Genzyme General to acquire GelTex Pharmaceuticals

GelTex's Renagel seen as potential blockbuster

Table of Contents

Terms of the agreement

Greater than anticipated potential for Renagel

Revenue growth

WelChol and more

Genzyme General (Cambridge, MA) and GelTex Pharmaceuticals Inc. (Waltham, MA) announced on September 11 that Genzyme will acquire GelTex. The transaction is expected to close in the fourth quarter, pending approval from regulatory agencies and GelTex shareholders.

With the acquisition, Genzyme obtains two patent-protected, marketed products: Renagel (sevelamer hydrochloride) and WelChol (colesevelam hydrochloride)—in addition to a significant pipeline of promising products and a proven and productive polymer technology platform. Renagel is a rapidly growing product used in end-stage renal disease; WelChol is a new cholesterol-lowering agent that will be launched this month by Sankyo-Parke Davis.

Genzyme believes that the worldwide market opportunity for Renagel is far greater than originally anticipated. Genzyme expects that at least four fundamental factors will propel the product's exponential growth:

- rapidly increasing market share driven by evidence of the role of calcium in cardiovascular disease;

- appropriate adjustment of daily doses of Renagel by physicians to lower patient phosphorus levels into the normal range;

- substantial growth in the dialysis patient population; and

- Renagel's potential to lower the overall cost of caring for dialysis patients.

"Renagel has the potential to become a blockbuster product that will serve as an important driver of our future growth," said Henri A. Termeer, chairman and CEO of Genzyme Corp. According to Termeer, Renagel represents "the most important advance in the treatment of dialysis patients since… Epogen. We expect to soon begin a large clinical trial to study the product's ability to improve morbidity and mortality. Genzyme expects that the market potential for Renagel will surpass $500 million within five years and that it will reach $1 billion within the decade."

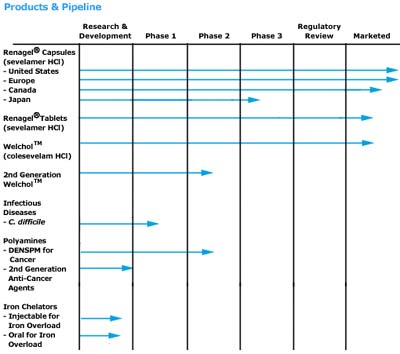

By acquiring GelTex, Genzyme obtains a broad pipeline of 12 products in clinical development.

Terms of the agreement

GelTex shareholders will receive 0.7272 of a share of Genzyme General common stock or $47.50 in cash for each GelTex share owned, subject to proration to maintain the cash portion of the consideration at 50%, approximately $500 million. The merger consideration represents a 27% premium over GelTex's closing share price on September 8, 2000.

The tax-free transaction has a total value of approximately $1 billion, based on GelTex's 21.4 million shares outstanding today and Genzyme General's closing share price of $65.3125 on September 8.

The boards of directors of Genzyme Corp. and GelTex have approved the transaction, which is subject to clearance under the Hart-Scott-Rodino Anti-Trust Improvements Act. The transaction will require the approval of GelTex shareholders, and is subject to customary closing conditions.

Genzyme General expects that the acquisition of GelTex may result in a one-time charge in the fourth quarter of 2000, related to the write-off of in-process research and development. The acquisition, which will be accounted for as a purchase transaction, is expected to be dilutive to Genzyme General's near-term earnings but is expected to become accretive to earnings in 2002 prior to depreciation and amortization of good will.

GelTex employs approximately 110 people. Genzyme plans to retain GelTex's administrative offices and laboratories in Waltham, Massachusetts. In addition to its marketed products, its pipeline, and unique polymer technology, GelTex has assets that include approximately $119 million in cash, usable net operating loss tax carry forwards, important intellectual property protecting Renagel and their other products, and research facilities.

