FDA, PDUFA, And Patient Engagement — What Pharma Companies Need To Know (And Do)

By Karla S. Anderson, Tim Pantello, and Alexander Gaffney, PwC

Pharmaceutical companies operating in the U.S. are facing challenges in 2017 and beyond related to how their products are assessed by regulators and paid for by insurers and customers. But new opportunities are emerging, and patient engagement is the key to unlocking them. New regulatory developments at the FDA and beyond allow companies to leverage patient experiences and behaviors to create better products, obtain faster regulatory approvals, and better demonstrate the value of their products over time to payers and reimbursement bodies.

A Challenging Environment

The pharmaceutical industry already faces several unique challenges, all of which seem likely to continue for several years at the very least.

First, 2017 will be a year of regulatory change and uncertainty. The industry will almost certainly see the reauthorization of the Prescription Drug User Fee Act (PDUFA), which will elevate patient engagement to be a core part of the FDA’s regulatory approvals process.1 CMS, too, is emphasizing patient engagement as part of its implementation of the Medicare Access and CHIP (Children’s Health Insurance Program) Reauthorization Act.2 And patient engagement is a core part of the 21st Century Cures Act, passed in December 2016, which includes sections devoted to streamlining patient input and using patient experience data in drug development.3

Major changes are also reshaping the Washington policy and regulatory landscape, with potential impacts for the FDA and the way it interacts with the life sciences industry. The FDA has new leadership in Dr. Scott Gottlieb, a long-time observer of and commentator on health policy issues who has argued the FDA needs to take a more risk-based approach to regulation and be more open to using surrogate measures, including those meaningful to patients.4 Beyond Gottlieb, the FDA is also under pressure from the Trump administration to find regulatory efficiencies to speed product approvals.5 Health reform, too, may place new pressures — including cost pressures — on companies and patients alike.

Second, companies are coming under tremendous pressure to demonstrate the value of their products. Insurers are fiercely negotiating the price and value of products based on outcomes. Some are even entering into deals with drugmakers to pay for products based on their performance in patients, or basing pricing on the recommendations of third-party assessments.6, 7 As medical affordability becomes a focus of society and industry, insurers are more concerned about the demonstrable, real-world performance of products more than efficacy, which is often determined in a closely monitored clinical trial.

Finally, consumers are also behaving in new ways, using social media to find and share healthcare information (37 percent of respondents to a PwC survey reported having done so), looking up healthcare information on their smartphones (25 percent), and using fitness bands to track activity (14 percent).8, 9, 10 As consumers seek and collect information in new ways, companies need to adapt to these new behaviors — a challenge for a traditionally slow-moving, highly regulated industry. They will also need to adapt to new cost pressures on patients. According to PwC data, in 2016, 32 percent of employers offered high-deductible health plans to their employees, compared to just 17 percent in 2012.11 As out-of-pocket costs for consumers rise, in some cases patients are going without recommended products and treatments. In 2015, 28 percent of consumers did not fill a prescription due to cost.12

Opportunities For Success

Despite the myriad of complex challenges facing pharmaceutical executives in 2017 and beyond, they have many opportunities to progress by leveraging a powerful but often under-utilized asset: the patients they serve.

Regulatory approvals offer one powerful example. Since 2012, the FDA has been holding regular meetings with patients as part of its patient-focused drug development program. At those meetings, the regulator has asked patients to describe their experiences living with diseases, how the diseases affect their daily lives, the downsides to their current treatments, and the risks patients are willing to assume in return for the prospect of potential benefit.

Some of those questions are asked frequently, even across seemingly dissimilar groups of patients afflicted with different diseases and conditions. Such questions and the answers to them offer regulators and companies alike a way to understand the views of patients, to identify areas of need, and to begin to quantify the extent of patient groups’ — and sub-groups’ — tolerance for treatment risk.

