Nephrology Sector Of The Immunology Market: A Major Biopharma Development Opportunity

By Agata Wiśniowska and Ashwin Singhania, Guidehouse

For pharmaceutical companies seeking their next major opportunity, multiple recent breakthroughs in novel mechanisms of action (MOAs) have set the stage for advances in immunology treatment options. However, analysis identifies one market in particular — nephrology — among the best therapeutic development bets, due to current market conditions and a significant unmet need.

Scientific Advances In Immunology

Historically, pharmaceutical manufacturers investigated therapeutic treatment options for immunology “anchor” indications, e.g., rheumatoid arthritis (RA), psoriasis, psoriatic arthritis (PsA), ulcerative colitis (UC), Crohn’s disease (CD), and inflammatory bowel disease.1 From there, progress continued. Manufacturers used broad-acting MOAs, such as tumor necrosis factor alpha (TNF-a) inhibitors, to develop treatment options for additional conditions. These innovations included adalimumab, etanercept, and infliximab. All are on the market and are TNF-a inhibitors, which activate various downstream pro-inflammatory mediators, such as interleukin (IL)-1 or IL-6. Acting as the body's host defense, TNF blockers suppress the immune system by blocking the activity of TNF, a substance in the body that can cause inflammation and lead to immune-system diseases.2,3 Although these three TNF-a inhibitors were initially developed to treat RA, they now are indicated across several conditions, including PsA, ankylosing spondylitis, UC, and CD.

Unlike other monoclonal antibodies, adalimumab (first sold under the brand name Humira) and etanercept (sold under the brand name Enbrel) were among the first fully human monoclonal antibodies approved by the U.S. FDA to treat immune diseases. Their use as a subcutaneous drug allows patients the flexibility to avoid long infusion times. Infliximab (sold under the brand name Remicade) is given intravenously.3

More recently, pharma companies began exploring treatment options for atopic dermatitis (AD) and asthma. This led to the successful development of the novel biologic dupilumab, which is an IL-4/13 inhibitor used to treat AD. Sold under the brand name Dupixent, this therapeutic is an emerging success story. It grossed $2.56 billion in 2019 sales, which are anticipated to peak at nearly $11 billion thanks to a series of upcoming launches and new indications in the pipeline.4,5

All this is to say, the immunology market is surging with innovation — and revenue-generating opportunities. Most of the development in immunology to date has happened in rheumatologic, dermatologic, and respiratory indications. Meanwhile, anchor immunology indications, such as RA and PsA, have become easier to diagnose and treat due to the recent availability of many new treatment options.

Compelling Business Case For Nephrology

On the other hand, nephrology, the medical branch that focuses on kidney diseases, has few approved treatment options outside of those that are expensive and higher risk, such as dialysis and transplants. Compounding the treatment barriers, symptoms tend to be nonspecific and/or manifest at a late stage, making diagnosis difficult.

Understanding this, Guidehouse conducted market research and analysis of the nephrology market. The results identified the following five key factors that make this segment a strong development opportunity for pharmaceutical companies:

- High unmet need: Given an estimated 15% of U.S. adults with chronic kidney disease, there is a high unmet need to identify disease-modifying treatments for many nephrology diseases, e.g., lupus nephritis, IgA nephropathy, etc. Currently, these are ineffectively managed with off-label treatments, such as angiotensin II receptor blockers, angiotensin-converting enzyme inhibitors, steroids, and immunosuppressants.

