Complex Antibody-Drug Conjugate Supply Chains: To Integrate or Not?

By Brian Clark, GMP Operations Consulting LLC

Antibody-drug conjugate (ADC) development and clinical trials have increased rapidly in recent years. This is largely due to the success of Adcetris for the treatment of Hodgkin’s lymphoma and Kadcyla for the treatment of HER2-positive metastatic breast cancer.

ADCs generally include a combination of a monoclonal antibody for targeting specific cell receptors with an attached cytotoxic small molecule payload to kill the cells of interest. The antibody and payload are connected using a small molecule linker or, in some cases, a small molecule and polymer linker. The three components are usually attached in a single or multi-step chemical conjugation process.

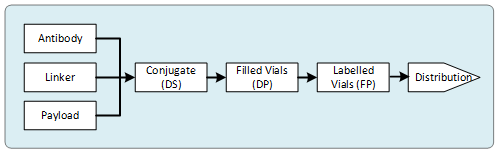

The number of critical components in this process creates one of the most complex supply challenges in the biopharmaceutical industry. As shown in Figure 1, the process can involve working with an antibody manufacturer, a small molecule manufacturer with cytotoxic manufacturing capability, a conjugate manufacturer, a drug product fill house capable of handling cytotoxic products, a labeler/packager, and a logistics company for distribution. Additionally, appropriate testing capabilities are required, or independent contract test labs may need to be utilized.

Figure 1: ADC supply chain

CDMO Identification And Selection

The contract development and manufacturing organization (CDMO) selection process is similar to that utilized for any other biopharmaceutical process. CDMOs are identified, capabilities are assessed, requests for proposals are prepared and submitted, proposals are received, and the field is narrowed. Technical and quality due diligence visits are completed, and finalists are assessed. Many considerations are weighed in this selection, including technical capabilities, quality requirements, costs and availability, and geographic/logistical issues. This review process includes many considerations that will not be addressed in this article.

One of the most critical factors to consider for ADC manufacturing is whether to use integrated CDMOs for all or a portion of the manufacturing process. Over the past five years or so, CDMOs with the capability to manufacture ADCs have grown exponentially. Early ADC manufacturers such as Lonza and Piramal have now been joined by new entrants including Abzena, Althea, BSP, Carbogen Amcis, Goodwin, MabPlex, Novasep, Pierre Fabre, SAFC, and WuXi.

Integrated CDMO Capabilities

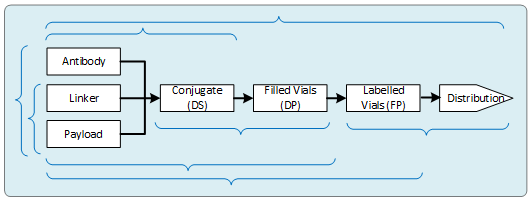

With the expansion and entry of all these CDMOs into the conjugation arena have come more integrated offerings. Some of the organizations were previously focused on drug product filling or small molecule or biologics manufacturing; others are newer companies that arose through mergers. The added capabilities allow them to perform multiple steps of the supply chain. Additionally, some companies have announced partnerships or consortiums with other CDMOs, using centralized project management to further increase the integration capability. In some cases, this is approaching one-stop shopping. The current combined offerings from these companies and consortiums vary and are represented by the brackets in Figure 2.

Figure 2: Integrated ADC supply chain offerings

This variety of offerings allows companies to choose from individual CDMOs for each stage of the supply chain (a best-of-breed approach), consolidated offerings across some of the supply chain, or fully turnkey manufacturing. Some of these integrated activities, such as drug product finishing and distribution, have been used successfully for some time. Other newer models, such as the combined conjugation and fill or small molecules and conjugation, have also been quite successful. The end-to-end and mostly integrated options are still relatively new, and we have not heard of many projects that have gone through a single supplier from start to finish.

