Emerging Market Trends For APIs

By Sampatkumarr Govind Donthula, MarketsandMarkets

The active pharmaceutical ingredient (API) market is estimated at $158.4 billion in 2023 and is projected to reach $232.8 billion by 2028 with a CAGR of 8.0% during the forecast period (2023-2028). Let’s take a closer look at new market research on APIs. Are innovative or generic APIs experiencing higher market growth right now? Synthetic or biotech APIs? I’ll answer these questions and more.

Pay Attention To Emerging Economies

Emerging economies such as India and China are expected to offer potential growth opportunities for players operating in the APIs market in the coming years. The cost of API manufacturing is 30%–35% lower in India compared to the U.S. Similarly, in China, the API manufacturing cost is 35%–40% lower than in the U.S. In addition to lower manufacturing costs, markets in developing countries are characterized by the presence of lenient and flexible environmental regulations related to API production capacities. The industry can take advantage of this to scale up production, productivity, and efficiency. But in order to realize this potential, companies must use economies of scale.

Technological Advancements In API Manufacturing

The introduction of new and advanced technologies for API manufacturing is one of the major factors supporting the growth of this market. Continuous manufacturing technology, which includes continuous flow chemistry, offers the potential for improved safety and environmental profiles. This technology has recently been adopted by companies such as Vertex Pharmaceuticals (U.K.), GlaxoSmithKline (U.K.), and Novartis (Switzerland) for API manufacturing. By ensuring continual processing and output, and consistent production, this technology offers several potential advantages over traditional batch manufacturing of pharmaceuticals, such as greater optimization and control of the process and a reduced manufacturing footprint. Also, the micro-structured devices used for this type of API manufacturing provide controlled process conditions, high flow rates, and high mass throughput.

Innovative Vs. Generic API

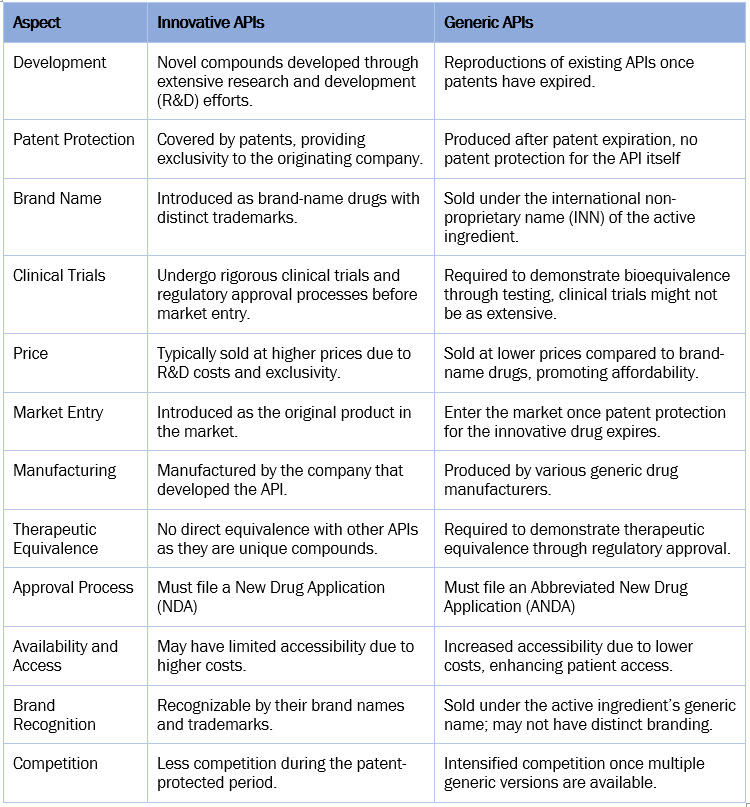

The table below provides a general comparison of innovative and generic APIs.

The higher market share of innovative APIs in the market is primarily driven by their higher pricing compared to generic APIs. Additionally, the rising number of regulatory approvals for new biologics contributes to the growth of innovative APIs. Meanwhile, new government initiatives to increase the adoption of generics are expected to boost the growth of generic APIs.

Synthetic APIs And Biotech APIs

Based on their mode of synthesis, APIs are classified as synthetic APIs or biotech APIs. Synthetic APIs currently dominate the API market owing to the emergence of new molecules, the increasing number of new product approvals, and technological advancements in synthesis methods.

On the other hand, the biotech APIs segment is projected to register the highest growth rate in the market. This is attributed to the increasing demand for monoclonal antibodies (mAbs), commercial introduction of cell and gene therapies for the treatment of genetic disorders, rising prevalence of cancer and diabetes, high incidence of autoimmune and neurodegenerative disorders, government initiatives, and the rising geriatric population worldwide. In September 2022, a National Biotechnology and Biomanufacturing Initiative was established by an Executive Order signed by U.S. President Biden. Through the initiative, biotechnology innovation will be accelerated and the bioeconomy in America will expand across several industries, including health, agriculture, and energy.