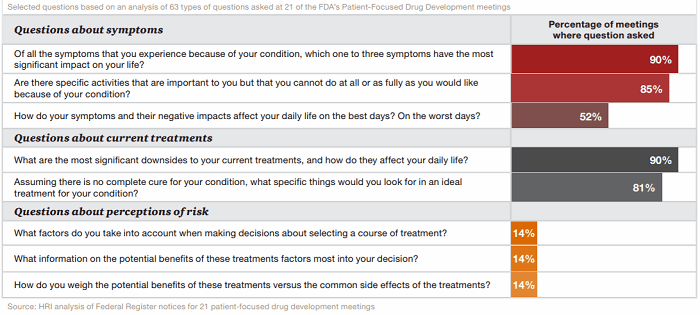

Figure 1: What do regulators want to know? An analysis of the FDA’s own questions to patients

Regulators have indicated they will use this information to tailor the regulatory approval process, potentially providing more leniency in cases where groups of patients are desperate for new treatments. But pharmaceutical companies can leverage this information as well. By engaging similarly with patients, they can find out which needs are not being met, allowing them to design clinical trials, products (such as drug delivery devices), and services to better meet their needs.

These interactions can prove powerful for patients and companies alike. By leveraging patient input, some companies have already found success in arguing for regulatory approval for drug products that might not otherwise have been granted approval. Companies may also find that patients need help, especially in taking a product correctly, remembering to take a product on a regular basis, or having their treatment-specific questions answered by medical professionals.

Obtaining Insights From Patients

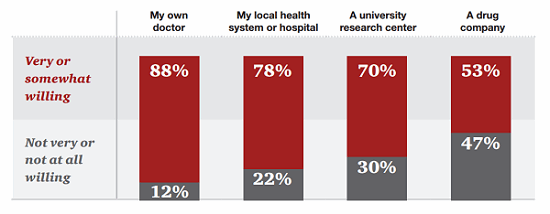

For their part, patients seem willing to provide some — though not all — information to companies, though they must first overcome a general deficit of trust. According to research by PwC’s Health Research Institute (HRI), 53 percent of patients are willing to share personal health data with pharmaceutical companies as long as that data is used to help discover new treatments.13

Figure 2: Patients are less likely to share their data with pharmaceutical companies than doctors, hospitals, or researchers.

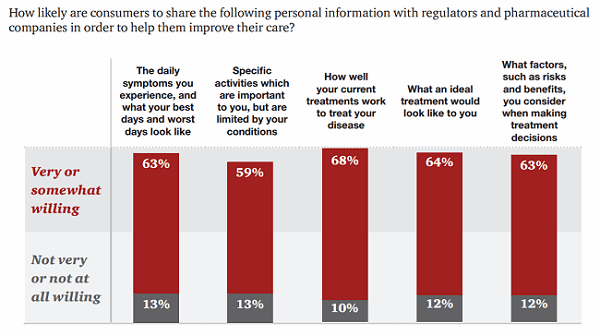

However, patients are willing to share some data even more freely: 63 percent would share their tolerance for treatment risk, and 68 percent are willing to share how well their current treatments work.14 In fact, the majority of patients were more likely to share narrative health data — their daily experiences or challenges, for example — than their complete health data, such as test results or their complete medical histories.

Figure 3: Consumers are willing to share certain health data with pharmaceutical companies and regulators.

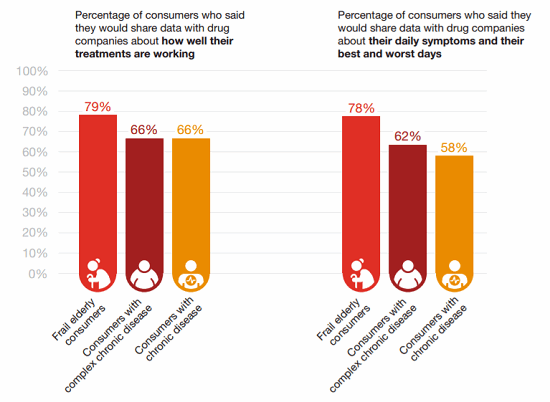

Interestingly, some sub-sets of patients are even more likely to share data than others, according to HRI’s survey. Patients who are frail or elderly are generally more willing to share, for example.15

Figure 4: Who’s willing to share? Some types of patients are more — or less — likely to share their insights than others.

Companies can facilitate the exchange of this data through partnerships, such as with advocacy organizations, which may provide access to this data.

Leveraging Data To Obtain Easier (Or Higher) Reimbursement

Patient data can prove especially useful to companies trying to confront a key challenge: How does a company make the case for the reimbursement value of its product?

