How Is The Market Responding To Brisk HPAPI Demand?

By Pooja Sharma, Global Market Insights

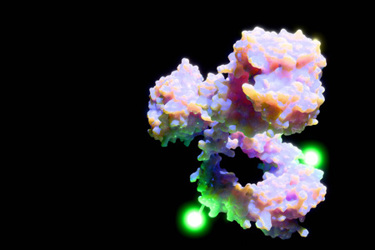

The highly potent active pharmaceutical ingredients (HPAPI) market is gaining significant traction thanks to the growing demand for targeted therapies and precision medicine, especially in oncology. With the increasing complexity of pharmaceutical products and the need for highly potent formulations, HPAPIs are an essential part of next-generation drug development.

According to the latest report by Global Market Insights Inc., the HPAPI market is estimated to reach $62.4 billion in 2034 from $27.1 billion in 2024 with a CAGR of 8.8%.

Amid this substantial growth, understanding the market’s segmentation and evolving dynamics is essential for sponsor companies and outsourcing partners. This article explores the HPAPI market landscape, including product types, drug innovations, manufacturing trends, applications, and regional insights — while answering key questions about market access, demand-supply gaps, and regulatory impacts.

HPAPI Market Overview: Growth Driven By Oncology And Targeted Therapies

The global HPAPI market is growing at a rapid pace, fueled by the rising prevalence of cancer, autoimmune disorders, and infectious diseases that require potent and selective APIs. According to the WHO, an estimated 9.7 million cancer-related deaths and 20 million new cancer cases were reported globally in 2022. Additionally, around 53.5 million people were living within five years of a cancer diagnosis, highlighting the growing burden of the disease. Statistics indicate that about one in five people will develop cancer at some point in their lives, while approximately one in nine men and one in 12 women are expected to die from cancer. Oncology alone accounts for over 60% of HPAPI applications, with cancer treatments increasingly relying on cytotoxic agents and antibody-drug conjugates (ADCs) — both heavily dependent on HPAPIs.

In response to this growing demand, companies are ramping up production capabilities. For instance, in June 2022, Merck announced the opening of a $64 million CDMO facility in the United States to address the rising need for critical cancer therapies, including those using HPAPIs. As the market expands, sponsor companies are gaining greater access to HPAPI sourcing, with more CMOs and CDMOs now equipped with specialized containment facilities, offering outsourcing options that were limited just a few years ago.

Segmentation Breakdown: Understanding The Core Of HPAPI Demand

1. By product: synthetic HPAPIs dominate the market

The synthetic HPAPI segment leads the market, accounting for $18 billion in 2024. HPAPIs play a critical role in the production of small molecule drugs and complex formulations, including many targeted oncology treatments. With demand soaring, outsourced synthetic HPAPI manufacturing has become essential, as not all pharmaceutical companies can afford to build high-containment manufacturing sites in-house. Recognizing this need, companies like AGC are expanding their capabilities — in April 2022, AGC announced the expansion of its synthetic pharmaceutical production base in Spain, which includes new facilities dedicated to HPAPIs, such as those used in cancer therapies.

Partnering with experienced CDMOs like Lonza, Cambrex, and WuXi AppTec has become a strategic choice for many sponsor companies seeking reliable HPAPI supply. However, as demand is currently outpacing supply, particularly for synthetic HPAPIs in oncology, sponsor companies are advised to pursue long-term supply agreements and engage early with CDMOs to secure production capacity and avoid potential delays.

2. By drug type: innovative drugs driving HPAPI demand

Innovative HPAPIs, used in formulating next-gen therapeutics and personalized medicines, are pushing market boundaries. According to CHEManager, a trade and business newspaper for executives in the chemical and pharmaceutical industries, HPAPIs now account for more than 30% of the drug development pipeline.

Blockbuster drugs like Merck’s Keytruda and Bristol Myers Squibb’s Opdivo are real-world examples of innovative therapies that depend on HPAPIs. This trend highlights how market growth creates new opportunities for sponsor companies but also increases competition for limited HPAPI supply.

With the demand for innovative HPAPIs outpacing the available capacity, companies need to collaborate early with specialized manufacturers to avoid production bottlenecks that could delay market entry.

3. By manufacturer type: outsourcing as a strategic imperative

Given the high cost and complexity of HPAPI manufacturing, over 55% of pharmaceutical companies now outsource HPAPI production. This growing trend enables small and midsize pharma companies to access state-of-the-art containment and production facilities without the burden of heavy up-front investments. For instance, in February 2023, Carbogen Amcis, a Swiss CDMO, opened a new facility in France dedicated to the custom development and production of sterile injectable drug products, including highly potent compounds and advanced therapies like ADCs.

