Overcoming The Challenges Of Companion Diagnostics Commercialization

By Alexander Vadas, Ph.D., and Peter Rosenorn, L.E.K. Consulting

Companion diagnostics (CDx) are key to delivering personalized medicine in oncology, and increasingly in other conditions as well. In 2015, the Tufts Center for the Study of Drug Development estimated that 73 percent of cancer drugs, and 42 percent of all drugs, in development are paired with a diagnostic test to identify patients who can benefit from them.

However, commercializing CDx products remains a challenge for pharmaceutical companies as it may require touching unfamiliar stakeholders and processes as well as performing a range of incremental activities. Further, pharma and their CDx partners may not always be aware of the technological, regulatory, and educational requirements needed to commercialize products with companion diagnostics, nor are they always resourced and incentivized to address those requirements effectively.

Pharma will need to respond to CDx commercialization challenges in order to minimize test leakage, which we define as the failure of biomarker-eligible patients to receive appropriate targeted therapy. There is evidence that some pharma companies are improving their CDx commercialization through a range of approaches, including partnering to develop new tests, staffing organizations with diagnostics specialists, working more closely with CDx partners on commercialization, and forging commercial partnerships with laboratories and other stakeholders. While this represents a step in the right direction, test leakage remains a significant issue that pharma needs to address; handled correctly, these approaches could in the long run significantly improve pharma commercialization models.

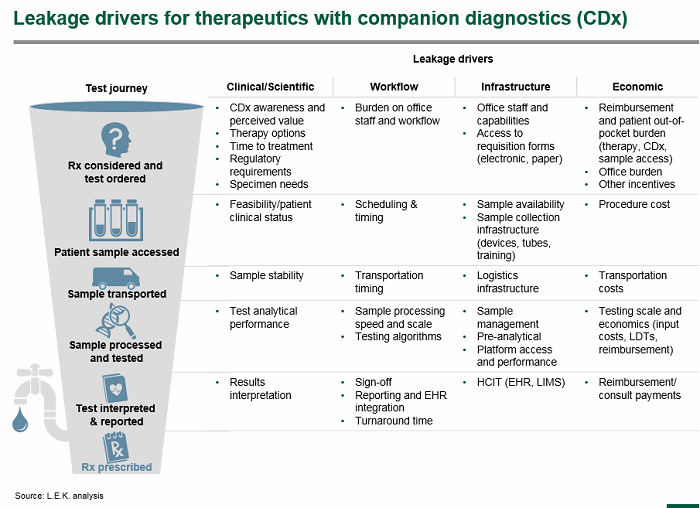

A Framework For Potential CDx Leakage Drivers

To guide commercialization efforts, pharma and their CDx partners first need to understand the barriers and potential leakage sources the CDx test might face in the marketplace. Every test and situation is unique, and barriers faced may evolve over the lifecycle. A framework that that captures potential leakage sources along the test journey from drug consideration and test ordering through the reporting of an actionable test result can facilitate the identification of leakage sources.

Note: These leakage drivers carry different weights; some are time-consuming inconveniences, while others can derail the journey whereby a biomarker-positive patient receives the targeted drug.

Here is a quick discussion of leakage drivers that pharmaceutical companies will need to understand:

- CDx ordering. To start, CDx tests need to be ordered, and the pharma company must understand and address the targeted clinician’s awareness, testing proclivity, and perception of the companion diagnostic’s value proposition (relative to other options they may be considering). Understanding how other competitive therapies may impact CDx testing is also an important dynamic to consider; in some circumstances, a competitor may market a test-free option, and in others, a competitor may market a different test that may not be as sensitive. Clinicians also consider how the test might burden office workflow and whether they have the staff and capabilities in place. The reimbursement situation may impact decision making, especially if a test requires incremental costs to the patient.

- Sample access. While some sample access procedures may be invasive, costly, and potentially risky (e.g., biopsy), others may just require saliva or blood. But regardless of the procedure, the inconvenience and cost can potentially cause leakage. Even simple things like ensuring access to appropriate sample collection tubes could raise significant problems.

- Sample transportation. Sample stability and logistics associated with ensuring the sample is sent to an appropriate testing lab are also important. For novel or low-volume tests, logistics in certain countries may add significant time and cost associated with testing and could impact use.

- Sample processing and testing. Clinical laboratories will need to have the right sample management and pre-analytical and analytical infrastructure in place to perform quality testing. But laboratory workflows, scale, and economics are also important factors to consider. Willingness to perform testing will be driven by lab economics and test volumes; low-volume tests may be centralized for practical reasons, and this could adversely impact access and turnaround time. Test analytical performance may also hamper identification of biomarker-positive patients driven by factors such as poor sensitivity.

- Test interpretation and reporting. Finally, tests will need to be interpreted, signed out by the lab director, and delivered to the clinician. A delay or miscommunication has the potential to further impact the orderly flow and timeliness of prescribing the targeted therapy.

- Reimbursement. This is a theme that touches many of these steps, and its impact needs to be understood across the various drivers and stakeholders affected. Clinicians may focus on coverage of the companion diagnostic, therapeutic, and sample access procedure and the implications for patient out-of-pocket costs; laboratories will focus on impact of economics and whether they can run the test profitably.

