Datamonitor Examines Anti- Hypertensive Marketplace

Key Findings

- In 2005, the anti-hypertensive market value is forecast to reach $34.3 billion. Growth in the market will be significantly slowed after the year 2000, hence the small increase on the 1998 market value.

- The leading drug in 1998, Norvasc, is forecast to remain the leading drug by 2005, but otherwise the market will see an almost complete switch in the market leaders. AIIAs are forecast to make up the next four leading drugs in 2005.

- Three of the AIIAs are forecast to reach sales of between $2.2 billion and $2.5 billion in 2005, although in two of these cases sales of the drugs will be split between at least two marketing companies. BMS/Sanofi's AvaPro is forecast to be the leading AIIA, with total 2005 sales of $2,487m, followed by Merck & Co.'s Cozaar, the current leader, and Takeda/Astra's Atacand.

- The market will be strongly affected by the loss of patent protection on a number of the leading drugs during the period from 2000 to 2005. The patent expiry on Vasotec (enalapril) in particular will cause a significant wave of new generic competition. This will be rapidly followed by several more of the leading ACE inhibitors, causing a significant decline in the value of the ACE inhibitor market to 2005. The calcium channel blocker (CCB) market is also forecast to decline as a result of patent expiries on the once-daily line extensions of first generation CCBs, but will be supported by second generation drugs such as Norvasc.

- Other major changes in the anti-hypertensive market during the period from 1999 to 2005 are expected to be related to treatment recommendations and guidelines, partly driven by new trial results. These include new guidelines on the goals of treatment, and also on the desired choice of drug class for initial and second line treatment. Results from long term morbidity and mortality trials of new drugs will also help to settle long-running arguments over the benefits of newer classes.

Market Overview

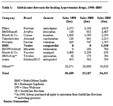

Figure 1 shows the forecast sales and market shares of the current five leading anti-hypertensive drugs from 1998 to 2005. The leading five drugs account for 27.0% of sales in 1998. This share is forecast to rise slightly to 27.4% in 2000 and then to fall off rapidly, down to 22.0% in 2005. This is set against the background of a forecast increase in the total market size of around 9.1% from 1998 to the year 2000 but a further subsequent total increase of only 3.4% from 2000 to 2005, a year on year compound annual growth of only 0.67%

The fortunes of these leading five drugs neatly encapsulate the future of the whole market over the next seven years. Three will suffer massive losses, whilst two will show strong growth. In the overall market, the two leading classes are expected to suffer losses, the angiotensin converting enzyme (ACE) inhibitors in particular, but the overall level of the market will be sustained by rapid sales growth in the angiotensin II receptor antagonist (AIIA) class, a few potentially promising new drugs, and also by increasing use of anti-hypertensives, particularly as combination therapy, as new guidelines and protocols become accepted into practice.

Figure 1: Market share of leading five hypertension drugs, 1998–2005 (Source: Datamonitor)

The leading drug, Pfizer's Norvasc, remains patent protected until around 2007 and is forecast to continue its steady sales growth, to around $4 billion in 2005, setting a new standard in sales of an individual anti-hypertensive brand. The current second placed drug, Merck & Co.'s Vasotec, is forecast to continue its gradual slide in sales to the year 2000 at which point it loses patent protection in the US and various other markets. This will herald a rapid fall in its sales, which can be clearly seen in the figure.

A similar fate awaits Zeneca's Zestril, which is forecast to peak in sales around 2000–2001 as a result of competing with generic enalapril and will then fall rapidly as it itself loses patent protection around the end of 2001/early 2002. The fourth drug, Merck & Co.'s Cozaar, represents the AIIA class, which is forecast to fill the gap left by the decline of the ACE inhibitor class. Cozaar's rise is forecast to continue to sales of $2.3 billion in 2005, slightly checked by competition from both generic ACE inhibitors and from the already arrived second generation AIIAs, several of which are also forecast to reach around $1 billion or more in sales by 2005. The fifth of the current leading drugs, Bayer's Adalat, shows a similar decline to the ACE inhibitors, as it too loses patent protection on the once-daily component of the Adalat line.

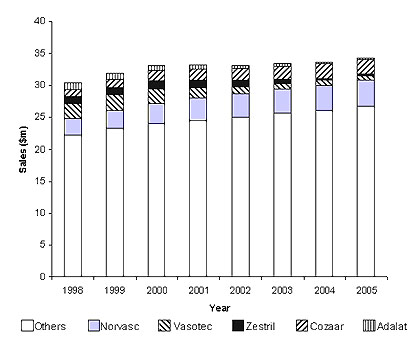

Table 1 shows the global sales and sales forecasts for the leading 10 hypertension drugs from 1998 to 2005. Where the new AIIAs are marketed by more than one company, combined sales have been shown.

