Pfizer, Warner-Lambert Agree to $90 Billion Merger

The combined company, which will be called "Pfizer Inc.," will have annual revenues of approximately $28 billion, including $21 billion in prescription pharmaceutical sales, and will have a market capitalization in excess of $230 billion.

Compounded annual revenue and earnings growth are expected to be 13% and 25%, respectively, in 2001 and 2002, which prompted the two companies to anoint their new venture as the "world's fastest-growing pharmaceutical company." The transaction will be accretive in the first full year of operations and will use pooling of interests accounting. Upon completion, Pfizer's shareholders will own approximately 61% of the new company on a fully diluted basis, and Warner-Lambert shareholders will own 39%.

Excellent opportunities for additional earnings growth based on anticipated cost savings and efficiencies are expected to total $1.6 billion. Two hundred million dollars of these savings are expected to be achieved by year-end 2000, $1 billion by year-end 2001, and $1.6 billion by year-end 2002. These cost savings alone will accelerate the projected compounded annual net income growth through 2002 for the new company from 20% to 25%, excluding one-time transaction and restructuring charges. Diluted earnings per share for Pfizer as a stand-alone company are projected to be $1.04 for 2000, $1.25 for 2001, and $1.50 for 2002, representing 20% average compounded growth per year. For the combined Pfizer/Warner-Lambert entity, pro forma earnings per share in 1999 would be $.80. From this base, we project that diluted earnings per share for the combined entity will be $.98 in 2000, $1.27 for 2001, and $1.56 for 2002, representing 25% average compounded growth per year. These numbers include the $1.6 billion of cost savings phased in over this time period, but do not include any increased sales from collaborative activities.

Unlike other pharmaceutical industry mergers, which are often based on market threats and weaknesses, everyone agrees that Pfizer-Warner is a merger of strengths. Either company could have prospered independently but together they believe they can do even better. If history is any indication, however, the new Pfizer will have a tough time justifying this latest mega-merger: Every major pharmaceutical merger since 1980 has been followed by a loss of market share, whereas companies that have remained independent (Schering, Merck) have seen their market shares rise. Still, Pfizer-Warner management appears to be prepared for the challenge of matching expectations with results.

"By combining two world-class organizations to create the fastest-growing, major pharmaceutical company in the world, we are positioned for global leadership in the discovery of new medicines that will benefit millions of patients around the world," said William C. Steere, Jr., chairman and chief executive officer of Pfizer. "Pfizer and Warner-Lambert represent a new competitive standard for our industry. We will work together in a spirit of partnership and mutual respect to capitalize on the extraordinary opportunity now before us."

According to Warner-Lambert chairman Lodewijk J.R. de Vink, his goal from the beginning was to get the best possible deal for Warner-Lambert shareholders, adding that "The current Pfizer merger terms achieve that goal. Our two organizations, having worked together for several years to achieve the unprecedented success of Lipitor, will bring the same energy and intensity to achieving the most rapid and seamless integration of the two companies."

"Through our Lipitor partnership, we've gained a deep appreciation for Warner-Lambert's commitment to quality and innovation in health care," said Henry McKinnell, Pfizer's president and COO. "Our conviction that Warner-Lambert is the right partner for us has only been strengthened as we have explored the complementary nature of our companies. Working together, we will create a new organization made up of the best people, best practices, and best facilities. The combined talents of Pfizer and Warner-Lambert people will make us not just bigger, but better."

Corporate headquarters of the merged company will remain in New York. The Warner-Lambert Consumer Health Care Division, along with the other consumer businesses and selected additional functions, will be located at Warner-Lambert's offices in Morris Plains. The worldwide and U.S. pharmaceutical division headquarters will be in New York with operational support functions in both New York and Morris Plains. The transaction is subject to customary conditions, including the use of pooling-of-interests accounting, shareholder approval at both companies and usual governmental and regulatory approvals. The transaction is expected to close in mid-2000.

The new Pfizer will boast a strong international presence with enhanced global reach in all major markets. This includes Japan, the second largest pharmaceutical market in the world, where Pfizer is the leading non-Japanese pharmaceutical company. The company will be in the top tier in most major markets.

Board, Management Drawn from Both Companies

Eight independent directors from Warner-Lambert's Board will be invited to join Pfizer's Board. Steere will be chairman and chief executive officer; McKinnell will be president and chief operating officer. From the period of contract signing to closing, the transition planning team will be co-chaired by McKinnell and Anthony H. Wild, executive vice president and president, Pharmaceutical sector of Warner-Lambert. Three members of the Warner-Lambert management team will join Pfizer's Corporate Management Committee. Lodewijk de Vink will remain as Chairman and CEO of Warner-Lambert until closing. He has made a personal decision not to be an executive in the company after the closing.

