Teva's Unorthodox Strategy For The Respiratory Market — Will It Work?

By Elena Kozhemyakina, Ph.D., Decision Resources Group (DRG)

GlaxoSmithKline’s (GSK’s) blockbuster Advair (salmeterol/fluticasone) is a long-acting beta2 agonist/inhaled corticosteroid fixed-dose combination (LABA/ICS FDC) therapy used in the treatment of asthma and chronic obstructive pulmonary disease (COPD). Advair is one of GSK’s best-performing drugs, garnering more than $2 billion in company-reported U.S. sales in 2017, despite intense competition from other LABA/ICS FDC brands.1

There are two versions of Advair on the U.S. market, Advair HFA and Advair Diskus (HFA and Diskus designate the type of the device used to deliver salmeterol/fluticasone into the lungs), the latter of which captures the majority of market share for the brand. The last Diskus patent in the U.S. expired in 2016, opening the gates for generic manufacturers. Since then, two companies and one alliance—Mylan, Hikma/Vectura, and Sandoz—have attempted to bring a substitutable (AB-rated) Advair generic to the U.S. market, but all three have failed thus far, receiving complete response letters (CRLs) from the FDA. The reason for their failure partially lies in the strict bioequivalence guidance issued by the FDA in 2013, intended to help manufacturers of generic salmeterol/fluticasone products navigate the rough regulatory waters to approval while ensuring high-quality standards are applied to these complex drug-device combinations, thereby making “genericizing” of salmeterol/fluticasone combinations difficult.2 Indeed, many industry experts, including FDA Commissioner Scott Gottlieb, realize the regulatory hurdle of creating generic copies of complex drugs — such as inhaler therapies — is high, but the guidance stays in place and, thus, the burden remains.3

Where does Teva fit into the story? Just like the other generic manufacturers, Teva was keen to create a version of Advair for the U.S. market, but realized early that the feat would be extremely challenging in the current climate and instead opted for a creative, alternative approach. Rather than taking the difficult — and uncertain — path of duplicating the Diskus device, Teva developed what we call a branded-generic version of Advair — AirDuo RespiClick — designed to deliver the salmeterol/fluticasone combination using Teva’s proprietary RespiClick device. Marketing a branded-generic LABA/ICS FDC product, in lieu of a true generic, is not new. Many companies — including Teva — successfully used this strategy to introduce several branded-generic LABA/ICS FDC agents in Europe. The unexpected twist this time is that, in addition to launching AirDuo RespiClick, Teva simultaneously launched a substitutable generic of AirDuo RespiClick — which also happened to be the first substitutable LABA/ICS FDC generic in the U.S. (It is important to note that Teva’s salmeterol/fluticasone generic can only be substituted with AirDuo RespiClick and not with Advair, since no bioequivalence to Advair has been established.) Upon launch in April 2017, Teva priced AirDuo RespiClick on par with other LABA/ICS brands (approximately $300 for all doses, based on the wholesale acquisition cost of the package), while the generic was launched at a substantial discount ($95 per package, for all doses).4 Certainly an unconventional decision, but was it effective?

Background On The LABA/ICS FDC Market In The United States

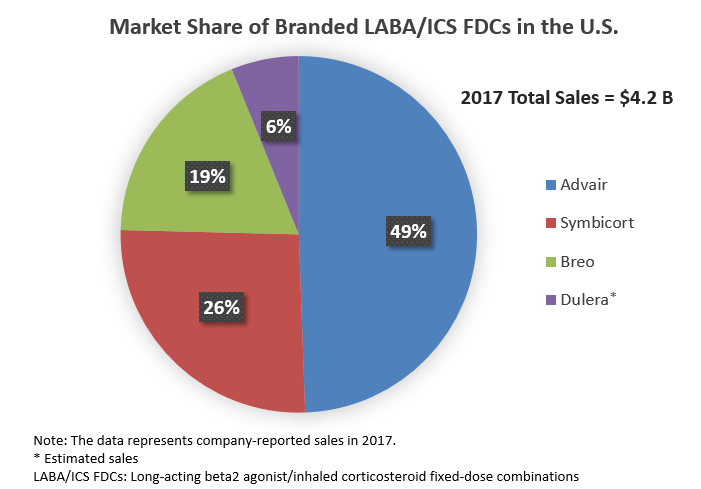

LABA/ICS FDCs is a high-value market. The four branded LABA/ICS FDCs available in the U.S. — GSK’s Advair and Breo (vilanterol/fluticasone furoate), AstraZeneca’s Symbicort (formoterol/budesonide), and Merck’s Dulera (formoterol/mometasone) — garnered more than $4 billion in sales in 2017.1, 5, 6

Intense competition in the drug class creates a strong pricing pressure on branded LABA/ICS FDCs and limits current sales of these agents, compared with the peak sales reached several years ago. Sales erosion is expected to intensify further as some agents in the class start losing patent protection in the U.S. The manufacturers of branded LABA/ICS FDCs recognize the impending threat of generics and are putting up a fight. For instance, as part of its strategy to maintain its respiratory franchise in the face of possible Advair generics, GSK introduced a second, more-convenient (i.e., once-daily) LABA/ICS FDC agent, Breo.