Here again, patient involvement can prove to be a key differentiator. Companies that work closely with patients can better understand their needs, how an experimental or marketed treatment can have a meaningful impact on their lives, and how additional solutions or changes to a product’s design can improve adherence and patient satisfaction.

As companies are increasingly asked to demonstrate the value of their products — sometimes as part of performance-based pricing contracts — they need to understand how patient preferences can have an impact on product outcomes over time. A product that works great in clinical trials may underperform in real-world settings if it is difficult or unpleasant to use, challenging to obtain, or if patients forget to take it, for example.

If companies are able to find or develop performance enhancements for their products, they can better argue that their product is worth its purchase price and should be on a formulary.

As Consumers Change, So Too Must Companies

As consumer behaviors change, companies also need to be clued in to how they can provide personalized treatment that meets the needs of their customers. Patients should be understood as having unique needs, which may vary by factors such as disease severity and age.

One example is the growing acceptance of digital technology in patient treatment. When HRI asked consumers aged 25 to 34 whether they would be willing to incorporate a video game into their treatment if they were diagnosed with a mental health problem, 78 percent said yes. Just 36 percent of surveyed consumers over the age of 65 were willing.16

Unique needs lend themselves to unique solutions, and companies should be prepared to think creatively and enter into strategic partnerships with consumer and technology companies. For example, 18 percent of consumers said they want help understanding their medications and how to take them correctly.17 A solution that works for younger patients may need to be reimagined for the elderly, just as a solution that works for a healthy workout enthusiast may need to be reimagined for someone with chronic conditions.

One critical element for companies to incorporate is the concept of patient activation. If patients express a desire to do something — remain adherent to their treatment regimen, for example — a company’s challenge will be to initiate a change and then maintain that positive behavior over time. Patient engagement is only fully realized if their needs are met over a sustained period of time. Here, companies can leverage social science research to determine how to affect human behavior to help patients make positive, self-directed changes to benefit their health, such as focusing on a series of tiny changes to habits instead of one or two drastic ones.

When it comes to patient engagement, you know your product, your data and your audience-now learn how to influence patient-focused outcomes. View Jill Donahue's engaging webinar on-demand:

The Power of Influencing – Achieving Patient-focused Outcomes to Guarantee Success

Leveraging Digital Technologies

Fortunately for pharmaceutical companies, technological solutions can help them create patient solutions at scale and at a reasonable cost. Technology can be used to help patients improve health outcomes, but only if they are consumer-friendly. It is this combination — of technology and a deep understanding of behavioral science — that can be seen as a resource for patients and used frequently.

Another important dimension is understanding the users of the technology. If patients find an application useful, but their caregiver or physician do not, the full potential of that product is not being realized. Just 5 percent of physicians use remote monitoring technology, including apps, to stay connected to their patients. When consulting patients during visits, 13 percent of clinician respondents to an HRI survey indicated they received data from mobile apps used by patients to track health data. However, sixty-eight percent of clinicians say the use of smartphones and mobile health apps in their practice has increased convenience for patients.18

Designing apps with physicians or caregivers in mind — or designing applications capable of serving patients directly but outputting data in a usable way for healthcare providers — is critical as pharmaceutical companies seek to improve patient health. Companies should understand how data will ultimately be used by a range of stakeholders in a patient’s health to ensure patients feel engagement is an asset rather than a burden of data entry.

Companies must also be prepared to listen: First to the needs of patients to identify areas of unmet need; second, to ways those needs can be met; and third, to how to improve upon existing efforts. Patient engagement is not a one-and-done exercise but rather an iterative, conversational process in which patient needs, technologies, and preferences may change over time, requiring adaptation by life sciences companies. Prescribing is generally not a one-time event. While companies focus much on how to get patients to start a treatment, less focus has been placed on how to ensure patients maintain those treatments and improve their health.

Further, companies should look to emerging technologies to solve as-yet unmet needs. A disease which primarily affects young children, for example, might require frequent injections — an uncomfortable and scary prospect for a child. A company could help, for example, by leveraging virtual or augmented reality technology to transport that child to a virtual environment, allowing the shots to be administered with less distress.

