Growth And Trends In Topical Drug Contract Manufacturing

By Pooja Sharma, Global Market Insights

Topical drugs, designed to be applied directly to the skin, are key to treating a wide range of conditions, from skin diseases and infections to cosmetic concerns. The demand for these formulations has skyrocketed, driven by the increasing prevalence of dermatological conditions and the growing emphasis on personal care and skincare.

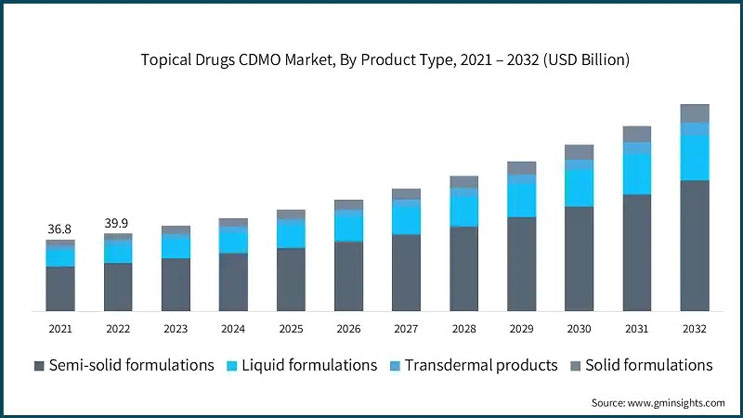

As the need for effective topical treatments expands, the usage of CDMOs in this space is also experiencing significant growth as they provide the pharmaceutical industry with essential expertise, advanced infrastructure, and robust production capacity, enabling the swift development and market introduction of these products. Our latest market research forecasts the market to reach an impressive $105.9 billion by 2032, with a robust CAGR of 10.5% from 2024 to 2032. This surge is driven by breakthroughs in drug delivery technologies, increasing global healthcare needs, and the growing focus on dermatology treatments. This editorial delves into the key segments shaping the market, such as semi-solid formulations, dermatology applications, contract manufacturing services, and critical regions like Asia Pacific and the U.S., offering a comprehensive outlook on the industry's future trajectory.

Dermatology: A Key Therapeutic Area Driving Market Demand

Dermatology is one of the fastest-growing therapeutic areas in the topical drugs market. This growth is fueled by rising incidences of dermatological conditions, including acne, psoriasis, eczema, and skin cancer. Topical treatments for dermatological conditions such as eczema and psoriasis are increasingly popular due to their ability to target the skin directly, offering faster relief and minimizing side effects compared to oral medications.

Skin cancer is the most commonly diagnosed cancer in the U.S., surpassing the combined cases of all other cancers annually.

In addition, the ongoing shift toward biologics in dermatology treatments has brought about the development of specialized topical drugs targeting specific conditions, such as targeted therapies for psoriasis. The increasing use of biologic topical products has opened new avenues for CDMOs in the dermatology space.

Semi-Solid Formulations: The Backbone Of Topical Drug Manufacturing

Semi-solid formulations dominate the market. These formulations are preferred due to their ease of application, effectiveness in localized treatments, and versatility.

These formulations include creams, gels, ointments, lotions, and pastes, all of which are extensively used for dermatology treatments, pain management, and various skin conditions.

- Creams and Lotions: These are the most commonly produced semi-solid products and are used widely for dermatological treatments. Their emulsion-based composition allows for a smooth, non-greasy feel, making them ideal for consumer use.

- Gels and Ointments: Gels offer fast absorption and are suitable for conditions requiring faster penetration into the skin, while ointments provide long-lasting moisture and are better suited for chronic skin conditions.

- Foams and Sprays: These are gaining traction in the market due to their convenience and ease of application, especially for hard-to-reach areas on the body.

With conditions such as acne, eczema, and psoriasis on the rise globally, the need for effective, easy-to-use treatments like semi-solid formulations has grown significantly.

Manufacturers in the CDMO sector are also increasingly focusing on these formulations, as their production processes often require advanced technologies and specific expertise to ensure consistent product quality and safety. Companies such as Cambrex and Bora Pharmaceuticals are investing in innovative manufacturing techniques to cater to this demand.

According to the latest research by Global Market Insights Inc., the semi-solid formulation segment generated $27.3 billion in the overall topical drugs CDMO market in 2023 and is projected to grow steadily over the next decade.

Technological Advancements To Watch

Technological advancements in formulation technology and transdermal drug delivery systems are propelling this trend forward. Innovative technologies, including nanoparticle-based topical treatments, liposomes, and microencapsulation, are enhancing the bioavailability and therapeutic efficacy of topical drugs. This enhancement makes them more attractive for treating a broader range of conditions, from chronic skin issues like eczema and psoriasis treatment to pain management and hormonal therapies.

An Overview Of Contract Manufacturing Of Topical Drugs

Contract manufacturing plays a pivotal role in the production and development of topical drug products. Pharmaceutical companies often outsource manufacturing to CDMOs to reduce operational costs, improve efficiency, and leverage specialized expertise. Outsourcing production to CDMOs allows pharmaceutical companies to focus on their core competencies such as research and development (R&D), marketing, and distribution. CDMOs in the topical drug market offer a wide range of services, including formulation development, scale-up, clinical trial manufacturing, and commercialization support.

