How To Improve Supplier Relationship Management In The Life Sciences

By Hector M. Samper, principal and strategic advisor, Global Strategic Sourcing Solutions (GSSS)

In today's global business environment, life science companies need lean operations and cost optimization to ensure a sustainable profit margin. These challenges provide an impetus to unleash suppliers’ value to directly impact the bottom line.

Supplier relationship management (SRM) is much more than just managing supplier relationships. It is about a mutual commitment, between the sponsor and well-chosen suppliers, to be transparent, innovate, and deliver predictable results. In fact, suppliers need to manage clients as much as clients need to effectively manage mutual contractual obligations and promote continuous collaborative innovation. This means managing a relationship through structured collaboration to align suppliers’ activities across the enterprise with common goals.

A Paradigm Shift

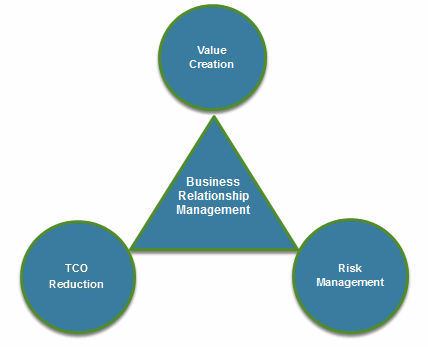

Changing the paradigm from an SRM program to a business relationship management (BRM) approach links suppliers' performance to business goals while optimizing suppliers’ value through an accountable business partnership.

The top two criteria used to segment suppliers, volume of spend and criticality of products/services, is insufficient. We now have to consider the ability of the supplier to contribute to our competitive advantage in terms of total cost of ownership (TCO) reduction, risk management (e.g., risk sharing), and value creation (i.e., technology/innovation, shortening of time to market, new business development opportunities). This is a crucial issue for strategic alignment.

Figure 1: Business relationship management is at the core of companies’ competitive advantage.

A survey conducted by IBM of 1,130 executive leaders in the life sciences industry found that enterprise model innovation (i.e., development of new and unique concepts to reach financial success) is the common choice among the majority of CEOs (51 percent) and are reconfiguring their business models to specialize, become more efficient, and re-think what is done in-house and through collaboration.1

Closing The Gap Between Client And Supplier

In reality, suppliers continue to suspect ulterior motives driven by price consideration rather than total value. This prompts the discussion to openly address mutual behavior that leads to different expectations and perceptions of the business relationship.

Figure 2: Client expectations vs. supplier perception

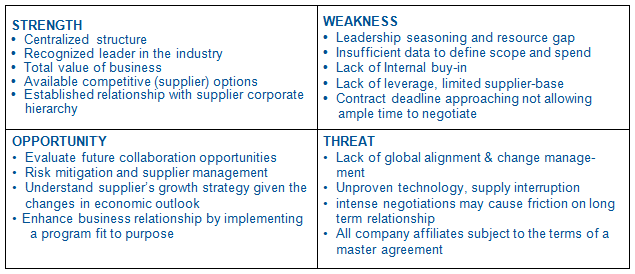

The first order of business is to level the field with trust and transparency to close the gap between client’s expectations and suppliers’ perceptions. Closing this gap can be as simple as performing a SWOT (strength, weakness, opportunity, threat) analysis to better understand the pulse, tone, and posture of the current relationship. This provides an opportunity to assess potential risk and to develop a plan to strengthen mutual collaboration, while identifying areas for mutual benefit.

Table 1: Sample SWOT Analysis

This analysis can be performed independently by the client and supplier to serve as a basis to align and synchronize the conversation toward a collaborative business relationship. Ultimately, it can be used to develop a strategic business plan to build and formalize the relationship.

Forging A Collaborative Business Relationship

Basic criteria must be considered to make certain both organizations are committed to collaboration and to ensure business values align with common objectives. Key factors to balance the relationship are:

- Identifying executive sponsors — preferably VP level for the client and C-1 management-level for the supplier — to represent each party globally and to establish top-to-top management-level interaction to focus on strategic leadership and relationship direction. Additionally, this will ensure sponsorship of team resources and institute a top escalation point to resolve issues.

- Understanding the business footprint to define how the teams will interact and address any gap that may threaten business coverage at a local, regional, or global level. This may require identifying key function and counterpart representatives (procurement, research, engineering, marketing, finance) to manage internal clients’ communication.

- Mutual commitment must be demonstrated to ensure alignment and obligation to the business relationship. Client willingness to truly collaborate with suppliers can secure “preferred customer” status over time; reverse evaluations by the client can be helpful to assess if the client is considered a preferred customer.