Finally, companies should give thought to how they wish to use data obtained from patient engagement technologies. Some companies may seek to maximize the use of any data collected, while others may simply seek to use it to improve a specific patient engagement offering. Transparency and clarity about the intended uses — and non-uses — of data is critical to earning and maintaining patient trust. If patients perceive intended engagement to be nothing more than a transactional arrangement — that is, for the primary benefit of companies rather than patients — they will likely disengage from current and future efforts.

The Big Picture

Pharmaceutical clients face challenges over the coming year, but patient engagement efforts can help alleviate those pressures by setting up companies for regulatory and commercial success.

Early engagement with patients allows companies to better understand their needs and wants, enabling companies to better design their products and set up cohesive support systems for users. Understanding those needs is crucial in a value-based environment, where patients, payers, and healthcare providers focus on quality and costs. And in an increasingly flexible regulatory environment, patient engagement can help companies better make the case for FDA approval.

While the sector faces a critical deficit of trust with patients, it can surmount this obstacle by collaborating with patient groups and others to develop tools that will provide an opportunity to help patients and, by extension, the companies themselves.

References:

- FDA. “PDUFA VI: Fiscal Years 2018 - 2022.” http://www.fda.gov/ForIndustry/UserFees/PrescriptionDrugUserFee/ucm446608.htm

- CMS. Quality Payment Program: Advancing Care Information. https://qpp.cms.gov/measures/aci

- Congress. 21st Century Cures Act. https://www.congress.gov/bill/114th-congress/house-bill/34/related-bills

Gottlieb, Scott. American Enterprise Institute. “FDA needs to change how it regulates novel technologies.” http://www.aei.org/publication/fda-needs-to-change-how-it-regulates-novel-technologies/

Gottlieb, Scott. American Enterprise Institute. “Yes: It prods bureaucratic FDA into taking actions that will save countless American lives.” http://www.aei.org/publication/yes-it-prods-bureaucratic-fda-into-taking-actions-that-will-save-countless-american-lives/

- “Christensen, Jen. CNN. “Trump vows to ‘slash restraints’ on drug development for FDA.” 1 March 2017. http://www.cnn.com/2017/03/01/health/trump-fda-slash-restraints/index.html

- Weisman, Robert. “Harvard Pilgrim adds new drugs under ‘pay-for-performance’ deals.” The Boston Globe. June 27, 2016. https://www.bostonglobe.com/business/2016/06/27/harvard-pilgrim-adds-new-drugs-under-pay-for-performance-deals/2OQYId32R5RSc0s8wGKooM/story.html

- Cigna press release. “CIGNA implements value-based contract with Novartis for heart drug Entresto.” February 8, 2016. http://www.cigna.com/newsroom/news-releases/2016/cigna-implements-value-based-contract-with-novartis-for-heart-drug-entrestotm

Humer, Caroline. “Novartis sets heart-drug price with two insurers based on health outcome.” February 9, 2016. http://www.reuters.com/article/us-cigna-novartis-drugpricing-idUSKCN0VH25K

- HRI. Third party drug assessors: Influential new voices in the value debate. 2016. https://www.pwc.com/us/en/health-industries/health-research-institute/publications/third-party-drug-assessors.html

- 2016 HRI Summer Consumer Survey. Question 143. “Have you ever used any of the following social media outlets for healthcare purposes (posting something about a health condition for advice from friends on Facebook, etc.)? Select all that apply.”

- 2016 HRI Summer consumer survey. Question 142. “Have you ever used a mobile device (e.g. smartphone, tablet, smartwatch) to do the following? Select all that apply.”

- 2015 HRI Consumer Survey. Question 29. “Which of the following wearable devices, if any, do you own? Select all that apply.” Selection: “Fitness Band.”

2016 HRI Fall Consumer Survey. Question 54. “How often do you use wellness or fitness apps on your smartphone, tablet or smartwatch? Examples include fitness trackers, trackers or entertainment/fitness apps.”

- 2016 Health and Well-being Touchstone Survey results. PwC. https://www.pwc.com/us/en/hr-management/publications/health-well-being-touchstone-survey-2016.html

- 2016 HRI Summer Consumer Survey. Question 157. “How many times have you decided not to seek medical care due to cost in the past year?”