Competitive Strengths

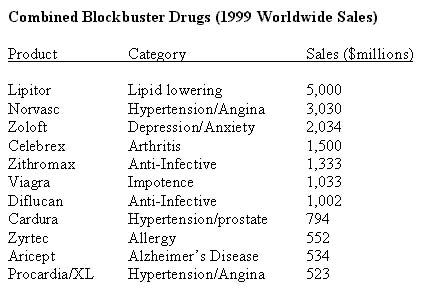

Companies of this size don't merge unless their product lines and pipelines complement each other's. Combined, The new Pfizer will sport an unusually deep, broad product portfolio that includes seven products with expected billion-dollar sales for 2000: Norvasc, Lipitor, Zoloft, Zithromax, Diflucan, Celebrex, and Viagra. The Parke-Davis trade name will be preserved and represented through the product portfolio, a dedicated sales force, and research organization.

"The combination of our companies provides us with a complementary array of products across virtually every product line," said Karen Katen, president of Pfizer's U.S. Pharmaceutical Group. "These range from our cardiovascular portfolio, which is now the industry leader, to our central nervous system medicines, where the combination of current products and late-stage candidates is unparalleled. We also have the leading cholesterol lowering medicine in the world. This broad product line will only be enhanced by the global alignment and high quality of our medical, marketing and sales organizations."

Specific areas of product focus include:

Cardiovascular/Lipid Lowering

- Major products: Norvasc, Glucotrol XL, Accupril, Rezulin, Lipitor

- Vast product line covers all major diseases

- Medicines treat key risk factors, including high blood pressure and diabetes

- Help patients manage multiple CV risks

- Combined CV sales total $11.0 billion in 1999 (including Lipitor)

- Companies co-promoted Lipitor, the fastest-growing lipid lowering agent, with sales expected to exceed $5 billion in 2000

CNS

- Major products: Zoloft, Aricept, Neurontin, Dilantin

- Products treat depression, anxiety, dementia, schizophrenia, epilepsy, migraine

- Outreach to mental health, psychiatry, and neurology disciplines

- Combined CNS sales total $3.3 billion

Infectious Diseases

- Major products: Zithromax, Diflucan, Viracept, Rescriptor

- Historic leader in antibiotics, from penicillin to Zithromax

- W-L/Agouron leader in HIV/AIDS treatments and research

- Combined infectious disease drug sales of $3.7 billion

Women's Health

- Major products: Diflucan VC, Zithromax STD, Loestrin, Estrostep, Fempatch, Femhrt

- Hormone replacement therapy, contraception, chlamydia

- Added emphasis on CV risk, (lipids and hypertension), mental health in women

- Broad educational outreach

Table 1 combines Pfizer/Warner 1999 blockbuster drugs (note: Cardura sales are expected to exceed $1 billion this year).

Other "synergies" arise from Warner-Lambert's consumer health and confectionery businesses through global brands including Halls, Benadryl, Sudafed, Listerine, Desitin, Schick, Visine, Ben Gay, Lubriderm, and Barbasol. Warner-Lambert's and Pfizer's long experience in retail and over-the-counter products provides a platform for future prescription-to-OTC switches for both companies.

Significant opportunities will also arise from the company's Animal Health business, which has a growing pipeline of genetically engineered vaccines, gene-therapy products and novel, convenient-to-use medicines.

Growing on Research, Development

The combined research and development operations of the company, headed by Pfizer Vice Chairman John F. Niblack, will have a worldwide scientific staff of over 12,000 and $4.7 billion in annual R&D expenditures in 2000, the largest in the industry. The combined companies have few research overlaps, and a total of 138 compounds in development in areas including central nervous system disorders, oncology, cardiovascular disease, metabolic disease and infectious disease. The Parke-Davis Research Center will continue to be located in Ann Arbor, MI.

"The immediate and long-term benefits of bringing together these two outstanding R&D organizations are profound," stated John Niblack, Pfizer vice chairman. "During the past decade, we have both grown extensively and across broad areas of scientific research. Together, we have a worldwide scientific staff of nearly 12,000, a projected R&D budget of $4.7 billion for this year, more than 138 active compounds in development and six state-of-the-art research campuses. This is the most comprehensive pharmaceutical research program in the world."

Pipeline drugs for the new company include:

Cardiovascular: Avasimbe (atherosclerosis), Norvasc/Lipitor combinatoin

Anti-infectives: Vfend (fungal infections), Remune, AG1549 (AIDS)

Central nervous system: Relpax (migraine), pregabalin (epilepsy, social phobia), zeldox (schizophrenia), pagaclone (anxiety), CP-101, 606 (head trauma), UK-279,276 (stroke).

Metabolic disease: inhaled insulin, Femhrt (osteoporosis; launched February 3, 2000), CP-424,391 (frailty), Zenarestat (diabetic complications), Lasofoxifene (osteoporosis), CI 1037 (diabetes).

Inflammatory disease: Valdecoxib (arthritis), Neurontin combinations (pain), pregabalin (pain).

Cancer: CP-358,774 (tumor growth supression), prinomastat (prostate cancer).

Urologic: Darifenacin (overactive bladder)

By Angelo DePalma