Emerging from the Merger: Warner-Lambert and Pfizer

By Melanie McCullagh, Datamonitor

Contents

Background

Product Portfolio Analysis

R&D Pipeline Analysis

Conclusion

Background (Back to Top)

On November 4, 1999, American Home Products (AHP) and Warner-Lambert announced their intention to merge, creating the world's largest pharmaceutical company, American Warner. However, following the announcement, Pfizer filed a complaint against Warner-Lambert and began a hostile takeover of the company.

In January 2000, despite Warner-Lambert's attempts to convince its shareholders that its deal with AHP would result in greater shareholder value, Warner-Lambert was forced to discuss a merger with Pfizer. These discussions recently resulted in the announcement that Warner-Lambert and Pfizer now intend to merge.

Pfizer started a hostile takeover of Warner-Lambert in December 1999. One of the principle reasons being to secure the full rights to Warner-Lambert's Lipitor (atorvastatin), which Pfizer already co-promoted with Warner-Lambert. The following section analyses the therapeutic fit between Warner-Lambert and Pfizer.

Product Portfolio Analysis (Back to Top)

Pfizer has a more diverse therapeutic focus than Warner-Lambert: Pfizer is active in six therapy areas, Warner-Lambert in three.

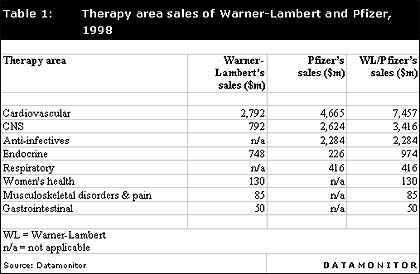

Therapy area sales of Warner-Lambert and Pfizer, 1998

Table 1 shows the therapeutic focus of Warner-Lambert's and Pfizer's leading 10 products in 1998, segmented by therapy area. In addition, sales of the merged company's top 20 products, by therapy area, are also indicated.

Pfizer and Warner-Lambert's ethical sales in 1998 were driven by the companies' cardiovascular portfolios. Pfizer's cardiovascular portfolio is dominated by the company's leading drug, Norvasc (amlodipine), which recorded sales of $2,575 million in 1998, and is also strengthened by its other anti-hypertensives, Procardia XL (nifedipine) and Cardura (doxazosin). These leading products complement Warner-Lambert's highest selling drug, Lipitor (atorvastatin), which is marketed as a treatment for hyperlipidaemia. Lipitor is co-promoted with Pfizer, and, therefore, Pfizer already possesses a sales force dedicated to the future sales of this drug.

The merged company will also hold a strong position within the CNS and anti-infectives therapy areas, mainly due to the influence of two of Pfizer's leading products, the antidepressant Zoloft (sertraline) and an antibacterial, Zithromax (azithromycin). These drugs generated 1998 sales of $1,836 and $1,041 million, respectively.

Analysis of other therapy areas indicates that both companies market treatments for diabetes. Warner-Lambert's second highest selling drug, Rezulin (troglitazone), is a diabetes drug and generated sales of $748 million in 1998, while Pfizer's leading diabetes drug is Glucotrol XL (glipizide), which recorded sales of $226 million in 1998. Other notable products in non-key therapy areas include Pfizer's Celebrex (celecoxib), which was launched in January 1999 and is expected to be Pfizer's next blockbuster drug and to further strengthen the combined company's future sales.

Figure 1 illustrates the therapeutic focus of Warner-Lambert's and Pfizer's leading 10 products in their respective portfolios in 1998.

Sales of Warner-Lambert's and Pfizer's leading 10 products in 1998 segmented into individual therapy areas

The merger between Warner-Lambert and Pfizer will produce a company that possesses a strong cardiovascular product portfolio containing two blockbuster drugs. In addition, the combined company will be particularly strong in the areas of CNS and anti-infectives, both of which will generate sales of over $2 billion. Further blockbusters have been launched by Pfizer, namely Celebrex (celecoxib) and Viagra (sildenafil), which will also boost future revenues. The combined company will therefore generate strong sales in a number of therapy areas, not just in its three key therapy areas.

R&D Pipeline Analysis (Back to Top)

The following section analyses the R&D pipelines of Warner-Lambert and Pfizer to identify the therapeutic synergies between the two companies.

Pfizer's main therapy areas, cardiovascular and CNS, are both well supported by the company's R&D pipeline. Pfizer has two cardiovascular and three CNS products in preregistration or registration. Its leading cardiovascular product is the anti-arrhythmia drug Tikosyn (dofetilide), which is currently in registration and expected to generate sales of between $560m and $810m in 2005. Pfizer also has one product, candoxatril (congestive heart failure), in preregistration. The company's earlier stage cardiovascular pipeline is weak, but will be supported by Warner-Lambert, which has a number of early stage cardiovascular products, including C1 1009 (ziconotide) for ischaemia, currently in phase III development, and the potential blockbuster CI 1011, which is in phase II trials for hyperlipidaemia.

