived APIs has reached an all-time high. This trend has significantly influenced the industry, prompting well-established players to adapt their production lines.

According to a recent report by Future Market Insights, the plant-based API market was valued at $30.08 billion in 2024 and will likely reach $52.08 billion by the end of 2034. This article explores the drivers, trends, opportunities, and future of the plant-based API market.

Growing Consumer Demand For Natural Products

Consumers today have become more concerned about their health. Owing to this factor, there is a strong preference for medications and supplements with minimal synthetic ingredients. A survey by the Organic Trade Association revealed that four out of five Americans prefer organic ingredients in their consumables. The trend has stirred a revolution in these sectors as complete reliance on synthetic compounds is being questioned.

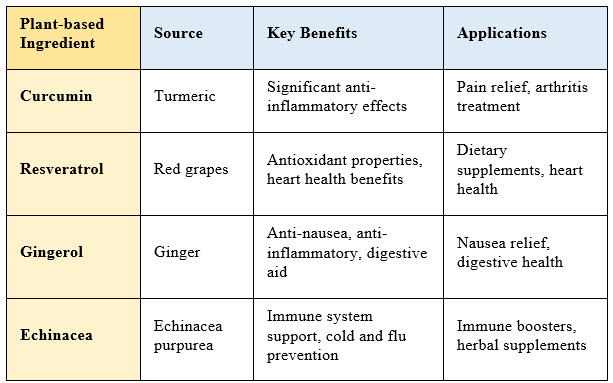

Moreover, the internet today is flooded with blogs and articles about the health benefits associated with plant-based ingredients. There is a very strong belief among the general populace that many plant-derived compounds possess anti-inflammatory, antioxidant, and antimicrobial properties. This has been a major driver for the growth of the plant-based API market.

Advances in Extraction Technologies

Extraction methods have advanced significantly over the years. Technologies such as supercritical CO2 extraction and ultrasonic extraction have considerably improved the efficiency and yield of plant-based APIs, ensuring the preservation of bioactivity. The Journal of Pharmaceutical Sciences stated that these technologies could enhance the extraction efficiency of bioactive compounds by up to 30%.

Regional Analysis And Regulatory Support For Plant-Based Ingredients

Regulatory bodies are increasingly establishing guidelines to ensure the safe and effective use of plant-based ingredients. For instance, the European Medicines Agency (EMA) recently introduced guidelines for herbal medicines, promoting the integration of plant-based APIs into mainstream healthcare. Policies like these are fostering innovation and encouraging businesses to bring more plant-derived products to market.

The U.S. is leading the plant-based API market around the globe and is poised to grow at 4.2% CAGR during the forecast period, driven by a powerful fusion of advanced biotechnology and agricultural technology (agritech). The country’s robust biotech ecosystem, which includes CRISPR gene-editing and synthetic biology startups, accelerates the discovery and scaling of plant-derived compounds. This allows for efficient and fast scaling to produce plant-based APIs to meet high demands in oncology and pain management.

Germany is expected to increase its market presence with a CAGR of 4.0% during the study period due to its long-standing expertise in phytopharmaceuticals. German companies exercise high skill in the techniques for extracting bioactive compounds, producing potent and stable plant-based APIs. Another factor is Germany's trained workforce in botany, pharmacognosy, and biochemistry, allowing quicker innovations in plant-based pharmaceutical development.

China’s leadership in plant-based APIs is largely driven by its integration of traditional Chinese medicine (TCM) with modern pharmaceutical practices. The magnitude of biological diversity in China offers an unmatched resource base for gaining access to novel medicinal plants. This, combined with China's strong manufacturing base, provides successful large-volume commercial scaling of these APIs.

Trends Within The Plant-Based API Market

In terms of product type, the industry is segregated into alkaloids, including opium alkaloids (morphine and codeine), tropane alkaloids, vinca alkaloids, and other alkaloids; glycosides (cardiac glycosides, flavonoid glycosides, anthraquinone, glycosides, other glycosides); cannabinoids (CBD, THC); flavonoids (isoflavones, quercetin, other flavonoids); terpenes and terpenoids (diterpenes, monoterpenes, other terpenes and terpenoids); polyphenols (stilbenes, curcuminoids, other polyphenols); saponins (steroidal saponins, triterpenoid saponins, other saponins); and others. In 2023, alkaloids held about 38% of the value share due to their potent bioactivity and versatility in therapeutic applications. Alkaloids are potent drugs that act in small doses and are widely used in analgesics, anti-inflammatories, and antimicrobial treatments.

In terms of API form, the industry is segregated into liquid (extracts, suspensions, tinctures), powders and granules, crystalline form, paste, and resins and oleoresins. In 2023, powders and granules held 34% of the value share due to their stability, easy incorporation, and palatability to patients. The powder and granule forms give them a long shelf life with active ingredients intact and adaptable into capsules, tablets, or sachets. This dosage also allows controlled or sustained release for optimum therapeutic effects and better bioavailability. Granules, in particular, dissolve easily in water, thus enhancing absorption.

In terms of botanicals, the industry is segregated into opium poppy (Papaver somniferum), Madagascar periwinkle (Catharanthus roseus), Pacific yew tree (Taxus brevifolia), foxglove (Digitalis purpurea), turmeric (Curcuma longa), ginseng (Panax ginseng), cannabis (Cannabis sativa), willow bark (Salix spp.), senna (Senna alexandrina), and other botanicals. In 2023, opium poppy held 25.3% of the industry share.

