Teledetailing: Targeting Overlooked, Over-booked Physicians - Part 1

By Joseph Macaluso, Access Worldwide Communications Inc.

This two-part article provides background information and case studies on physician teledetailing as an effective and powerful method of disseminating product information and influencing prescribing behavior. We try to answer these question: Is teledetailing appropriate for all pharmaceutical companies? What products should be teledetailed? Which physicians should be targeted? Also discussed are the qualities of a good teledetailing company and the methods for calculating return on investment.

Is Teledetailing Appropriate For All Pharmaceutical Companies?

What Products Should Be Teledetailed?

What Type Of Physicians Should Be Teledetailed?

There is a war being waged in physician offices and it is not between the doctors and managed care. This war is between the tens of thousands of pharmaceutical sales representatives and the companies that employ them. Often this struggle is targeted to those high prescribing offices that drug companies segment out as "high writers" who control the majority of prescriptions.

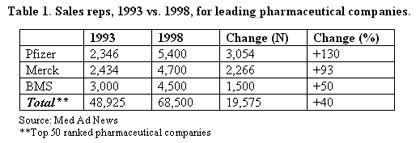

In recent years, the number of professional sales representatives hired by drug companies has skyrocketed and the total field force size of the top companies has grown dramatically. While the overall growth (presented in Table 1) may appear staggering at first, the rationale for building such large field forces is sound business. Simply put, representatives sell drugs. More representatives means more sales.

Pharmaceutical executives understand that detail people provide the relationship selling and customer service that drives disease and product knowledge, and subsequently sales. The sales representatives are directed to specific medical offices that influence the greatest number of prescriptions in a disease category. Unfortunately, the result is that high traffic medical offices are being targeted repeatedly by all companies, and other less productive physicians are seeing far fewer representatives. Furthermore, some offices, in an attempt to manage the influx of reps, have set strict criteria for detailing or have become "no see" offices. It is a very fine line between gaining key product and disease information from representatives and having the office controlled and disrupted by a constant flow of detail people.

Although sales representatives still provide a high return on investment, profitability is decreasing as rep numbers in the offices become too great. The reps become less productive as they wait longer to see physicians and the time they have to detail the doctors is becoming increasingly limited. Furthermore, doctors receive additional time constraints as they struggle to see more and more patients in a single day. This pressure further reduces overall detail time available for company representatives.

Physicians know that company representatives are an important source of disease and product information, but many feel there just isn't enough time in the day to meet reps face to face.

Given the increasing time pressures in the physician offices and the need to see a greater number of patients in a given day, there is a need for alternate techniques that provide disease and product messages that will inform the physicians of new information. Sales representatives are a valuable resource and a major driver of sales growth, but new tactics need to be utilized in conjunction to gain access to physician offices.

Teledetailing is a tool that has been successfully utilized throughout the pharmaceutical industry for many years. It allows messages to be delivered to the physician in a highly efficient and cost effective manner and can be utilized to access a wide-range of physicians.

The purpose of this article is to review various strategies that can be followed to maximize the impact teledetailing can have on the pharmaceutical business model.

Is Teledetailing Appropriate for All Pharmaceutical Companies? (Back to Top)

Some pharma companies tend to have greater success with teledetailing programs than others, and these successes are due to inherent management differences. While a teledetailing project is not a company wide program, it is clearly product specific, company executives and product managers do drive the success of every program. In fact, the companies that are continually most successfully utilizing teledetailing have the vision and strategic insight to use it appropriately and the knowledge to construct the correct messages and provide agency management. A teledetailing project is only as successful as the strategy behind the project, the message being communicated and the physicians being targeted.

Top company executives use teledetailing to maximize sales, while gaining a positive ROI on those products in their marketing portfolio that are not being fully supported by sales force and marketing spending—this could be a billion dollar brand or a 10 million dollar product. Executives realize that funds need to be utilized strategically to increase overall company sales and that often unique strategies and tactics need to be employed in order to get out the correct product message to key physicians. Strong product management within the company is also imperative to successful implementation because it is those individuals responsible for the day to day management of the agency as well as message creation and final physician segmentation. Overall, the greater the experience a company has with teledetailing, and the stronger its management, the more profitable the teledetailing project given appropriate product selection, message generation and physician segmentation.

What Products Should Be Teledetailed? (Back to Top)

As previously stated, any product that is under resourced with field representation or marketing spending is a potential candidate for teledetailing. It is necessary to carefully review the market dynamics and competitive landscape to determine if a teledetailing project will benefit the brand. For example, if the market is very small and the goal is to increase the size of the disease category, it would be useless to target specialists with a competitive superiority message. Conversely, if a brand is losing market share in the specialist office, the project should not concentrate on building the primary care market with a teledetailing project. The key to product selection is understanding the desired outcome of the program in order to develop the appropriate project plan, create an effective message and target the correct physicians. As examples, let us analyze the following cases:

- A large product losing detail time due to new product launches

- A growing brand with strong physician prescribing, but within a small group of doctors

- An older, under-resourced, but highly profitable product

In the first example, teledetailing is beneficial to preserve market share in those high volume offices that may not have the same target profile as the newly launched products. This would allow the teledetail message to focus on big writers with a competitive message regarding the superiority of the product while focusing the sales force on those offices most influential for the new product. Executives understand that there is usually some cost to older products as new products are launched, the goal is to minimize lost sales through unique tactics. By supplementing rep detailing with teledetailing to top prescribing offices, market share loss will hopefully be retarded. Specific physician segmentation, message development and project specifics (call frequency, sample fulfillment, and mailings) would be analyzed and implemented depending on strategy and company needs/budget.