Addressing Commercialization Challenges

Pharmaceutical companies must fully consider each leakage source to achieve their best chances of success, and they must continue to address leakage in a flexible and agile way. Here are starting guidelines for companies to follow:

Understand leakage and root cases. The first step is to understand the testing landscape and key contributing leakage sources across key regions. It is important to understand potential test journey leakage starting in early R&D (as that impacts companion diagnostics partnering) and to refresh that understanding through development and commercialization, as barriers may shift and change due to many factors, including changing test reimbursement, competitive landscape, etc.

Understand the competition’s testing strategy. It is also critical to understand the testing capabilities, resourcing, and strategies that competitors are using. In some circumstances, a competitor’s posture could be helpful, and in others, it could represent a counter-selling barrier.

Build the team. It is becoming increasingly important for pharma to build internal diagnostics expertise across commercial and medical functions, both at HQ and field-based. Specialists who understand both therapeutics and diagnostics are scarce and in high demand, so plan early and work on retaining top talent.

Leverage partners. Pharmaceutical companies should consider commercialization needs at a high level right from the start of their collaboration with a diagnostic partner. As the therapy/companion diagnostic approaches commercialization, it will also be important to plan how best to work together to minimize leakage. In some cases, it may be fruitful to add additional partners to develop new (more easily commercialized) tests and/or to perform certain commercialization activities.

Maintain coordination and alignment. Bringing therapeutic and companion diagnostics to market, companies must coordinate closely with their diagnostic partners, both at strategic and tactical levels. Traditionally, however, many in pharma have not aligned strategically with their CDx commercialization partners early on, defined remit for the internal therapeutics brand team and the CDx partner team, or installed coordinated performance metrics and incentives. One successful case example is the active joint steering committee that Pfizer established with Abbott Diagnostics for Xalkori.

Similarly, companies need to ensure that internal stakeholders remain fully and actively aligned. Closer ties between commercial and medical organizations, within the bounds of compliance, can aid in consulting on technical topics, sharing training materials, and coordinating educational efforts. Similarly, companies need to define task ownership for diagnostics-dedicated personnel and others in the organization with companion diagnostics responsibilities, and to use diagnostics-dedicated staff to disseminate CDx information and identify training needs.

Accept need for country-level flexibility. While multi-country commercialization is always complex, pharma companies should acknowledge that the need for country-level adaptation is more pertinent when launching a therapeutic/companion diagnostic pairing, as local differences in healthcare provision and reimbursement are magnified when dealing with both a therapeutic and companion diagnostic.

Start early and iterate. In all aspects of their CDx efforts, companies need to begin early in the commercialization process. Understanding commercialization challenges should ideally start at the time of diagnostic partner selection. And pharma should have some understanding of the commercialization landscape when making development decisions. Hiring suitable personnel, for instance, takes time. And given the rapidly changing dynamics in this arena, companies can’t just work through a planning checklist once and assume they are done with the initial launch planning exercise. Instead, they should continually reassess and reiterate their efforts. Successfully overcoming all these challenges is essential to delivering the benefits of personalized medicine to patients and to meeting corporate revenue goals.

About The Authors

Alexander Vadas, Ph.D., is a managing director and partner in L.E.K. Consulting’s Biopharmaceuticals & Life Sciences practice. He joined L.E.K. in 2000 and focuses on diagnostics, research tools, and personalized medicine. Within those areas, Vadas has worked with a range of established and emerging clients in the areas of corporate strategy, product strategy, and planning and transaction support. He received both his BS and Ph.D. degrees in chemical engineering from the University of California, Los Angeles.

Alexander Vadas, Ph.D., is a managing director and partner in L.E.K. Consulting’s Biopharmaceuticals & Life Sciences practice. He joined L.E.K. in 2000 and focuses on diagnostics, research tools, and personalized medicine. Within those areas, Vadas has worked with a range of established and emerging clients in the areas of corporate strategy, product strategy, and planning and transaction support. He received both his BS and Ph.D. degrees in chemical engineering from the University of California, Los Angeles.

Peter Rosenorn is a managing director and partner in L.E.K. Consulting’s Boston office. He joined L.E.K. in 2010 as a manager and specializes in the biopharma and life sciences sector with a particular focus on growth strategy and strategy activation. Rosenorn advises clients on a range of critical business issues including operational scale-up, launch planning and commercialization, transaction support, forecasting and valuation, franchise positioning and branding, and post-merger integration (PMI). Prior to joining L.E.K., he held key global, U.S., and E.U. marketing and sales operations leadership roles at Biogen Idec and Novo Nordisk. He received a BS in business and a MS in international marketing and management from Copenhagen Business School. Additionally, he completed the General Management program at Harvard Business School.

Peter Rosenorn is a managing director and partner in L.E.K. Consulting’s Boston office. He joined L.E.K. in 2010 as a manager and specializes in the biopharma and life sciences sector with a particular focus on growth strategy and strategy activation. Rosenorn advises clients on a range of critical business issues including operational scale-up, launch planning and commercialization, transaction support, forecasting and valuation, franchise positioning and branding, and post-merger integration (PMI). Prior to joining L.E.K., he held key global, U.S., and E.U. marketing and sales operations leadership roles at Biogen Idec and Novo Nordisk. He received a BS in business and a MS in international marketing and management from Copenhagen Business School. Additionally, he completed the General Management program at Harvard Business School.