Growth Of Cannabis-Based APIs

Cannabis-based APIs are taking a noticeable turn in this plant-based API market. As cannabis is legalized and decriminalized for government-approved medical usage around the globe, more pharmaceutical companies have begun their creative engagement in producing cannabis-derived APIs, with a greater focus on cannabinoids such as cannabidiol and tetrahydrocannabinol.

These compounds have thus far demonstrated therapeutic effects for conditions such as chronic pain, epilepsy, multiple sclerosis, and mental disorders, including anxiety and depression. In itself, this offers fertile growth opportunities and innovation within the pharmaceutical industry.

Cannabis-based APIs are supposed to be a growing area of interest, as they are perceived to deliver efficacy alongside a reduced side effect profile in comparison to traditional pharmaceuticals.

Continuous research of the endocannabinoid system proves the biological potency of cannabinoids, giving cannabis products targeting drug discovery immense development potential. Research arms focus not merely on CBD and THC but also engage in the more extended inventory of cannabinoids that develop as special formulations with the goal of attacking a particular disease.

Key Players In The Plant-Based API Industry

- Abbott

- Bright Green Corporation

- Kerry Group plc.

- dsm-firmenich

- Mallinckrodt

- C2 Pharma

- Sami-Sabinsa Group

- Afriplex

- Alkaloids Corporation.

- Phytotech Extracts

- Indena S.p.A

- Alchem International

- Roquette Frères

- Sichuan Xieli Pharmaceutical

- Shaanxi Jiahe Phytochem

- Xi'an Greena Biotech

- Veranova

- Teva Pharmaceutical Industries

Sustainability And Environmental Benefits Of Plant-Based APIs

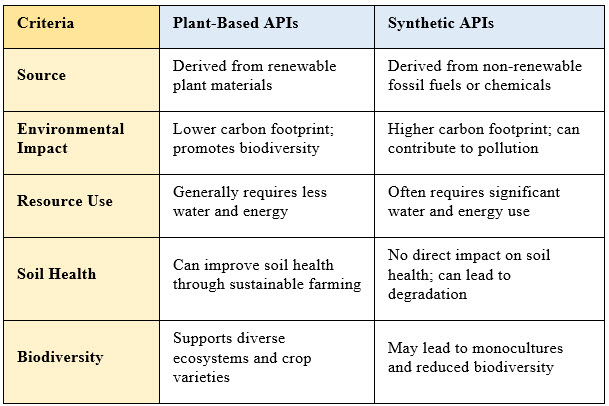

The sustainability trend has been influencing almost all the sectors in the international marketplace. Consumers are preferring sustainably sourced products, while manufacturers are focusing on ethical production practices. In accordance with this, plant-based APIs often have a lower environmental impact compared to synthetic alternatives. This is why a lot of pharma companies are investing in new production plants to enhance their capabilities for sourcing and processing plant-based ingredients.

The table below highlights the advantages of plant-based APIs over synthetic ones when it comes to sustainability and environmental concerns.

Standardization And Quality Control

Despite its growth, the market is also experiencing some challenges that are slowing down its expansion. The nascent stage of the market has led to a lack of standardized rules for manufacturers. In some countries, lack of quality control has often led to counterfeit products. The consumer base is also sometimes worried about the authenticity of these APIs. Furthermore, variability in plant materials has led to inconsistencies in the potency and efficacy of the APIs. These issues instill a sense of fear among the consumers, adversely affecting the adoption of the products.

Investment In R&D

A multitude of companies, such as Antheia, Evonik, Protalix BioTherapeutics, and Central Institute of Medicinal and Aromatic Plants, have invested comprehensively in research and development to explore the therapeutic potential of plant-based APIs, resulting in the discovery of new plant-based APIs.

For instance, in October 2023, Evonik, a specialty chemicals company, unveiled GMP-approved plant-based squalene PhytoSquene, which is obtained from amaranth oil. This product was launched to be utilized in adjuvants in parenteral dosage forms.

Looking Forward

Despite the growing popularity of plant-based APIs, manufacturers and consumers are still seeking synthetic ones due to their affordability and familiarity, and synthetic APIs are also easy to produce. However, the future of the plant-based API market looks very promising. With consumers demanding natural products and growing regulatory support, the market is very likely to soar in the coming few decades. In times like this, it is very important that manufacturers focus on procuring sustainable raw materials and investing in research and development activities.

The insights presented in this article are based on the report Plant-based API Market by Future Market Insights.

About The Author

Sabyasachi Ghosh is associate vice president of healthcare, medical devices, and pharmaceuticals at Future Market Insights. He has more than 12 years of experience in the industry and has been a researcher since the start of his career. His core expertise is in market entry and expansion strategy, feasibility studies, competitive intelligence, and strategic transformation. He holds a B.Sc. in microbiology. You can connect with him on LinkedIn.

Sabyasachi Ghosh is associate vice president of healthcare, medical devices, and pharmaceuticals at Future Market Insights. He has more than 12 years of experience in the industry and has been a researcher since the start of his career. His core expertise is in market entry and expansion strategy, feasibility studies, competitive intelligence, and strategic transformation. He holds a B.Sc. in microbiology. You can connect with him on LinkedIn.