Lipitor's Japanese Launch Threatens Global Lead of Zocor

Datamonitor's new report, Treatment Algorithms 2000: Hyperlipidemia, From First to Second Line Therapy and Beyond, reveals that Lipitor meets the unmet needs in the treatment of hyperlipidemia in Japan and should fuel the expansion of an already high growth market in that country.

Unmet Needs

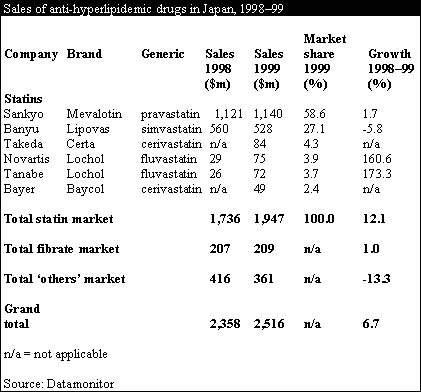

The Japanese market for lipid lowering drugs was worth $2.5 billion in 1999, an increase of 7% over 1998. Currently, the statins drug class dominates this market with a 77% share and a growth of 12.1% over 1999—faster than the Japanese anti-hyperlipidemic market as a whole. Nonetheless, with only four molecules launched before the arrival of Lipitor, the statins market in Japan is less developed than in the US and Europe.

Despite low growth of 1.7%, the current leading brand, Mevalotin held a 58.6% share in 1999, followed by Zocor, which is marketed by Banyu as Lipovas in Japan. Newer additions to the Japanese statins market, fluvastatin, marketed by Novartis and Tanabe, and cerivastatin, marketed by Bayer and Takeda, both showed higher levels of growth over 1999, albeit from a low base.

Zocor, the global market leader, held only 27.1% of the Japanese market, less than half the market share of Mevalotin, and experienced a 5.8% fall in sales. Zocor's relatively poor performance in Japan can be attributed to its high price, lack of long term clinical trial data and the non-reimbursable status of high dosage formulations.

Of the currently marketed statins in Japan, none are available in high dosage formulations and are, therefore, intrinsically less potent than in other countries.

This issue was a common criticism raised by Japanese physicians in a survey that was conducted for Datamonitor's Treatment Algorithm 2000: Hyperlipidemia report.

Datamonitor cardiovascular Analyst, Kate Bradley, comments:

"According to physicians interviewed, 60% of the statin-treated hypercholesterolemic patients switched to second line therapy are switched because of uncontrolled cholesterol. This is a significantly higher proportion than was found in other countries, which suggests that patients do not appear to be receiving the potency of dose needed for successful first line therapy."

The launch of atorvastatin is expected to fulfil this need, as it is the most potent statin at low doses and is more significant in lowering cholesterol levels. This should become apparent among hypercholesterolemic patients after two to four months on low dose formulations.

Impact of Lipitor's Launch

Sankyo is intending to reply to the much anticipated entry of Lipitor to the Japanese market on two fronts.

The first is through ongoing sponsorship of a large-scale phase IV clinical trial, the MEGA study, to verify the primary preventive effects of treatment with its statin, Mevalotin, on ischemic heart disease (IHD). While full results are not due for some time, positive interim results are likely to boost Mevalotin's performance. However, it is also expected that other drugs will benefit through the assumption of a "class effect." Physicians are likely to presume that, if the use of Mevalotin has been shown to prevent the development of IHD, other statins will do the same.

The second, and potentially the most powerful, line of Sankyo's defense, is the development of a new statin, itavastatin. Sankyo is co-developing itavastatin with Kyowa and, being a third generation statin, it is expected to have higher potency and attract a sizable share of the Japanese statin market upon its anticipated launch in 2001.

Although the availability of Lipitor will accelerate overall growth in the

anti-hyperlipidemics market, its launch is expected to cannibalize sales of "other" drugs used to treat the condition. The Japanese "others" market is currently very strong, with one product in particular, Epadel (EPA), being commonly used. Research for Datamonitor's Treatment Algorithms 2000: Hyperlipidemia report shows that EPA is frequently prescribed in conjunction with a statin, possibly because the approved doses of statins are often not considered sufficient.

In the US and Europe, Lipitor's phenomenal growth has been largely based on its potency advantages, the effectiveness of its low, 10mg starting dose, its triglyceride lowering indication and the support of the strong Pfizer/Warner-Lambert marketing partnership. Despite the presence of a strong brand leader, Mevalotin, Datamonitor expects Lipitor to have a similar impact on the Japanese market, as it has elsewhere, by taking the majority of new statin prescriptions. However, the drug's performance will depend to a certain extent on its launch price strategy, set against the context of recent Japanese National Health Insurance price cuts, which imposed an average reduction of 8% on existing anti-hyperlipidemic drugs.

Fueling an Already-Expanding Anti-Hyperlipidemia Market

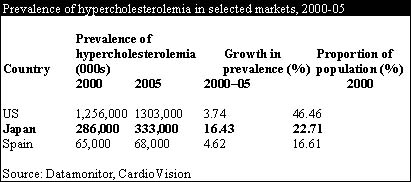

In contrast with other major markets, the patient pool for anti-hyperlipidemic drugs in Japan is expanding. Some 22.7% of the Japanese population are estimated to be hypercholesterolemic and the prevalence is forecast to grow by 16.4% over the next five years, largely driven by an increase of "Western" dietary habits and an aging population. The increasing prevalence of hyperlipidemia in Japan will fuel the expansion of the Japanese anti-hyperlipidemia market as a whole, which will mean that, as well as capturing market share from currently launched drugs, Lipitor stands to gain substantial sales from new patients.

Treatment Algorithms 2000: Hyperlipidemia is available from Datamonitor, priced at $6,995

For more information: Elisabeth Overend-Freeman, Datamonitor Healthcare PR, 1 Park Ave., 14th Floor, New York, NY 10016. Tel: 212-686-7400, ext. 765. Fax: 212-686-2626.