2022 Outsourcing Trends In Biopharmaceutical Manufacturing

By Smita Khanna, Ph.D., BioPlan Associates

Outsourcing began as a trend across the biopharmaceutical industry but today, with increased focus on competencies, it is now established as an imperative to many parts of the industry. Over the past 10 years, increasingly more biopharmaceutical companies have turned to contract manufacturers, making this industry a $14 billion rapidly growing business segment.

The continued focus on productivity and efficiency is moving manufacturers to consider outsourcing activities, thus driving increased business for CDMOs. Based on BioPlan Associates’ 2022 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, biomanufacturers are spending more, demanding better technologies, and expressing greater optimism, with 86.9% of biopharmaceutical respondents reporting outsourcing of at least some activities this year, up from 82.6% in 2021 and 84.8% in 2020.1

Outsourced Activities In Biopharmaceutical Manufacturing

Outsourcing remains a common and essential activity within most companies, although outsourced tasks vary. A large portion of outsourcing today continues to be dominated by relatively lower value-added and more specific services, such as fill/finish, analytical testing, sterility, and often routine testing and tasks, other than actual up and downstream bioprocessing. It is worth mentioning that process development tasks are widely considered to be internal core corporate capabilities not suitable for (or capable of) being outsourced.

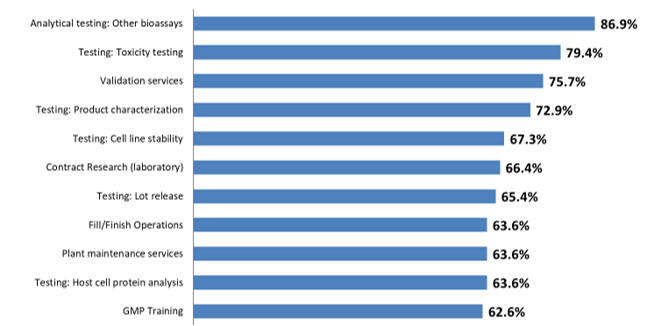

The 2022 BioPlan survey defined 26 areas for which respondents report at least some outsourcing activity (Fig 1). Respondents indicate ≥50% of outsourcing in nearly all 26 areas surveyed, compared to just 18 areas in 2020. Part of this increase in outsourced activity is due to the COVID-19 related supply chain challenges, as well as staffing challenges that have increased problems in productivity. Contract manufacturers and outsourced service suppliers offer alternatives to critical in-house operations, and more decision-makers are considering this option.

Figure 1: Selected Operations: Percent of Biomanufacturers Outsourcing at Least Some Activity (2022)

Source: 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, April 2022

The primary outsourced activity continues to be Analytical testing (other bioassays), followed by Testing: toxicity testing (79.4%, up from 78.0% in 2021). Validation services continues in the No. 3 position this year, with 75.7% of respondents, followed by Testing: Product characterization, again in the No. 4 position, with 72.9% of respondents.

Testing: Cell line stability rounds out the top 5 areas this year at 67.3%. At the bottom of the list this year are operations including Cell or Gene Therapies R&D, Design of Experiments (DoE), Downstream Process Development, and Upstream Process Development, which takes the last position with 46.7% in 2022.

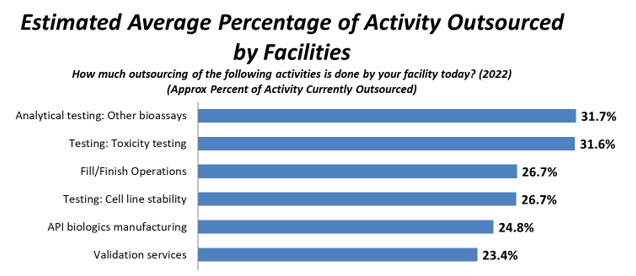

Average Percentage Of Activities Outsourced

While outsourcing of some bioprocessing-related tasks is nearly universal, with essentially every company doing some, no bioprocessing areas are predominantly outsourced. Some specialized, repetitive, non-core, or less technical activities are outsourced to a significantly greater degree, such as analytical testing/bioassays, fill/finish, and toxicology testing. For example, only a small minority of mostly very large companies now retain toxicology testing capability in-house.