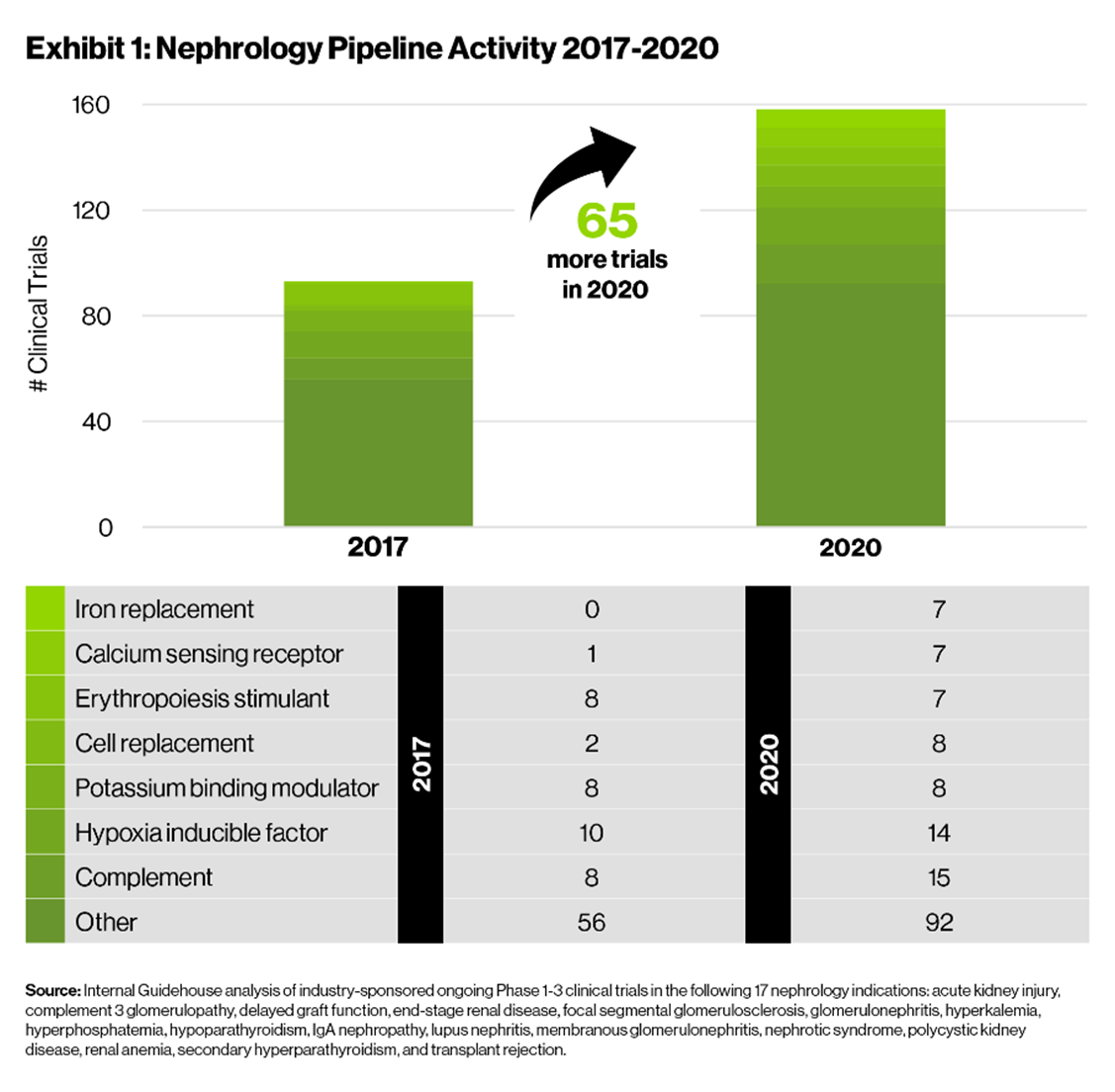

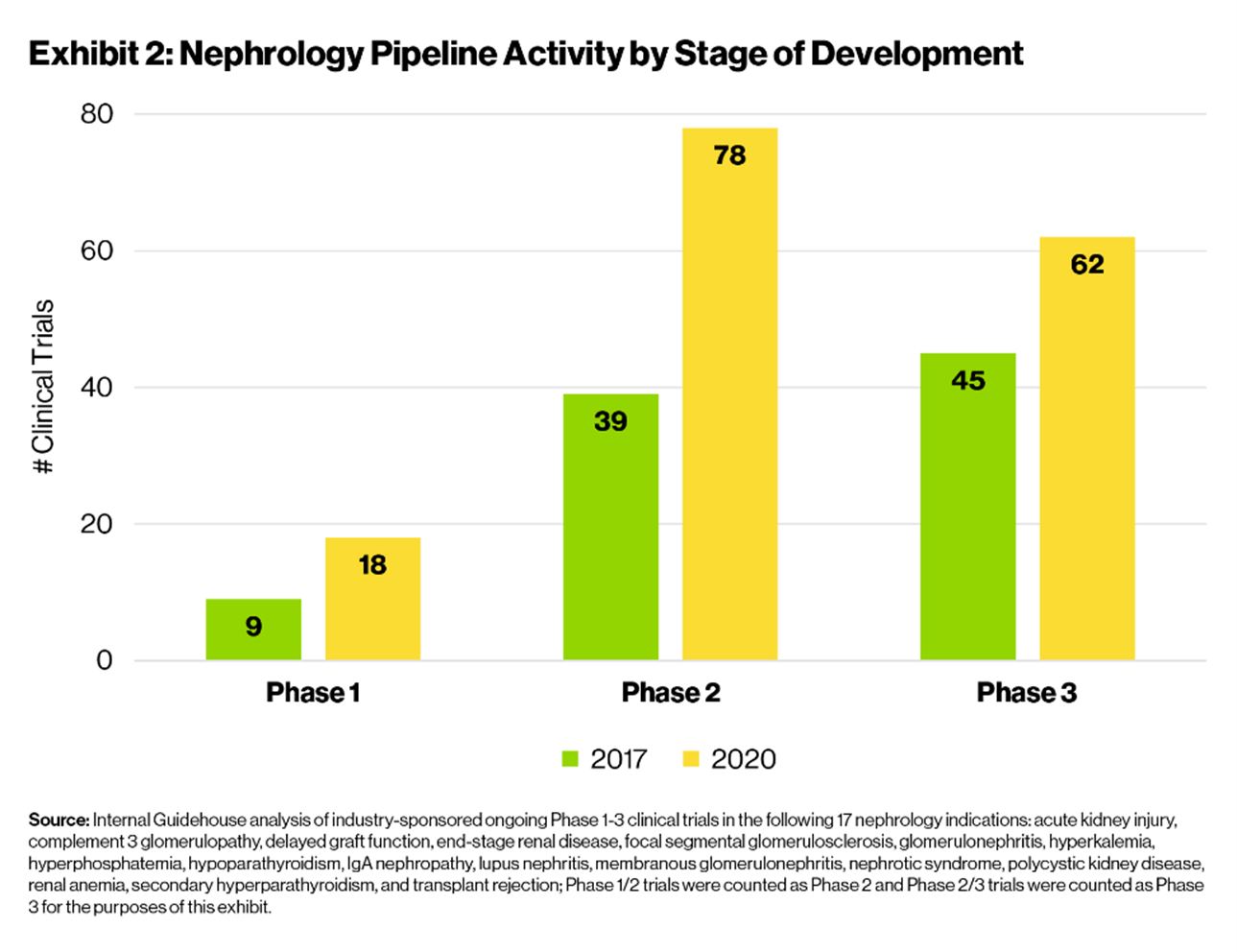

- Industry-recognized opportunity: There is no clear leadership in the nephrology space. Furthermore, over the past few years, increased understanding of disease pathophysiology has led to an approximately 70% increase in development activity [Exhibit 1] and the introduction of new promising MOAs, including complement inhibitors and hypoxia inducible factor inhibitors. While development activity has increased across all stages, the number of clinical trials has doubled for early stage (Phase 1 and 2) assets [Exhibit 2], suggesting an influx of novel MOAs and industry interest in nephrology indications.

- Easier endpoints: The FDA published guidance in July 2018 accepting surrogate endpoints as primary endpoints, which allows for smaller and shorter studies. A couple of recently adopted surrogate endpoints include proteinuria for glomerular diseases and plasma globotriaosylceramide levels in Fabry disease.

- Faster approval track: Regulatory easing since 2017 allowed potential for conditional (based on approximately 12-month data) and accelerated approvals. To that end, several smaller companies have worked with the FDA to shorten drug development timelines and reduce the number of patients required in nephrology Phase 3 drug trials for IgA nephropathy and Alport syndrome. Similar trial designs likely can be used in nephrology diseases leveraging surrogate endpoints, such as proteinuria, for faster approval.

- Favorable payment models: Newly introduced optional value-based kidney disease Centers for Medicare & Medicaid Services payment models provide incentives to nephrology healthcare providers to better manage kidney diseases through therapeutic recommendations aligned with quality measures. Additionally, in 2019, the U.S. Department of Health and Human Services launched a new initiative to improve kidney care with goals to increase the number of kidney transplants, use one mechanism across renal indications, reduce the number of people in the United States developing end-stage renal disease, and promote home-based procedures.6

Critical Success Factors

To realize the full market potential of innovative treatment options for kidney diseases, pharmaceutical companies can draw on lessons learned in oncology and best practices in immunology. Oncology embraced testing new molecules in multiple indications early on to progress promising indications to later stage testing, enabling faster screening of potential indications, accelerated patient access to life-saving treatments, and many blockbuster success stories (e.g., pembrolizumab, marketed as Keytruda). These lessons are translatable to nephrology.

Critical success factors include:

- Target indications for ease of entry. Focus on developing treatment options that can capitalize on fast track designation for approval and low competitive hurdles. This approach will enable a faster market entry with more market potential, due to lower risk and shorter studies.