The advantages to greater integration of the supply chain include:

- potential shorter cycle times based on CDMO coordination of schedules

- shorter cycle times based on advancing manufacturing at risk after preliminary or subset assay results

- opportunity to eliminate penalties associated with rescheduling due to delays in a prior part of the supply chain

- reduced sponsor effort associated with management of inventory and logistics by the CDMO

- lower risk associated with transfers if the different units are co-located.

Some of the disadvantages of the integrated supply chain include:

- execution risk associated with manufacturing functions that may be weaker than other organizations’ (i.e., not best of breed)

- loss of flexibility associated with managing multiple intermediates at a single manufacturer (e.g., swap antibodies to be manufactured in a reserved time slot without penalties)

- shipments, and associated logistics risk, may not be reduced in multi-site operations

- increased negative impact from poor project managers.

Evaluating ADC Suppliers

Regardless of which approach you take with potential CDMO partners, you should complete a thorough diligence assessment of each supplier, including each portion of the manufacturing process/business unit of the CDMO. This should include:

- technical review of all facilities and equipment to be used at each stage of the process

- quality audit and evaluation of all facilities involved including standard parameters, such as:

- overall quality systems (if different between manufacturing units)

- appropriate facilities and equipment (i.e., classification, maintenance, cleaning validation, verification)

- suitable utilities (i.e., water, air) for each manufacturing process

- environmental monitoring standards and results

- controls for transfers of materials, intermediates, and products among facilities

- meetings with your project’s team, particularly the project manager and technical leads

- assessing the organization and individuals’ experience with the manufacturing steps of interest

- meeting and evaluating the assigned project manager, or managers, and their backups

- industry reference checks for the CDMOs, covering each manufacturing unit you are assessing, include independent references not provided by the CDMO where feasible.

It is critical to ensure master service agreements and quality agreements address the unique aspects of integrated manufacturing programs. For instance, there should not be penalties associated with schedule changes if the delay is caused by the same manufacturer in a prior manufacturing step. Similarly, shipment terms, known as Incoterms, usually transfer ownership to the sponsor as soon as a product or intermediate is handed off to the shipper/courier. In an integrated, or partially integrated model, the CDMO should retain ownership in shipments between their own sites and only transfer ownership to the sponsor when they complete their activities. This will also impact how work in progress is insured and by which party.

Aligning With Your Contract Partner

The final decision to go with one or more CDMOs is the start of a partnership that will be key to the success of your product. It is critical that all sponsors have knowledgeable technical and CDMO management staff or representation to engage with the partners. Transparent, open relationships with a high level of engagement, including routine face-to-face meetings and person-in-plant oversight, and good governance structures will set the stage for successful partnerships and product realization.

About the Author:

Brian Clark is principal at GMP Operations Consulting LLC, a CMC consulting firm founded in 2006. He has more than 25 years of experience in the development, manufacturing, and quality management of biologics, drugs, and medical devices, with specific expertise in advanced technology medicinal products such as cell therapies, regenerative medicine, and antibody-drug conjugates. Previously, he served in executive and senior leadership roles at ImmunoGen Inc., Altus Pharmaceuticals, Alkermes, Therion Biologics, Antigenics (now Agenus), and Genzyme Tissue Repair. Brian has a bachelor’s in biology from the University of Massachusetts, Boston, and an MBA in general management from Boston University.

Brian Clark is principal at GMP Operations Consulting LLC, a CMC consulting firm founded in 2006. He has more than 25 years of experience in the development, manufacturing, and quality management of biologics, drugs, and medical devices, with specific expertise in advanced technology medicinal products such as cell therapies, regenerative medicine, and antibody-drug conjugates. Previously, he served in executive and senior leadership roles at ImmunoGen Inc., Altus Pharmaceuticals, Alkermes, Therion Biologics, Antigenics (now Agenus), and Genzyme Tissue Repair. Brian has a bachelor’s in biology from the University of Massachusetts, Boston, and an MBA in general management from Boston University.