Example two illustrates a common problem with many products in the early stage of growth- good sales due to select physicians, but limited universal prescribing. Sales for this product type are generally driven by an early adopter group that is often the sole focus of the sales organization. These offices have been segmented out due to prescribing behavior and call schedules crafted to maximize early sales impact. The goal for this type of brand is to increase product trial by a large number of physicians currently not prescribing. In this case, it may be appropriate to target teledetailing activity to those doctors that are regarded as "no see" physicians or those that the representatives have had trouble hitting the recommended frequency. Early in a product's launch it often takes 7–10 calls on one physician before that physician begins writing a product. Teledetailing provides another alternative to increase the frequency over a shorter time frame.

In a specific instance, product X treated a condition with a 2:1 ratio of prevalence (women to men). Unfortunately, the company launching the drug did not have a strong OBGYN presence in the field. As a result, the initial focus of the field force was on the primary care physicians, and although sales were outstanding during the initial two years, senior executives recognized the need to address the OBGYN marketplace. Instead of hiring a new force or contracting out sales reps, the logical alternative would be to test the messages and receptivity of the message and product through teledetailing to top OBGYNs. Based on the success of the program and the increase of prescribing from the OBGYNs, future decisions could become clearer.

The third example could be considered the typical teledetailing example–an old product that brings in profit, but doesn't get any detail time. Again, this is a very appropriate example, but it is the strategy, message development and segmentation that will drive the success of the project. It is not enough to say "just teledetail the top writers." For example, in the case of an older product that is written equally by both a specialist group and a generalist population, it is necessary to logically determine what physician group would benefit most from a teledetail. If the goal is to preserve market share, than it may be advantageous to hit the specialist sales force if the company is not calling on these physicians due to a portfolio shift away from this group. On the other hand, if the specialist salesforce remains, the company should most likely teledetail the top Primary Care Physicians that write for this disease state, but are not called on regularly by the field force. With an older product that has limited resources it is imperative that the goals of the project are clearly defined and the implementation strategy well thought out.

While these three scenarios have been utilized to illustrate the many different products that could benefit from teledetailing, in the end a good strategy and implementation plan could benefit almost any brand. As stated, the key is understanding the goals of the program, creating the correct message and segmenting out the correct medical population that will provide the highest return. If a product manager can answer the following question "What physician group am I not hitting with the right frequency?", then teledetailing may have a role in the product plan.

What Type Of Physicians Should Be Teledetailed? (Back to Top)

Although the ideal answer would be to segment out physicians by behavior as well as demographics and attitudes to teledetailing, it is very difficult to accomplish such a task. It is the ability to segment out the right doctors that will allow maximum return for a product. There are three primary physician segments that should be reviewed:

- Non-called on physicians

- "No see" physicians"

- Lower-tier physicians

Non-called on physicians are often specialists that the field force does not cover because the products used by this group are limited and it is not cost effective to have representatives make a single product call to a small group of doctors. Although the overall number of physicians and total prescribing for this group may be small nationally, from an influence standpoint this group may be important. Furthermore, the sales may still amount to significant gains in key regions based on specialist concentration. Teledetailing offers a cost effective way to provide these doctors with product information (and samples if requested) without removing reps from multi-product calls in the generalist office.

As discussed, time constraints are forcing physicians to reduce detail time in the office. The result is difficult to see or "no see" physicians that are looking for unique ways to learn about products and management techniques. While some of these physicians may have personality issues that preclude them from being open to any type of detailing, including rep or teledetailing, there are numerous examples where ‘no see" doctors will be very open to a well run teledetailing program. The real issue is most often not personality but merely time constraints. Offering doctors a teledetail based on their schedule is a unique tool that provides a product message when the physician is ready to listen.

The lower tiered physician typically does not write the high volume of prescriptions that a top tier physician does, subsequently, he/she is often overlooked from a rep detailing point of view. A strong field force calling on primary care physicians typically bases call plans off of the top 100,000–120,000 top prescribing physicians, with top tier doctors receiving a proportionately higher number of calls. The lower tier physicians, while still part of the call plan, receive reduced call frequency and less emphasis from the reps because the company representatives try to maximize sales with minimum time outlay. In the reps' eyes, it is far more beneficial to see a physician that writes 300 prescriptions a week than three physicians that each write 100 scripts. Unfortunately, the majority of other companies and representative have a similar outlook resulting in overcrowding in top offices and opportunities lost in smaller growing practices. Teledetailing can be used very cost-effectively to provide messages and sample fulfillment to those offices not being called on the minimum number of times.

Overall, many different physician types can benefit from teledetailing, and it is the overall brand strategy and market dynamics that will drive segmentation. Physician selection is really the final step in the strategic development of a teledetailing program, and it is as equally important as company management vision and product selection.

End of Part 1. To read Part 2 of this two-part article, see Teledetailing: Targeting Overlooked, Over-booked Physicians – Part 2.

For more information: Andrea Greenan, Senior Vice President, Marketing & Communications, Access Worldwide, 2200 Clarendon Blvd., 11th Floor, Arlington, VA 22201. Tel: 703- 841-1110. Fax: 703-812-9561.