In BioPlan’s 2022 survey, respondents indicated the most cited activity outsourced today, on average, is Analytical testing/bioassays, 31.7%, up slightly from 30.3% in 2021 and, overall, consistent with past years’ percentages. Moving to the No. 2 position this year is Toxicity testing, with 31.6%, down from 33.1% in 2021 and 33.2% in 2020. Respondents again indicated that on average, facilities outsourced Fill/finish Operations at No. 3 this year, with 26.7% of respondents, virtually unchanged from 26.1% in 2021, and tied with Testing: Cell line stability1 (Fig. 2).

Figure 2: Selected Areas: Average Percentage of Activity Outsourced Today (2022)

Source: 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, April 2022

Outsourcing over the past decade has remained relatively consistent, with few clear up or down trends. In the past few years, the budget for outsourcing at individual facilities has grown at a steady rate, hovering around the low double digits. Overall, in 2022, more outsourcing in R&D or manufacturing in the next 12 months is expected.

Trends In Outsourcing Destinations

Developing nations are changing the landscape of contract manufacturing, and the top leaders of outsourcing are changing as well. According to BioPlan’s survey, the U.S. still enjoys the top position as a potential outsourcing destination, with 39.6% of non-U.S. respondents indicating that they would outsource production to U.S.-based facilities. Among the developing nations, China and India are giving tough competition to the well-established U.S. and European facilities. Germany, the U.K., Singapore, and Japan are other important outsourcing destinations.2

In the survey, nearly 30% of respondents indicate they will offshore <50% of Clinical trials/operations to India, China, or another lower-cost country over the next five years compared to 32.7% of Biomanufacturing operations respondents. In 2022, overall, there is still an increase in planned offshoring for nearly all areas among biomanufacturers. Process Development and Biomanufacturing operations will witness increases in expected offshoring in the next five years. We also see a large increase in China as a potential production outsourcing site in coming years. This change in China as an outsourcing destination could be partly due to the fact that in recent years the uncertainty around IP has taken a back seat to other factors that were common concerns 10–15 years ago, but now are outweighed by the potential opportunities in the Chinese domestic market .3

But so far, most outsourcing to CDMOs in developing countries has involved less-regulated, smaller-scale R&D, screening, process development, research reagents, and preclinical supplies manufacture. These types of services have typified international outsourcing/offshoring from developed to developing countries so far. COVID-19 may accelerate trends toward acceptance of developing region CDMOs. For example, as Chinese vaccines are administered to developing countries, and can demonstrate efficacy, this is a first step toward more international acceptance.

Offshoring Trends

Clearly, biomanufacturers expect and require GMP standards significantly more than the potential for cost savings. Several important aspects are considered when outsourcing biopharmaceutical manufacturing to a CDMO. The important attributes are meeting international GMP standards, protecting intellectual property, compliance with the company's quality standards, pricing/cost of services, and demonstrated ability to do the work.1 Overall, the trend in outsourcing is a continuation of expectations established over the past decade, where sponsors are demanding high levels of professionalism, performance, and effectiveness in both managerial and technical areas from their outsourcing vendors. Some of the significant trends in the outsourcing industry include:

- Opportunities for Developing Regions: Overall, it can be seen that at least for the near future, offshoring of manufacturing tasks to CDMOs in other countries, particularly developing countries, will continue to be selective and not a major threat to U.S. and European CDMOs. However, among emerging regions, China, with its ongoing investments from Western CDMOs and its emerging domestic industry, will likely become a global player in the CDMO space for biologics within five to 10 years.3 Developing countries like China and India currently lack a strong bioprocessing infrastructure, including generally a lack of GMP-capable bioprocessing, and they need to work on these aspects to be considered as viable options.

- Small Companies as Source of Innovation: The modern biopharmaceutical business has been growing steadily now for nearly 40 years and, subsequently, many bioprocessing facilities were built in the past 20 or more years and most of the largest and oldest among them now have idle capacity (or have even been mothballed). Small companies continue to be major sources for innovation, and many have an active pipeline of products in development. These smaller companies essentially all need input and assistance from partners and access to facilities and know-how to enable their innovations to reach clinical stages and, particularly, eventually gain approvals and be successfully marketed and manufactured. That is, they need CDMOs (and CROs and consultants, too). CDMOs need to have the knowledge and experience to overcome regulatory hurdles to get their customers’ products approved for early clinical trials.