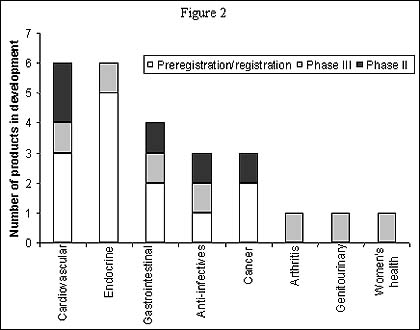

The following table and figure show the individual and combined R&D pipelines of Warner-Lambert and Pfizer and give an indication of the combined company's R&D pipeline in 1999.

Individual and combined R&D pipelines of Warner-Lambert and Pfizer, 1999

In the CNS area, Pfizer's Zeldox (ziprasidone) is in registration for the treatment of schizophrenia and is expected to record sales of between $370m and $830m in 2005. The company is also developing the migraine treatment Relpax (eletriptan) and the post-traumatic stress disorder treatment Zoloft (sertraline), both of which are in registration. Pfizer lacks phase III CNS products and this gap in its R&D pipeline will be filled by Warner-Lambert's phase III CNS drugs, CI 1007/PD 143188 and JO 1784/CI 1019 (igmesine), which are in development for dementia and depression, respectively. Warner-Lambert will ensure that the merged company possesses a continuous flow of CNS products onto the market.

Number of products in development in Pfizer and Warner-Lambert's R&D pipeline, 1999

A merger with Warner-Lambert will also strengthen Pfizer's phase II pipeline in the therapy areas of cancer, endocrine and gastrointestinals. One particularly strong synergy is apparent between Warner-Lambert's and Pfizer's endocrine therapy areas, where Warner-Lambert is developing two products for diabetes neuropathy, while Pfizer is developing a new inhaled version of insulin which complements Pfizer's and Warner-Lambert's existing diabetes products.

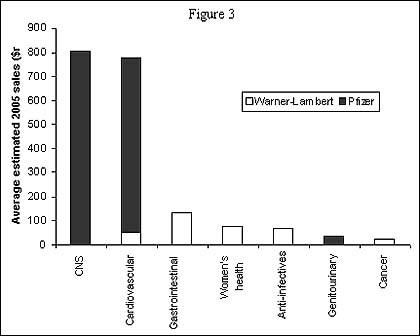

Figure 3 indicates the sales contribution to the combined company's 2005 sales from late stage products in individual therapy areas. Analysis of the two companies' late stage R&D product contributions to the combined company's revenues in 2005 indicates that Pfizer's CNS and cardiovascular products are likely to drive revenues, while Warner-Lambert's gastrointestinal, women's health and anti-infective products are likely to contribute to sales.

Sales contribution derived from Warner-Lambert and Pfizer's late stage pipelines

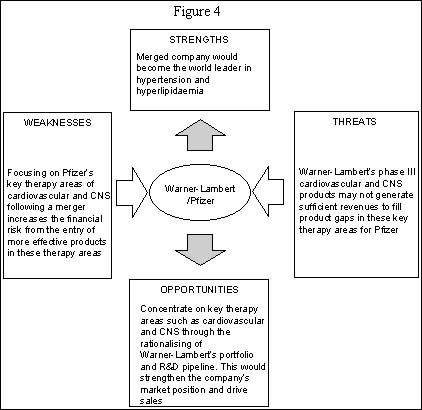

Conclusion (Back to Top)

Pfizer and Warner-Lambert share a number of synergies with respect to therapy area focus, especially in the area of cardiovascular products. The two companies also complement one another with respect to their R&D pipelines, although Pfizer's is very focused on a few key therapy areas. Pfizer has been particularly successful in identifying licensing opportunities for products, such as Lipitor and Celebrex, or developing products in house, such as Viagra. The company's analytical approach to R&D and the use of complicated risk-reward models during the development process enables it maximize to its return on ethical R&D spend. The acquisition of Warner-Lambert will provide it with a further blockbuster drug and a number of development stage compounds which will fill gaps in its current R&D pipeline. The resulting company will lead both the global anti-hypertensive and anti-hyperlipidemia markets and become one of the leading CNS marketers.

If the merger is successful, Pfizer can be expected to continue to employ its analytical approach to product portfolio management. This is likely to lead to a number of Warner-Lambert's products being divested and selected R&D programs terminated, as Pfizer concentrates on its key therapy areas.

SWOT analysis of the therapeutic focus of Warner-Lambert/Pfizer

For more information: Melanie McCullagh, Business Unit Head, Datamonitor, 108-110 Finchley Rd., Swiss Cottage, London NW3 5JJ, United Kingdom. Tel: +44 171 316 0001. Fax: +44 171 316 0002.