While aligning company vision can accelerate meeting business objectives, not much can be done to become a preferred customer; it’s based on company characteristics such as size, brand, market position, and growth perspective.

Smart Business Relationship

Mature life science companies invest significant resources to create and govern an SRM function to improve performance and collaboration with suppliers. While this is a one-way street approach, it is evident the supplier community needs to shift the paradigm from a sponsor one-way lecturing to a two-way collaboration. This approach can drive both companies’ business strategies to meet mutual long-term business objectives.

Ideally speaking, the key factors to building a SMART business relationship should be:

- Strategic governance framework to define roles and responsibilities

- Measurable key indicators to monitor business relationship

- Aligned with mutual corporate goals

- Results-based accountability focused on outcomes

- Time-bound business target setting

This approach can lead to business discipline and structured collaboration to amplify how suppliers add value, increase innovation, and yield long-term sustainable benefits for the life science industry.

Furthermore, a business relationship consists of sharing knowledge, skills, and behaviors (or competencies). Sustaining and nourishing this relationship is essential, and, if managed successfully, it can lead to gaining process efficiency by:

- establishing a robust business discipline and structure

- aligning activities across both organizations with common goals

- maximizing vendor value, innovation, and competitive solutions

- providing an aggregated view of supplier business footprint with the client

- focusing on total business relationship value, not transactional

- instilling a structured collaboration across organizational boundaries

- formalizing a governance and escalation process to streamline decision making

- facilitating dispute resolution, and escalation and closing gaps.

Performance measurement should be co-constructed, aligned with both corporate strategies and balanced between TCO reduction, risk management, and value creation.

Key Principles/Rules Of Engagement

Effective engagement may require dedicated resources to maintain a balanced relationship and a consistent business focus.

- Collective empowerment is essential to balance the relationship and requires total team integration while taking into account both companies feedback, recommendations, and solutions.

- Trust and collaboration will facilitate open and transparent conversations while engaging all and leveraging personal attributes.

- A credible roadmap provides a clear vision of projects and opportunities fully aligned with both corporations’ goals.

- Controlled communication must be designed to deliver consistent message/information and to get buy-in from stakeholders.

- Added value must be demonstrated through metrics that show the benefits of the business relationship.

In practice, a rapidly changing technology and delivery models environment makes it critical to define a roadmap and establish measured criteria to link the benefit of the business relationship with the business impact — and define success.

Conclusion

Building and managing a business relationship requires active participation by all and effective engagement with internal resources. It is essential to focus on the total business relationship value and find new ways to unleash the potential competitive advantage that can be gained through client-supplier collaboration. However, each party needs to preserve its identity and independence.

References:

- The Enterprise Of The Future — Life Sciences Industry Edition (IBM Global CEO Study), IBM Institute for Business Value, May 2008.

About The Author:

Hector M. Samper is principal and strategic advisor at Global Strategic Sourcing Solutions (GSSS), based in Bethlehem, PA. Samper recently formed GSSS to provide business solutions to the pharmaceutical and biotech sector, including services to transform and guide cross-functional business/procurement teams to generate maximum business value throughout the operations life cycle. He has over 30 years of global sourcing and procurement experience in a number of sourcing categories across North America, Europe, and Latin America. His recent experience at Sanofi included creating and leading the Strategic Vendor Management office for the Global IT function and heading the North America Operations and CapEx procurement group. Prior to Sanofi, Samper worked for Amgen, Purdue Pharma, and Merck, where he held roles of increased responsibility in the global sourcing and procurement organizations. Samper earned a bachelor’s degree in civil engineering from the New Jersey Institute of Technology. You can contact him at hmsamper@aol.com

Hector M. Samper is principal and strategic advisor at Global Strategic Sourcing Solutions (GSSS), based in Bethlehem, PA. Samper recently formed GSSS to provide business solutions to the pharmaceutical and biotech sector, including services to transform and guide cross-functional business/procurement teams to generate maximum business value throughout the operations life cycle. He has over 30 years of global sourcing and procurement experience in a number of sourcing categories across North America, Europe, and Latin America. His recent experience at Sanofi included creating and leading the Strategic Vendor Management office for the Global IT function and heading the North America Operations and CapEx procurement group. Prior to Sanofi, Samper worked for Amgen, Purdue Pharma, and Merck, where he held roles of increased responsibility in the global sourcing and procurement organizations. Samper earned a bachelor’s degree in civil engineering from the New Jersey Institute of Technology. You can contact him at hmsamper@aol.com