Success in Japan: Glaxo Wellcome Restructuring Turns Double-Digit Sales Decline into Double-Digit Increase

The July 1999 merger of Glaxo Wellcome's two subsidiaries in Japan, Nippon Glaxo and Nippon Wellcome, helped to generate immediate success for the company in the Japanese market. The company reported an increase of 15.0% in ethical pharmaceutical sales in Japan for the first nine months of 1999. This follows a sales decline of 11.5% in Japan in FY1998, which contributed to Glaxo Wellcome's decline from being the leading Western presence in the Japanese ethical pharmaceutical market in FY1995 to fifth behind Merck, Pfizer, Novartis, and Hoechst Marion Roussel in FY1998.

Datamonitor's new report, The Japanese Pharmaceutical Market: West Meets East, reveals that:

- The July merger of subsidiaries contributed to 15% sales increase for Nippon Glaxo Wellcome in 1999.

- Japanese drug approval harmonization and proposed pricing and reimbursement changes will benefit Western pharmaceutical companies.

In the summer of 1999, after four years of negotiations, Glaxo Wellcome finally merged its subsidiaries in Japan, Nippon Glaxo and Nippon Wellcome, after an agreement with Sumitomo Chemical. The company had previously acquired Shin Nihon Jitsugyo's 50% stake in Nippon Glaxo in 1996. The merged company is called Nippon Glaxo Wellcome and is 80% owned by Glaxo Wellcome and 20% by Sumitomo.

Datamonitor believes that Glaxo Wellcome's position in the Japanese market will benefit significantly from the merger. Merging its subsidiaries and activities in Japan will strengthen the company's presence in Japan as a single entity, and should lead to greater focus on building market share in the country. In fact, the merger of Nippon Glaxo and Nippon Wellcome appears to have been an immediate success—sales of the combined company in the first nine months of 1999 grew by 15% over the corresponding period in 1998.

As well as the completion of the merger, Glaxo Wellcome decided to dissolve its joint venture agreement with Sankyo in July 1999. The contract had expired on March 25, 1999. The companies established Glaxo Sankyo in 1983 for the marketing, promotion, and distribution of a selection of pharmaceuticals, including Zantac (ranitidine), Oracef (cefuroxime), and Zofran (ondansetron). John MacDonald, Datamonitor healthcare analyst, commented: "Assuming responsibility for marketing Glaxo Wellcome's products from the Glaxo Sankyo joint venture will clearly enhance Nippon Glaxo Wellcome's earnings potential in Japan."

Since 1995, Glaxo Wellcome has gone from being the leading Western presence in the Japanese ethical pharmaceutical market to being fifth behind Merck, Pfizer, Novartis and HMR. This decline has had several causes, including: the company's preoccupation with trying to merge Nippon Glaxo and Nippon Wellcome, which has taken four years of negotiation with Sumitomo and Shin Nihon Jitsugyo; and the failure to launch any new potential blockbusters to offset the decline of Zantac. However, Datamonitor believes the merger will help change this situation.

Despite inherent similarities in the Japanese drug approvals procedure to Western procedures, the great differences between the two are notorious for complicating Japanese drug launches for Western companies. However, recent developments in international harmonization will lead to greater compatibility of clinical trial data and standards, reducing the need to duplicate trials and making applications for marketing authorization in Japan easier for sponsors which are used to operating in the West.

In addition, at the US-Japan summit in May 1999, Japan reaffirmed the commitment to deregulation and reform it had made at the Birmingham Summit of May 1998. As part of this commitment, the government's current proposals for drug price setting include preferential treatment for innovative new drugs. Western companies are most likely to benefit from this change, given their strong culture of innovation. Already, almost three times as many drugs of Western origin are launched in the Japanese market as those of Japanese origin.

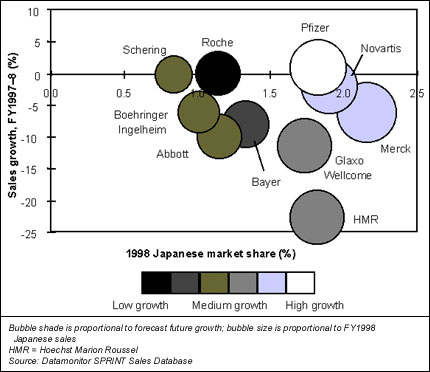

Datamonitor believes that these two factors, allied with Japan's likely economic recovery in the near future, will once again make Japan an attractive place for Western companies to launch and promote their drugs. The market is the second largest in the world, with a value of $46 billion in FY1998, and, although recent years have seen declines in the market's value, it is expected to experience growth in FY1999. The figure below shows the extent to which Datamonitor expects the leading 10 Western ethical pharmaceutical companies' sales in the Japanese market to grow in the short to medium term.

Pfizer is currently in the strongest strategic position in the Japanese market. The company's pharmaceutical portfolio was the only one of the top 10 companies to generate sales growth in FY1998, with revenues increasing by 0.8%. Pfizer is in a good position to experience accelerated growth in its Japanese sales in FY1999 and FY2000, with some strong products recently launched on the market, such as Viagra (sildenafil) and Zithromax (azithromycin). The company's strong marketing muscle should ensure continued growth for these products and its other leading products in Japan.

Novartis and Merck will record sales growth in Japan in the near future, as the companies supplement their current leading positions in several indications with new product launches, including Neoral (cyclosporin) for Novartis and Vioxx (rofecoxib) for Merck. Glaxo Wellcome should benefit from its reorganization and the launch of Heptovir (lamivudine) for the treatment of hepatitis. Meanwhile, HMR's new presence in the Japanese diabetes market, with nateglinide, will give a much needed boost to the company's diabetes portfolio.

The future does not look as bright for the other five companies shown in the figure. Bayer's reliance on Adalat (nifedipine) looks increasingly risky, with the product's sales beginning to decline and no alternative high-revenue-generating products in the pipeline. Abbott's lack of a major presence in any therapeutic area, coupled with the lack of promising products in its pipeline, look almost certain to result in continuing sales decline for the company. Roche appears to have similar short-term problems, while Boehringer Ingelheim's investment in R&D promises success in the long term. Schering will benefit from the approval of the contraceptive pill in Japan, but it may be a while before its use becomes common and Schering reaps the full benefit.

Western companies' market share and sales growth in the Japanese market, FY1997–8, and predicted direction of future growth

The Japanese Pharmaceutical Market: West Meets East is available from Datamonitor, priced at $7,995 for a single user electronic license.

For more information: Elisabeth Freeman, Global Product Manager, Datamonitor, 1 Park Ave., 14th Floor, New York, NY 10016-5802. Tel: 212-686-7400, ext. 165. Fax: 212-686-2626.