Prominent players operating in the space include:

- Ascendia Pharmaceuticals

- Bora Pharmaceuticals

- Cambrex

- Contract Pharmaceuticals

- DPT Laboratories

- MedPharm

- PCI Pharma Services

- Pierre Fabre Group

- Piramal Pharma Solutions

- The Lubrizol Corporation

As the market continues to grow, the role of contract manufacturers has become more prominent, especially with the rising demand for outsourcing in drug production. Some recent notable developments are:

- In September 2024, Blue Wolf Capital Partners LLC expanded its pharmaceutical presence by acquiring seven European manufacturing facilities from Recipharm in Sweden, France, and Spain, which specialize in oral solid, semi-solid, and liquid dosage forms. Additionally, Blue Wolf agreed to acquire Synerlab, a French CDMO with six facilities. These acquisitions have enhanced Blue Wolf's CDMO capabilities, regulatory expertise, and geographical reach in the European pharmaceutical market.

- MedPharm, a global CDMO for topical and transdermal products and an Ampersand Capital Partners portfolio company, announced its merger with Tergus Pharma, a portfolio company of Great Point Partners, in July 2024. Operating under the MedPharm name, the combined entity will become an end-to-end CDMO, offering comprehensive scientific expertise, clinical trial manufacturing, and commercial production capabilities.

- In April 2024, Aterian Investment Partners, a private investment firm, announced that one of its affiliates entered into an agreement to recapitalize Contract Pharmaceuticals Limited Canada. CPL is a North American CDMO specializing in non-sterile liquid and semi-solid dosage forms.

- In January 2024, Taiwan-based CDMO Bora Pharmaceuticals announced its expansion into the United States with the acquisition of Minnesota-based generics manufacturer Upsher-Smith Laboratories for $210 million.

- In January 2023, Swiss American CDMO, a Dallas-based company specializing in topical skincare products, announced a new agreement with LiquiGlide, the creators of the EveryDrop dispensing platform. This nontoxic slippery surface technology eliminates friction between solids and liquids, resulting in zero product waste for consumer packaged goods. With this partnership, Swiss American becomes the first CDMO to offer LiquiGlide’s technology to the global skincare market. The technology, made from FDA-approved materials, meets stringent safety and regulatory standards and has already been successfully launched in Europe, North America, and Asia in other packaged goods categories.

By partnering with specialized CDMOs, pharmaceutical companies gain access to advanced technologies and manufacturing capabilities without the burden of building expensive infrastructure.

Regional Market Insights: Asia Pacific And The U.S.

Asia Pacific: Emerging Market

Asia Pacific (APAC) is one of the fastest-growing regions for CDMO support of topical drugs. The growing demand for dermatology products, coupled with improving healthcare infrastructure and increasing awareness of skin diseases, is driving this growth. The region is expected to register a CAGR of 10.8% from 2024 to 2032, with China, India, and Japan being the key markets.

In addition, the increasing prevalence of skin conditions in developing countries like India and China has prompted the expansion of pharmaceutical companies and contract manufacturers into these regions.

Rising disposable income and greater access to healthcare are contributing to the increasing demand for effective topical treatments.

United States: Market Leader

The U.S. remains the largest market for CDMOs supporting topical drugs due to high healthcare expenditures, significant investments in R&D, and a robust pharmaceutical manufacturing ecosystem.

The U.S. government’s focus on healthcare innovation, regulatory support, and advanced clinical trial infrastructures all contribute to the country’s leadership in the global market. For instance, in July 2024, the U.S. FDA approved the supplemental new drug application for roflumilast cream 0.15% to treat mild to moderate atopic dermatitis (AD) in adults and pediatric patients aged 6 years and older. Developed by Arcutis Biotherapeutics and marketed under the brand name Zoryve, roflumilast cream 0.15% is a steroid-free topical phosphodiesterase 4 inhibitor. It was previously approved in a higher concentration for the treatment of seborrheic dermatitis and plaque psoriasis.

The U.S. is also home to some of the largest dermatology-focused pharmaceutical companies, which continue to drive the growth of the topical drug CDMO market. With increasing cases of skin diseases and the availability of advanced biologics, demand for contract manufacturing services in the U.S. is expected to continue rising.

Key Challenges And Opportunities

While the market presents significant opportunities, it is also faced with challenges that must be overcome for continued growth:

- Regulatory Compliance: Navigating the regulatory environment for topical drugs, especially across different regions, remains a challenge for CDMOs and pharmaceutical companies alike.

- Manufacturing Cost Pressures: Reducing manufacturing costs while maintaining high-quality standards remains a primary concern for both CDMOs and pharmaceutical companies.

- Intellectual Property Risks: Intellectual property protection is crucial for companies involved in developing innovative topical formulations.

However, these challenges also present opportunities for innovation in drug delivery systems, improved formulation strategies, and more efficient manufacturing processes.

Conclusion

The topical drugs CDMO market is poised for substantial growth, driven by increasing demand for dermatological treatments, rising consumer awareness of skincare, and technological advancements in drug delivery. The market’s evolution is supported by the expanding role of contract manufacturers in driving production and innovation, especially in semi-solid formulations and dermatology treatments.

With key players expanding their offerings, a favorable regulatory environment in North America, and growing investments in the Asia Pacific region, the topical drugs CDMO market is well positioned for continued expansion. Industry stakeholders must focus on innovation, cost-effective manufacturing, and regulatory compliance to capitalize on the vast opportunities within this growing market.

About The Author:

Pooja Sharma is a writer at Global Market Insights who writes about technology, healthcare, and chemical sectors.

Pooja Sharma is a writer at Global Market Insights who writes about technology, healthcare, and chemical sectors.