The table shows how the AIIAs are forecast to become the dominant class in the market, certainly in terms of the leading drugs, although CCBs are actually forecast to reach slightly higher total sales in 2005 due to Norvasc, other smaller second generation drugs, and a very large generics market. The table shows that two new drugs are forecast to enter the top 10 by 2005, Boehringer Ingelheim's AIIA, Micardis, which was launched in January 1999 and is being comarketed by Abbott and Glaxo Wellcome, and BMS' Vanlev (omapatrilat), which is expected to be launched before 2001.

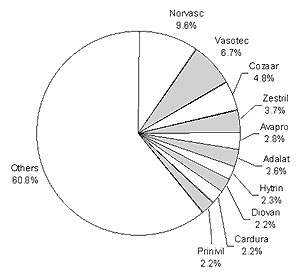

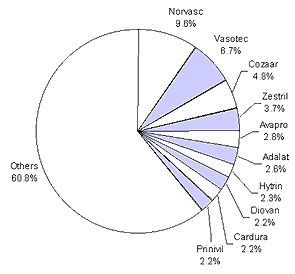

Figure 2 shows the forecast breakdown of the global anti-hypertensive market in the year 2000. At this point, the leading drugs in the market are fairly similar to those in 1998, except for the first generation CCBs, of which only Adalat is forecast to remain in the top 10. Notably, combined sales of BMS' and Sanofi's AvaPro are forecast to overtake sales of Diovan in 2000, whilst both Vasotec and Zestril remain in the top 10 but their rapid decline is about to start at this point.

Figure 2: Breakdown of the global hypertension market, 2000 (Source: Datamonitor)

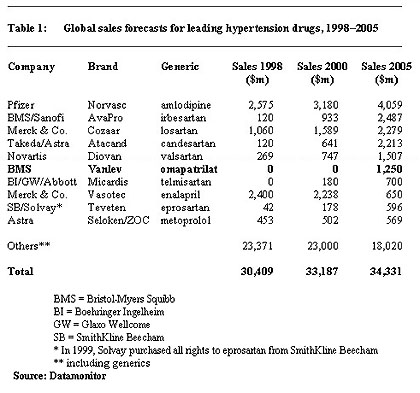

Figure 3 shows the forecast breakdown of the global hypertension market in 2005. This is significantly changed from the market in the year 2000 and shows the emergence of the AIIAs as the most prominent class in terms of leading drugs. It is also noticeable that these leading 10 drugs are forecast to account for nearly 50% of anti-hypertensive sales in 2005, compared with nearly 40% in the year 2000. This emphasises the fact that many current leading drugs outside the top 10 will also be losing patent protection or will at least become subject to competition from other generics, and emphasises the importance of new drugs, particularly the AIIAs, to the market.

Figure 3: Breakdown of the global hypertension market, 2005 (Source: Datamonitor)

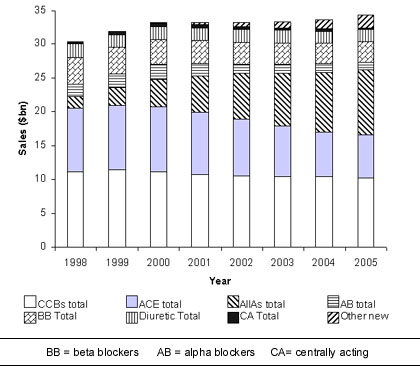

Figure 4 shows the forecast breakdown of the anti-hypertensive market between the seven existing classes and other new development drugs, such as omapatrilat. This figure more clearly shows the dynamics of the market over this period, highlighting the falling sales in the ACE inhibitor class after the year 2000, and the fact that this arrests the rapid growth of the market and slows it far more modest levels. It also shows the importance of the AIIAs and new development drugs in sustaining sales lost to generic ACE inhibitors and, to a lesser extent, in the CCB class.

Figure 4: Anti-hypertensive market share by class, 1998–2005 (Source: Datamonitor)

For more information: Kate Bradley, Analyst, or Howard Miller, PharmaVitae Manager, Datamonitor, Charles House, 108 -110 Finchley Rd., Swiss Cottage, London NW3 5JJ, UK. Tel: +44 20 7675-7000. Fax: +44 20 7675-7500.

Angelo DePalma