Sponsor companies seeking reliable HPAPI partners should prioritize CDMOs that offer:

- High-containment manufacturing (OEL ≤ 10 ng/m³)

- Comprehensive regulatory compliance (FDA, EMA, OSHA)

- Proven experience with oncology and cytotoxic APIs

However, with demand outpacing available capacity, it is crucial for sponsor companies to engage early and plan manufacturing slots well in advance to avoid delays and secure supply.

4. By application: oncology is the key growth driver

Oncology remains the primary driver, accounting for $15.2 billion in 2024. The surge in targeted cancer treatments, such as ADCs, cytotoxic chemotherapy, and immunotherapies, is fueling this growth.

Cancer remains the second-leading cause of death in the United States overall and is the leading cause of death among individuals under 85 years old, according to the American Cancer Society. The WHO estimates new cases globally to increase by 77% between 2022 and 2050 — from 20 million cases to 35 million cases annually.

This rise in disease suggests demand for potent APIs will only increase. Sponsor companies focusing on oncology must anticipate supply chain constraints and work closely with specialized CDMOs to ensure the availability of high-quality HPAPIs for clinical and commercial applications.

5. By region: North America leading global HPAPI production

North America holds the largest share of the global HPAPI market, driven by several key factors:

- Advanced pharmaceutical R&D hubs like Boston and San Diego

- Robust regulatory frameworks that support innovation, including FDA fast-tracking for oncology and rare disease treatments

- Well-established CDMOs equipped with high-containment manufacturing capacity

The region is projected to generate $28.4 billion in HPAPI market revenue by 2034, solidifying its position as a top destination for sponsor companies seeking capable HPAPI manufacturing partners. Notably, in July 2024, Agilent Technologies signed a $925 million agreement to acquire Biovectra, a Canadian CDMO known for producing biologics, HPAPIs, and other targeted therapeutic molecules.

However, regulatory scrutiny in the U.S. is tightening, with increased focus on containment, worker safety, and environmental standards, influencing how HPAPIs are handled and manufactured across the region.

6. By country: The United States accounted for more than one-third of HPAPIs

The U.S. alone contributed $11.3 billion in 2024 to the HPAPI market. Its robust oncology drug pipeline, heavy investments in biotech innovation, and presence of world-class CDMOs make it the go-to-market for sponsor companies worldwide.

However, regulatory challenges in the U.S. are evolving. Agencies like the FDA, OSHA, and EPA are enforcing stricter containment and environmental safety protocols for HPAPI production. Pending regulations could impose higher compliance costs but will also ensure safer handling, benefiting companies that align early with these standards.

How Do Regulations Shape The HPAPI Landscape?

One of the major factors influencing HPAPI manufacturing today is regulatory compliance. As the market grows, FDA, EMA, and other global agencies are imposing stricter guidelines on occupational exposure limits (OELs) and containment technologies to safeguard workers and ensure product purity.

These regulatory shifts are reshaping market access, pushing smaller or less-equipped manufacturers out of the space. For sponsor companies, this means a more consolidated market dominated by CDMOs that invest in cutting-edge containment facilities and stay ahead of regulatory requirements. Partnering with such players helps ensure compliance and avoids supply disruptions.

What Should Sponsor Companies Do To Stay Competitive?

Given the demand-supply imbalance and increasing regulatory scrutiny, sponsor companies should adopt a proactive approach to HPAPI sourcing:

- Partner early with trusted CDMOs specializing in HPAPI production.

- Opt for long-term supply agreements to ensure manufacturing slots.

- Focus on regulatory-compliant manufacturers to avoid future disruptions.

- Stay updated on pending regulatory changes to adapt swiftly.

Conclusion: HPAPI Market Poised For Growth But Demands Strategic Action

The HPAPI market is set for robust growth, driven by innovative cancer treatments and precision drugs. While the market expansion offers greater access to sponsor companies, it also brings challenges of supply constraints and regulatory complexities.

To succeed in this competitive and evolving market, pharmaceutical and biotech companies must forge strategic partnerships, prioritize regulatory compliance, and engage early with manufacturing partners.

As HPAPIs continue to shape the future of medicine, staying ahead of market trends will be key to accelerating drug development and achieving commercial success.

About The Author:

About The Author:

Pooja Sharma is a writer at Global Market Insights covering technology, healthcare, and chemical sectors.