2016 HRI Summer Consumer Survey. Question 158. “How many times have you decided not to fill a prescription due to cost in the past year?”

- 2015 HRI Summer Consumer Survey. Question 20. “How willing are you to provide the following with your personal health data to help discover new treatments?”

- 2016 HRI Summer Consumer Survey. Question 166. “Now, focusing on pharmaceutical companies and regulators (e.g., the U.S. Food and Drug Administration) specifically, please rate how likely you would be to share the following personal information with those organizations in order to help them improve your care.”

- PwC Health Research Institute. “Top health industry issues of 2017: A year of uncertainty and opportunity.” http://www.pwc.com/us/en/health-industries/top-health-industry-issues.html

- 2015 consumer survey. Question 86. “How willing would you be to use videogames as part of mental health treatment?”

- 2016 HRI Summer Consumer Survey. Question 120. “Which of the following would you like to have to be able to better manage your overall health or a specific health problem? Select all that apply.”

- 2017 HRI Spring Clinician Survey.

About The Authors:

Karla S. Anderson is a partner in PwC’s Advisory Pharmaceutical and Life Sciences group, leading the commercial practice. She has over 30 years of experience in the healthcare industry, with a clinical background and broad healthcare system knowledge. Karla focuses on the factors impacting demand, market access, and value. She works with her clients to design and implement new commercial models based on the changing global marketplace with a specific focus on market access and customer engagement. In addition, Karla has worked extensively on multichannel strategy and operations projects for a broad set of clients. She can be reached at karla.s.anderson@pwc.com.

Karla S. Anderson is a partner in PwC’s Advisory Pharmaceutical and Life Sciences group, leading the commercial practice. She has over 30 years of experience in the healthcare industry, with a clinical background and broad healthcare system knowledge. Karla focuses on the factors impacting demand, market access, and value. She works with her clients to design and implement new commercial models based on the changing global marketplace with a specific focus on market access and customer engagement. In addition, Karla has worked extensively on multichannel strategy and operations projects for a broad set of clients. She can be reached at karla.s.anderson@pwc.com.

Tim Pantello is a managing director with-in PwC’s Health Industry Advisory team. His experience has been instrumental in helping clients become leaders in their respective categories in the pharmaceutical and life sciences space through the development of creative business solutions and digital platforms. Tim’s 20 years of experience in digital media, relationship marketing, general advertising, and outside sales encompassed working for three of the top six marketing services firms, holding positions of increasing responsibility with Digitas (Publicis), DDB (Omnicom), HAVAS, and Sanofi. He can be reached at tim.pantello@pwc.com.

Tim Pantello is a managing director with-in PwC’s Health Industry Advisory team. His experience has been instrumental in helping clients become leaders in their respective categories in the pharmaceutical and life sciences space through the development of creative business solutions and digital platforms. Tim’s 20 years of experience in digital media, relationship marketing, general advertising, and outside sales encompassed working for three of the top six marketing services firms, holding positions of increasing responsibility with Digitas (Publicis), DDB (Omnicom), HAVAS, and Sanofi. He can be reached at tim.pantello@pwc.com.

Alexander Gaffney is a senior manager with PwC's Health Research Institute (HRI) and leads HRI’s analysis of regulatory and legislative policies impacting the life sciences industry and new entrants. Prior to joining HRI’s regulatory center, Alexander worked for the Regulatory Affairs Professionals Society (RAPS), where he led their regulatory intelligence unit. He has written extensively about the regulation of pharmaceuticals, biotechnology products, medical devices, and dietary supplements, and his work has been cited in several congressional reports. He can be reached at alexander.r.gaffney@pwc.com.

Alexander Gaffney is a senior manager with PwC's Health Research Institute (HRI) and leads HRI’s analysis of regulatory and legislative policies impacting the life sciences industry and new entrants. Prior to joining HRI’s regulatory center, Alexander worked for the Regulatory Affairs Professionals Society (RAPS), where he led their regulatory intelligence unit. He has written extensively about the regulation of pharmaceuticals, biotechnology products, medical devices, and dietary supplements, and his work has been cited in several congressional reports. He can be reached at alexander.r.gaffney@pwc.com.