PLC global market growth advances

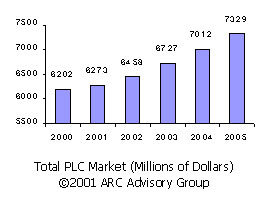

The global process loop controller (PLC) market will grow 3.4% per year to reach $7.3 billion in 2005, from $6.2 billion in 2000, according to a newly revised ARC Advisory Group (Dedham, MA) study.

"In spite of global competition, and downward pricing pressures from users, which are causing eroding margins and reduced revenues for PLC suppliers, the global PLC market will experience modest growth," says ARC senior analyst Himanshu Shah, the principal author of ARC's PLC Worldwide Outlook, Market Analysis & Forecast Through 2005.

Battling for revenue growth, some PLC suppliers have implemented a variety of effective strategic offerings. These range from spot services to complete integration services. "Suppliers are introducing products with greater functionality, designing common software architectures across many platforms, and encroaching on PAS turf in the process industries," says Shah. "The battle for the low-end PLC market continues to develop as the nano and micro segments provide growth opportunities into new application areas."

Battle Escalates for PLC Global Market

After more than ten years, industrial automation mergers and acquisitions have left 90% of the global PLC market dominated by a small group of suppliers. These merger and acquisition activities are not likely to end. Discussions in many boardrooms are continuing to determine which company to target next. Many companies ARC interviewed confirmed their diligence for capitalizing on the right candidate and opportunity for merger, acquisition, or strategic alliance.

Top tier companies are developing major facilities outside their home country. In addition to global sales and support capabilities, these foreign facilities include highly technical staff to support new projects, local industry expertise, fully skilled trainers, logistic centers, customer service centers, and e-business support structures.

Suppliers are Forming Strategies on All Fronts

In spite of changing economic conditions, customers continue to demand products with greater variation, higher quality, lower cost, and quicker deliveries. To increase market share, PLC suppliers seek to provide open platforms and connectivity, enhanced productivity tools, multiple services with installation, and equipment with built-in Web-enabled technologies. They are making significant investments in easy to use and more intuitive products.

With increasing processing power, PLCs now come with more functionality at each level of PLC platform, causing encroachment on the market share of the next higher type of PLC. In addition, while some suppliers are targeting the high-end applications with triple redundancy for safety systems or other critical control applications, others are pursuing low-end applications where generally simple switches and relays were used.

It Pays to Target the Right Markets and Applications

ARC predicts a significant unit volume growth in nano and micro type PLCs during the next five years, and moderate overall revenue growth in the PLC market despite price erosion. PLC suppliers will benefit by targeting packaging, electronics, semiconductor, oil and gas pipeline, and building automation, which will flourish and increase demand for automation. Strong worldwide demands for IT and telecommunication equipment will also fuel high capital investment for automated machinery that use these products and solutions.

ARC Advisory Group provides strategic planning and technology assessment services to leading manufacturing companies, utilities, and global logistics providers, as well as to software and solution suppliers worldwide. From Global 1000 companies to small start-up firms, ARC has the strategic knowledge needed to succeed in today's technology driven economy. Further information can be obtained from

For more information: Himanshu Shah, Senior Analyst, ARC Advisory Group, Three Allied Drive, Dedham, MA 02026. Phone: 781-471-1160. Fax: 781-471-1060. E-mail: hshah@arcweb.com.

Subscribe to our free e-mail newsletter.

Click for a free Buyer's Guide listing.