Glaxo Wellcome and SmithKline Beecham Merge at Last

Both companies' shareholders will also benefit from the merger, as the companies' substantial global sales and marketing strengths will result in increased global revenues from current and future products. The increased revenues and cost savings will also result in the new company, Glaxo SmithKline, possessing the highest R&D budget in the industry.

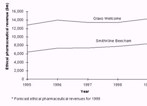

Revenue Growth

Glaxo Wellcome's ethical pharmaceutical sales only grew by 0.03% in 1998 to $13.4 billion, although Datamonitor forecasts that growth will be greater for 1999 with sales expected to increase to $14.2 billion for full year 1999. However, SmithKline Beecham's ethical pharmaceutical revenues increased by 4.7% in 1998 to $7.8 billion and are forecast to grow even more strongly in 1999 to $8.3 billion.

Over the next three years SmithKline Beecham is expected to continue to achieve strong growth partly due to increased sales of its diabetes treatment Avandia. Although the growth which SmithKline Beecham's ethical pharmaceuticals division will experience is likely to be tempered by Glaxo Wellcome's weaker growth, the combined company will have stronger sales growth than Glaxo Wellcome alone and, therefore, the merger will be of substantial benefit to Glaxo Wellcome. The key benefit of the merger for SmithKline Beecham is that the combined company's increased pharmaceutical revenues will provide greater funds for pharmaceutical R&D. This will allow SmithKline Beecham to pursue research projects for which it did not previously have the necessary funding. The combined company will have the highest R&D budget in the industry, which should allow the development of innovative products with high future revenue potential.

Ethical revenues for Glaxo Wellcome and SmithKline Beecham, 1995-99

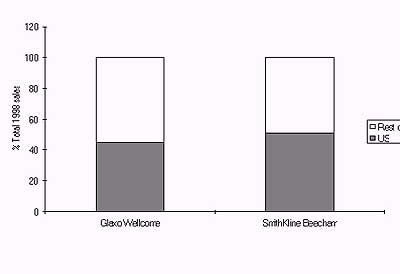

Geographic Strategy

Glaxo Wellcome has a strong global presence with only 44.7% of total sales derived from the US in 1998. SmithKline Beecham is more US focused, with US revenues making up 51.0% of total sales in 1998. The merger between Glaxo Wellcome and SmithKline Beecham will significantly increase both companies' global strength and, in the US in particular, the merged company will have one of the largest sales forces in the industry. Therefore, as a strategy to increase geographic strength, the merger will be of benefit to both parties.

Geographic split of total sales, 1998

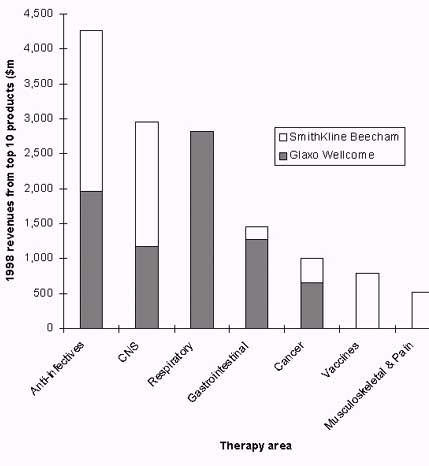

Portfolio Strategies

In terms of portfolio fit, Glaxo Wellcome and SmithKline Beecham have two core areas in common: anti-infectives and CNS. Their merger will lead to the combined company being particularly strong in these markets and create synergies between the two companies' sales and R&D infrastructures. Also, as SmithKline Beecham's anti-infectives portfolio is focused on antibacterials, while Glaxo Wellcome's is focused on antivirals few product divestments should be necessary.

Their cancer and gastrointestinal portfolios will also be strengthened, which is likely to result in significant cost savings across these key areas. Glaxo Wellcome's other main therapy area is respiratory and, combined with SmithKline Beecham's strength in vaccines and arthritis, will result in the merged company having a broad portfolio with little reliance on any one therapy area.

Significant synergies also exist between Glaxo Wellcome and SmithKline Beecham's R&D pipelines, both being focused on anti-infectives, CNS and cardiovascular products. This will increase the merged company's portfolio strength in these fields in the future and also allow significant cost savings to be made. Both pipelines also contain products in development in a variety of other therapy areas which will result in a broad pipeline.

Combined portfolios of Glaxo Wellcome and SmithKline Beecham, 1998

For more information: Howard Miller, PharmaVitae Manager, Datamonitor, 106 Baker St., London W1M 1LA, England. Tel: +44-171-316-0001. Fax: +44-171-316-0002.