- Start broadly. Test a new drug candidate in multiple indications early on (basket Phase 1 trials) and progress best efficacy candidates into Phase 2. Learnings from other disease areas, such as oncology (programmed cell death protein 1) and immunology (TNF-a) suggest potential for broad-acting MOAs. Early adopters of this approach in nephrology (e.g., Reata with bardoxolone methyl) are leveraging learnings from oncology to detect potential indication expansions early on with basket trials.

- Add value post-launch. Show long-term efficacy by collecting real-world evidence post-launch. Even though diagnosis, therapeutic, and medical risk assessments are largely based on clinical trial data, real-world data may introduce an alternative route for therapy approval. For instance, certain manufacturers have pursued FDA approval for various oncology drugs by generating real-world evidence based on available patient, electronic health record, and sales data.7 Similarly, an opportunity exists for manufacturers to generate real-world data in nephrology post-launch, such as by pursuing surrogate endpoints for approval, while collecting more traditional endpoints post-launch. This will help instill confidence in the new product and increase its value proposition.

- Pipeline in a molecule. Aim for multiple approvals with the same mechanism of action. Recent large merger and acquisition deals demonstrate a high interest in complement-based therapies. For example, when Alexion acquired Achillion for $930 million and UCB acquired RA Pharmaceuticals for $2.1 billion, both companies’ clinical development programs carried strong potential for life cycle management growth in nephrology, hematology, and ophthalmology.

Looking Ahead

The increase in nephrology pipeline activity over the last few years is a testament to the industry recognizing the opportunity to help patients in dire need of disease-modifying treatments. The spur in nephrology clinical development gives us confidence that we will continue to identify innovative and effective molecules. We further envision that the trend toward shorter, reduced clinical trials and more favorable payment models continues to accelerate, resulting in faster access to innovative treatments for patients and lower up-front pharmaceutical investments that perhaps allow for smaller entrants. This is an opportunity for pharmaceutical companies to fix the underlying problem — kidney function — eliminating the need for risky and expensive treatments such as dialysis and transplants.

References:

- Meacham G., Brayer O., Harrison G., et al. (2020) US Biopharmaceuticals: State of the I&I Market: What are the latest trends and where is it going? BofA Securities

- https://www.fda.gov/drugs/postmarket-drug-safety-information-patients-and-providers/information-tumor-necrosis-factor-tnf-blockers-marketed-remicade-enbrel-humira-cimzia-and-simponi, accessed on 10/18/2020

- Monaco C., Nanchahal J., Taylor P., et al. (2015) Anti-TNF therapy: past, present and future. Int Immunol 27:55-62

- clinicaltrials.gov, accessed on 6/15/2020

- https://www.fiercepharma.com/pharma/sanofi-regeneron-plot-clinical-bum-rush-at-5-new-indications-for-blockbuster-dupixent, accessed on 10/18/2020

- https://www.hhs.gov/about/news/2019/07/10/hhs-launches-president-trump-advancing-american-kidney-health-initiative.html, accessed on 10/18/2020

- https://www.pfizer.com/news/press-release/press-release-detail/u_s_fda_approves_ibrance_palbociclib_for_the_treatment_of_men_with_hr_her2_metastatic_breast_cancer, accessed on 10/18/2020

About The Authors:

Agata Wiśniowska is a senior consultant in Life Sciences at Guidehouse. She started her career as a scientist at MIT, resulting in publications on molecular imaging in Nature Communications and PNAS. Since joining Guidehouse, she partners with internal and client teams to bring innovative treatments to patients. Her project experience includes disease area strategies, indication expansions, competitive readiness, and market access and pricing strategy

Agata Wiśniowska is a senior consultant in Life Sciences at Guidehouse. She started her career as a scientist at MIT, resulting in publications on molecular imaging in Nature Communications and PNAS. Since joining Guidehouse, she partners with internal and client teams to bring innovative treatments to patients. Her project experience includes disease area strategies, indication expansions, competitive readiness, and market access and pricing strategy

Ashwin Singhania is a partner and lead for the West Coast in Life Sciences at Guidehouse. With nearly 20 years of experience in the life science industry, he is focused on supporting pharmaceutical and biotech companies reach their growth aspirations. He and his team partner with clients to execute complex projects, such as supporting new product launches, executing commercial due diligence, creating life cycle management plans, and preparing for changes in competitor landscape.

Ashwin Singhania is a partner and lead for the West Coast in Life Sciences at Guidehouse. With nearly 20 years of experience in the life science industry, he is focused on supporting pharmaceutical and biotech companies reach their growth aspirations. He and his team partner with clients to execute complex projects, such as supporting new product launches, executing commercial due diligence, creating life cycle management plans, and preparing for changes in competitor landscape.