Systemic Antifungals: A Market Bound for Change

‘The rise in the use of prophylaxis and empiric therapy is set to change the balance of power in the systemic antifungals market." -- Datamonitor Analyst Nick Falk.

Contents

Prophylaxis and Empiric Therapy: New Opportunities

New Merck, Fujisawa Products Should Dominate

The systemic antifungals market is growing rapidly, and with it awareness of such diseases as invasive aspergillosis. As the patient population rises, so does pressure to develop efficient diagnostic tests. Systemic fungal infection markets are not only poised for growth, they are positioned for change.

Datamonitor's new report, Treatment Algorithms 2000: Segmenting The Fungal Infections Patient Population, reveals that:

- The rising use of prophylaxis and empiric therapy is creating new market opportunities.

- New products from Merck and Fujisawa are set to dominate the market.

Prophylaxis and Empiric Therapy: New Opportunities (Back to Top)

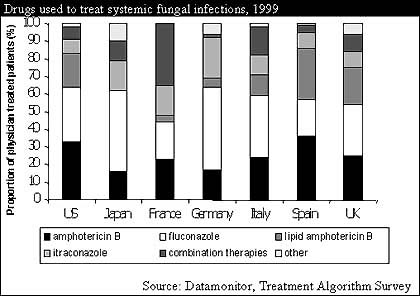

Physicians in the US and Europe are becoming increasingly aware of systemic fungal infections among individuals with compromised immune systems. In the United States alone in 1999, doctors reported 77,000 cases of systemic fungal infection. Since many patients remain undiagnosed, the actual population size could be considerably larger.

Experts suspect that most systemic fungal infections remain undiagnosed until the later stages of infection. With aspergillosis, the disease is often unresponsive to treatment by the time patients are diagnosed: Only 10% of treated aspergillosis patients respond to drug therapy. Drug regimens are therefore usually initiated late in the course of the disease, when a premium is placed on effectiveness and potency rather than affordability or low toxicity.

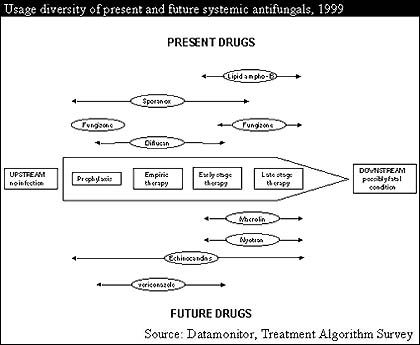

Products such as Gilead Sciences' AmBisome (lipid amphotericin B) and the Liposome Company's Abelcet (lipid amphotericin B) dominate within this market alongside traditional amphotericin products and azoles. As more individuals are tested and diagnosed at earlier stages, however, there will be an increasing need for early stage, or "upstream" therapies.

Prophylaxis and empiric therapy are gaining prominence, with significant implications for systemic antifungal markets. Empiric antibiotic therapy is based not on firm microbiologic confirmation of disease, but on what an expert physician suspects is the most likely causative agent. The point: Many microbiologic infections are serious and life-threatening, so the first few days after diagnosis are often critical.

Prophylaxis and empiric treatment may well reduce the market for downstream antifungals. This will have a significant effect on liposomal amphotericins such as Abelcet (lipid amphotericin B), which are considered by many physicians to be too expensive to be used empirically.

New treatment models will also affect what physicians come to expect from effective antifungals. Drugs used for upstream therapy and prophylaxis need to be affordable and non-toxic. Consequently, physicians may be unwilling to use a drug such as Bristol-Myers Squibb's Fungizone (amphotericin B), which is inexpensive but can cause severe renal problems. This creates new opportunities for drugs previously used infrequently for systemic infection treatment. Sporanox, Janssen's itraconazole product, is particularly likely to prosper since it is affordable, has a comparatively mild side-effect profile, and has not as yet displayed the high rates of resistance that have affected usage of Pfizer's Diflucan (fluconazole).

Changing market structure also creates new priorities for antifungal manufacturers. With earlier diagnosis and empiric treatment, rapid onset of action has taken a back seat to cost. Regimens of empiric therapy can be long, especially for transplant and cancer patients. A major priority, however, is the ability to withstand resistance, a problem affecting both azole and amphotericin drugs. Long treatment regimens may well factor in future markets, and prove advantageous to newer drugs that do not display such a rapid build up of drug resistant strains.

New Merck, Fujisawa Products Should Dominate (Back to Top)

Several new antifungals will enter the marketplace over the next three years, with characteristics that are markedly different from those of their predecessors. Considering the shift in the antifungals market towards upstream therapy, new products from Merck and Fujisawa will enjoy the greatest success, according to Datamonitor.

Demand for effective downstream therapies will diminish but by no means be completely eclipsed by the growing upstream market. With diagnostic tests set to improve, considerable scope for effective late-stage antifungals will persist. Unfortunately prophylaxis will cause an increase in the occurrence of drug-resistant strains, resulting in a need for drugs for all stages of therapy that can handle resistant strains.

Although a number of drugs can fulfill one or two of these roles, the echinocandin drugs stand out since they are used at all stages of the disease and are effective against drug resistant strains. In comparison, Pfizer's new antifungal, voriconazole, will be effective as late stage therapy but will be too prone to resistance to be used for upstream treatment. Liposomal products such as Abelcet (lipid amphotericin B) and Nyotran (lipid nystatin) may provide competition, but their price will limit their usage for extensive empiric therapy.

Cancidas (caspofungin), manufactured by Merck, probably be the first echinocandin to reach the market, should be approved in the U.S. and the European Union in late 2000 or early 2001. Fujisawa's FK463, another echinocandin, will enter the market shortly thereafter. Whether either product fulfills this potential will depend both on marketing and cost. The risk these drugs pose to current systemic antifungal drugs, however, is clear.

Treatment Algorithms 2000: Segmenting The Fungal Infections Patient Population is available from Datamonitor, priced at $6,995.

For more information: Elisabeth Overend-Freeman, Datamonitor, 1 Park Ave., 14th Floor, New York, NY 10016. Tel: 212-686-7400, ext. 765. Fax: 212-686-2626.

Angelo DePalma