Another trend sometimes observed in smaller and midsize companies, particularly in difficult times for them, is for these CDMO clients to seek to cut corners, such as avoid engineering runs, long-term investigations, meetings with regulatory agencies, etc. This is not a good recipe to improve client-CDMO relationships or to get products to, or be successful in, world markets.

- Increased Use of Single-Use: For years, we have seen a trend to use more single-use equipment for biopharmaceutical manufacturing, with CDMOs particularly adopting single-use systems. In some cases, stainless-steel facilities go hybrid, i.e., are retrofitted to also use single-use/disposable equipment. Overall, the flexibility and decreased capital investment associated with single-use systems are resulting in their increased use by CDMOs and their clients.

- Change in Outsourcing Leaders: This industry had much the same few CDMO market leaders, or rather those with the largest volumetric capacities, for decades. This has changed notably, with a few new Asian companies offering CDMO services, e.g., Celltrion, Samsung, and WuXi, and a few larger CDMO companies formed from mergers and acquisitions, such as Patheon acquiring Laureate and Gallus, then Patheon later being acquired by Thermo Fisher.2 The biopharmaceutical market will continue to increase, and we will have more players, including developers, equipment suppliers, and CDMOs, getting into the business over time. And there will also inevitably be more industry consolidation.

While Lonza, BI, and other leading CDMOs such as WuXi in China (e.g., in terms of capacity, commercial manufacturing, and number of projects) will still have their larger-scale and established customers, we are likely to see more smaller companies looking elsewhere for CDMO services to get their products into clinical trials and commercially manufactured. Here, we see opportunities for smaller and midsize CDMOs.

Conclusion

Outsourcing of bioprocessing will continue to become more important as more companies seek to get on the market quickly and more cost-effectively. This includes a large number of new entrants, including biosimilar, biogeneric, and biobetter developer companies, new developers and CDMOs in developing countries, such as China, and those now producing COVID-19 pandemic-related products. More established companies will continue to search for partners to get their established products outsourced, so they can free up their internal capacity for new, more important products in their pipelines.

Dramatic expansions in CDMO facilities and capacity are needed in new(er) product technology areas, such as cellular and gene therapies, antibody-drug conjugates (ADCs), and others. COVID-19 pandemic vaccines and therapeutics continue to take a dominant role in absorbing much of the flex capacity available in the CDMO industry, but as demand moderates, capacity requirements will normalize. Overall, the bioprocessing CDMO business appears to have a promising and profitable future, certainly for the next decade.

References

- Langer, E.S., et al., Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 19th annual edition, BioPlan Associates, Rockville, MD, April 2022, 500+ pages.

- Rader, R.A., Langer, E.S., Top 1000+ Global Biopharmaceutical Facilities Index, BioPlan Associates, online database, www.top1000bio.com.

- Xia, V.Q., et all, Growth of Biopharmaceutical Contract Manufacturing Organizations in China: An In-depth Study of Emerging Opportunities, BioPlan Associates, June 2020, 144 pages.

About The Author:

Smita Khanna, Ph.D., is a biopharmaceutical industry and healthcare market researcher/analyst, as well as a director of research at BioPlan Associates. With a Ph.D. in biotechnology, she has extensive experience working in key industry segments. She has experience at the Council of Scientific & Industrial Research-Indian Institute of Toxicology Research (CSIR-IITR), India. Her expertise includes primary and secondary research and market analysis of healthcare and biopharma segments. She contributes to international publications and journals and research for in-depth reports. She can be reached at smitakhanna@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.

Smita Khanna, Ph.D., is a biopharmaceutical industry and healthcare market researcher/analyst, as well as a director of research at BioPlan Associates. With a Ph.D. in biotechnology, she has extensive experience working in key industry segments. She has experience at the Council of Scientific & Industrial Research-Indian Institute of Toxicology Research (CSIR-IITR), India. Her expertise includes primary and secondary research and market analysis of healthcare and biopharma segments. She contributes to international publications and journals and research for in-depth reports. She can be reached at smitakhanna@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.