New Trends In Pharma/Bio Executive Compensation

By Steve Cornacchia, ON Search Partners

Over the past several years, the life sciences industry has faced an increasingly challenging environment overall, including stringent regulatory issues, ever-increasing scientific hurdles in new therapeutics R&D, and an increasingly competitive global marketplace. The global hiring pool for life sciences also has become increasingly competitive.

Over the past several years, the life sciences industry has faced an increasingly challenging environment overall, including stringent regulatory issues, ever-increasing scientific hurdles in new therapeutics R&D, and an increasingly competitive global marketplace. The global hiring pool for life sciences also has become increasingly competitive.

To entice key talent into the fold, companies are offering more aggressive and creative compensation packages.

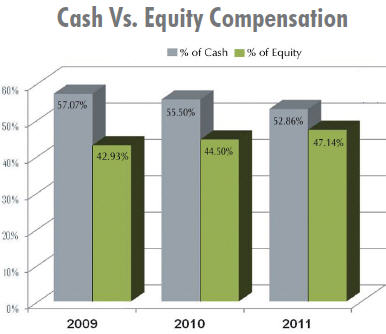

The structure of executive compensation plans has changed broadly over these last four years. Regardless of company size, there is not only a healthy gain in total compensation, but also a significant change in the mix of cash-vs.-equity and stock-vs.-option awards. Companies need to take note in order to remain competitive in recruiting and retaining their most talented leaders.

New Changes For Rewarding Executives

New Changes For Rewarding Executives

In an analysis of the publicly disclosed executive compensation plans within the U.S. public biotech and pharmaceutical industry, there are several changes that can be tracked in the way executives are being rewarded. These trends can be observed across the spectrum of large corporations with market capitalizations over $10B to small businesses under $250M. Since 2009, these executives have seen an average 20% increase in their overall compensation, mostly driven by increases in variable compensation, including cash incentives and stock and options awards.

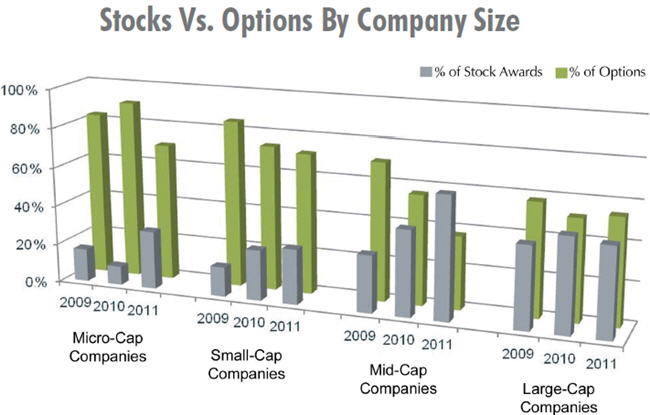

Additionally, it is obvious from the research that life sciences companies are moving away from incentivizing executives with cash bonuses, gravitating much more aggressively towards a mix of equity incentive awards. The percentage of stock to options is increasing, likely reflecting the last several years of stagnant stock performance. Increasing the stock offer in the form of restricted stock units, performance share units, and other nonoption grants in an overall compensation package has become a differentiating offer strategy. These trends are particularly evident with small and midcap companies, organizations that had tended toward stock options as their primary equity driver, but are now moving to stock awards as a major component of their equity incentive.

Additionally, it is obvious from the research that life sciences companies are moving away from incentivizing executives with cash bonuses, gravitating much more aggressively towards a mix of equity incentive awards. The percentage of stock to options is increasing, likely reflecting the last several years of stagnant stock performance. Increasing the stock offer in the form of restricted stock units, performance share units, and other nonoption grants in an overall compensation package has become a differentiating offer strategy. These trends are particularly evident with small and midcap companies, organizations that had tended toward stock options as their primary equity driver, but are now moving to stock awards as a major component of their equity incentive.

Even microcap companies with market capitalization under $250M are following suit, despite having historically leveraged significant option awards and lower cash compensation. Today, that same group is now compensating executives with an even mix of cash and equity, and the share of stock awards within that equity package has grown significantly.

Why Compensation Packages Are Evolving

Fierce competition for skilled, experienced, and successful senior executives is forcing life sciences companies to offer compensation packages that grow annually at double-digit rates.

The drive behind increased stock awards seems obvious. Over the last decade, candidates have found themselves holding options that inevitably had little or no value after years of service to a company. This is not surprising given the highrisk nature of an industry challenged with difficult scientific hurdles, ever-strengthening regulatory barriers, and issues of broad global market access. Many companies fail, and many therapies do not make it to market. With this sobering view of the market and the odds of success less certain, executives are unwilling to put such a large percentage of their compensation into traditional option awards which — based on recent exits — are less likely to realize the payoffs seen in years past. Until the industry can reinvigorate pipelines and opportunities for significant growth with healthier returns, this trend is certain to continue.

Crafting Offers to Compete

Base compensation is certainly the foundation of a compelling offer to a candidate for an executive position, but companies can provide some strong lures by paying attention to how they craft their equity offering. The executive search industry is seeing firsthand that a candidate’s deciding factor is often the percentages of stock options vs. stock awards in the equity. Prospective candidates are well aware of the market trend, so stock awards have become expected, not just a negotiation strategy.

To remain relevant within the marketplace, biotechnology and pharmaceutical companies will have to remain more cognizant of these trends. Executives and investors will have to evaluate how their own compensation plans may be affecting their ability to attract top talent and then adjust their ongoing strategies accordingly.