Greater than anticipated potential for Renagel

Renagel's growth will also be driven by a substantial increase in the number of patients undergoing dialysis. Worldwide, approximately 1 million people are now on dialysis and the number is expected to reach 1.7 million by 2009, led by the increased incidence of diabetes, hypertension, and a growing elderly population. The current annual cost of Renagel therapy is approximately $1,000 per patient and is expected to double within the decade from a combination of prescription-driven dosage increases and compliance improvements. Based on market penetration estimates and the availability of reimbursement, Genzyme expects Renagel revenues to reach $500 million within five years and $1 billion in ten years.

Another major driver of Renagel's growth will be its potential to improve patient morbidity and mortality. In a study to be published next month, Allan Collins of the University of Minnesota showed a significant improvement in morbidity and observed improved trends in mortality among Medicare patients treated with Renagel compared with patients treated with calcium binders. In this retrospective analysis of data from the U.S. Renal Data System, Collins found a statistically significant 50% reduction in hospitalization, and a 35% reduction in deaths among Renagel patients compared to the calcium-treated patients.

One of the more intriguing aspects of the Collins study was its analysis of patient Medicare payment histories. In this analysis, Collins found dramatic annual costs savings for patients treated with Renagel. These savings averaged more than $17,000 per patient annually based on decreased hospitalizations alone. Genzyme believes Renagel's ability to lower the overall cost of care for dialysis patients will play a critical role in the product's long-term growth.

Finally, an additional and significant attribute of Renagel is that it has been shown in clinical studies to dramatically lower LDL cholesterol while increasing HDL cholesterol.

Revenue growth

Renagel has generated average quarter-to-quarter revenue growth of 25% since its introduction. Renagel sales in 1999—the product's first full year on the market—were $19.5 million. For 2000, Renagel sales are expected to more than double, and Genzyme is now revising its revenue guidance upward, for the second time this year, to around $45 million. Renagel revenues are expected to double again in 2001 and—within five years—to exceed $500 million.

Renagel is currently marketed in the United States, Europe, Canada, and Israel under a 50/50 joint venture between Genzyme and GelTex. The product is being developed and will be commercialized in Japan and other Pacific Rim countries by Chugai Pharmaceuticals and Kirin Pharmaceuticals under agreements with GelTex.

WelChol and more

In addition to Renagel, Genzyme's acquisition of GelTex will also give it access to WelChol, three products in clinical trials, and three more product candidates potentially entering clinical trials next year.

Genzyme will receive royalties from sales of WelChol, which is being launched by Sankyo-Parke Davis this month. A Phase 2 clinical trial of a second-generation version of WelChol will be completed this quarter, and additional clinical trials are planned.

GelTex also has a number of products in its pipeline. Its leading product in development is a toxin binder known as GT160-246 for Clostridium difficile (C. difficile), which is a major cause of antibiotic associated colitis, a condition common in hospitals and nursing homes. C. difficile affects over 500,000 patients per year, resulting in prolonged hospital stays and increased costs, and is the cause of an estimated 5,000 deaths annually. A Phase 1 trial of GT160-246 in normal volunteers was completed in August, and a Phase 2 clinical trial of the product is expected to begin later this year.

In addition, GelTex has made progress in its research efforts towards discovery of a new class of fat-absorption inhibitors, a family of polymers that inhibit pancreatic lipase, the key enzyme involved in fat digestion in the intestine. In pre-clinical studies, these compounds have shown they can inhibit lipase with a potency in the range of that of known inhibitors. They have also show that they can significantly inhibit fat absorption. GelTex has also identified polymers that bind fat and prevent the oily stool associated with lipase inhibition. Since these compounds are high-molecular-weight polymers, they are unlikely to be absorbed into the blood stream. Such compounds could potentially inhibit fat absorption without causing oily stool side effects associated with current therapy.

GelTex's polymer technology platform has produced two approved products and several promising product candidates within a short six-year time span. Genzyme expects that this technology will be a consistent and productive source of product candidates to feed its therapeutics pipeline. Polymer technology has wide ranging applications, and polymer-based products enjoy a relatively quick development pathway and have proven to be very safe. GelTex's scientists are widely respected in the industry, and the company's two most senior scientists recently received an award from the American Chemical Society for their innovative application of polymer technology to the development of therapeutic agents.

Edited by Angelo DePalma

Managing Editor, Drug Discovery Online and Pharmaceutical Online