Based on product type, the biotech API segment is further classified into mAbs, hormones and growth factors, fusion proteins, cytokines, therapeutic enzymes, blood factors, and recombinant vaccines. The mAbs segment is the largest and fastest-growing segment of the biotech APIs market. Factors such as the increasing incidence of cancer, increasing investments in R&D, technological advances in genetic sequencing and target gene selection, and the minimal side effects compared to chemotherapy are driving the growth of this market. Additionally, emerging classes of more effective and efficient mAbs (such as Anti-PCSK9 monotherapy) show tremendous efficiency in the treatment of cardiovascular disorders.

Prominent Players And Recent Developments

The prominent players in the active pharmaceutical ingredient market include Pfizer Inc. (U.S.), Divi’s Laboratories Limited (India), Novartis AG (Switzerland), Sanofi (France), Boehringer Ingelheim (Germany), Bristol-Myers Squibb (U.S.), Teva Pharmaceutical Industries Ltd. (Israel), Eli Lilly and Company (U.S.), GlaxoSmithKline plc (U.K.), Merck & Co., Inc. (U.S.), AbbVie Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), AstraZeneca (U.K.), Cipla Inc. (India), Mylan N.V. (U.S.), Dr. Reddy’s Laboratories Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Evonik Industries AG (Germany), and Aurobindo Pharma (India).

These players in this market have adopted strategies such as agreements, collaborations, product launches, technology advancements, partnerships, acquisitions, and expansions to expand their global presence and increase their shares in the API market. Some of their strategic initiatives are given below:

- In June 2023, GSK plc announced the acquisition of BELLUS Health Inc., a biopharmaceutical company. The acquisition is focused on developing therapy for refractory chronic cough (RCC).

- In May 2023, Google Cloud announced the launch of two new AI-powered solutions called the Target and Lead Identification Suite and the Multiomics Suite that aim to help biotech and pharmaceutical companies accelerate drug discovery and advance precision medicines.

- In January 2023, Sai Life Sciences announced the launch of a new high-potency API (HPAPI) manufacturing facility at its cGMP API manufacturing site in Bidar, India. This new facility broadens the company's expertise in HPAPI development and manufacturing.

- In January 2023, Agilent Technologies Inc. announced an investment of around $725 million to double manufacturing capacity of therapeutic nucleic acids in response to a strong demand for the company’s API.

- In January 2023, the U.K. government signed a memorandum of understanding with BioNTech aimed at accelerating clinical trials for personalized immunotherapies for cancer and infectious disease vaccines.

- In 2022, Pfizer expanded its collaboration with CytoReason (Israel) for the use of its AI technology for drug discovery and development.

- In 2022, Novartis invested $300 million to increase the capacity and capabilities for next-generation biotherapeutics across Switzerland, Slovenia, and Austria.

- In 2022, Pfizer entered into an agreement with Acuitas to deliver a lipid nanoparticle delivery system for use in mRNA vaccines such as COMIRNATY (tozinameran) and therapeutics.

- In 2022, Sanofi and IGM announced a strategic collaboration agreement to streamline and optimize the development and commercialization of IgM antibody agonists for oncology, immunology, and inflammation.

- In 2022, Merck announced the launch of the Merck Digital Sciences Studio (MDSS) to enable the generation of innovative technologies for drug discovery and development.

The Dynamic Role Of APIs In Combatting Diseases: Application Analysis

APIs find a wide range of applications, including the treatment and management of various diseases such as communicable diseases, oncology, cardiovascular diseases, diabetes, pain management, respiratory diseases, and other therapeutic applications. APIs have been pivotal in the development of pharmaceuticals to combat a wide range of communicable diseases, including viral and bacterial infections. Communicable diseases are one of the leading causes of death worldwide and have a major impact on global public health and economic development. Additionally, the emergence of new diseases and the appearance of drug-resistant tuberculosis and malaria and insecticide-resistant vectors have led to more challenging medical procedures, which cause long-term financial and health implications for patients. Thus, the global health impact of these diseases and increasing antimicrobial resistance, together with limited antibiotic pipelines, compel innovator companies to focus on the discovery and development of new therapeutic drugs.

About The Author:

Sampatkumarr Govind Donthula, D.Pharm, B.Pharm, M.Pharm. (pharmacology), is assistant manager — healthcare (pharma/biotech) at MarketsandMarkets. He has more than 10 years of management consulting experience, with expertise in competitive intelligence, go-to-market strategy, pricing, market access, and more. He has worked on syndicate and consulting projects for pharmaceutical, medical device, and biotech companies. He has a postgraduate degree in pharmacology and undergraduate and diploma in pharmacy from the University of Pune.

Sampatkumarr Govind Donthula, D.Pharm, B.Pharm, M.Pharm. (pharmacology), is assistant manager — healthcare (pharma/biotech) at MarketsandMarkets. He has more than 10 years of management consulting experience, with expertise in competitive intelligence, go-to-market strategy, pricing, market access, and more. He has worked on syndicate and consulting projects for pharmaceutical, medical device, and biotech companies. He has a postgraduate degree in pharmacology and undergraduate and diploma in pharmacy from the University of Pune.