On the other side of the battle are at least two companies and one alliance — Mylan, Hikma/Vectura, and Sandoz — working intensely to have their copies of a substitutable Advair generic approved, with little success thus far. Mylan was the first to receive a CRL from the FDA, in March 2017, delaying the launch of its drug until 2018, at best. Hikma/Vectura was hit next; it received a CRL from the FDA in May 2017, which has led the company to run an additional clinical trial and ultimately delays launch until at least 2019. Sandoz suffered a blow in February 2018 with its FDA-issued CRL, making the approval and launch of its salmeterol/fluticasone generic unlikely in 2018 as well.

What Is Teva’s Plan?

In light of the above failures, Teva’s decision to bet on a branded-generic/generic duo is starting to look less puzzling and rather wise. By launching two identical products under different names, one as the premium-priced, branded-generic AirDuo and the other as its discounted, substitutable generic, Teva will likely be able to capitalize on the buzz around the launch of the first substitutable generic of salmeterol/fluticasone (if not Advair, per se), as these agents were eagerly awaited by patients and physicians alike. The launch of a substitutable generic also helped open generic tiers in managed care organization (MCO) formularies, making access to the agent less costly for patients. And by launching the branded-generic simultaneously, Teva is able to generate additional sales in the small percentage of patients who opt for premium-priced AirDuo.

Although the discounted price of the generic will likely be the main factor promoting uptake and thereby advancing sales for Teva, the company didn’t view price as the sole uptake driver, but rather invested in the RespiClick device design and expanded the RespiClick portfolio to other agents used for the treatment of asthma and COPD as a mean of boosting sales of AirDuo and its generic. The design of the RespiClick inhaler device (also known as Spiromax in Europe) received positive reviews from physicians. The device is easy to use, requires a reduced number of steps, has a dose counter, and is considered efficient overall (delivering lower doses of salmeterol/fluticasone and thus potentially minimizing side effects). Physicians interviewed by DRG acknowledged that patients are frequently confused when required to switch devices upon changing their maintenance drugs — such as going from an ICS to a LABA/ICS FDC or vice versa — or when they need to simultaneously use multiple medications packaged in a variety of inhalers. An example is when prescribed a maintenance and a rescue therapy in different inhaler devices to manage their disease, potentially resulting in incorrect use of the devices and/or decreased compliance.

As such, the availability of Teva’s short-acting rescue therapy, ProAir RespiClick (albuterol), the only dry-powder rescue agent available in the U.S. — and the first of the RespiClick family, launched in 2015 — further strengthens Teva’s case. Because many patients with COPD and asthma routinely use both maintenance and rescue inhalers for disease control, Teva’s RespiClick family of inhalers creates an opportunity for patients to receive their maintenance medication (AirDuo/generic) and the rescue agent (ProAir) in the same device. Moreover, AirDuo/generic and ProAir is the only maintenance/rescue pair of drugs available in an inhaler that doesn’t require hand-breath coordination during inhalation, which could be useful for younger and older patients who may have difficulty coordinating the actuation with their breathing. Finally, to further extend the RespiClick family and to complement AirDuo and its generic while synergizing the sales potential, Teva followed the launch of AirDuo/generic with the launch of ArmonAir RespiClick, a branded-generic fluticasone product (i.e., an ICS) also delivered in the RespiClick device, thus offering an easy transition between the ICS and the LABA/ICS FDC drug classes.

Is The Strategy Working? The Payer Perspective

For AirDuo and its generic to succeed, favorable formulary placement is key. Manufacturers of LABA/ICS FDC brands frequently rely on exclusive contracts with MCOs in exchange for more favorable formulary placement and/or fewer utilization management controls for their products. Brands failing to provide sufficient discounts could be penalized with stricter utilization management controls, unfavorable tiering, or exclusion from formulary.

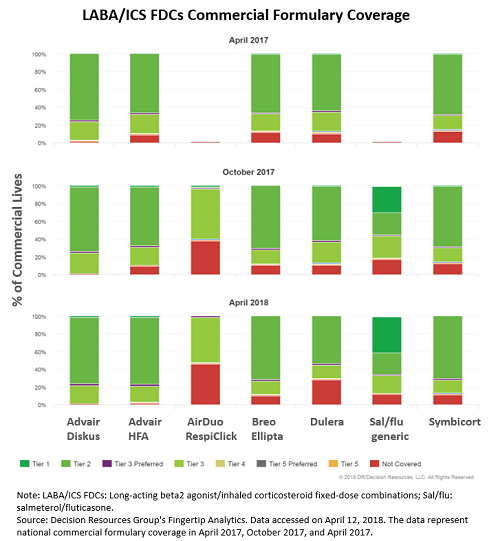

According to formulary data — trended over the past year — in October 2017, six months following the launch of Teva’s generic, 83 percent of commercially insured patients in the U.S. had access to Teva’s generic drug, with approximately 30 percent of all commercially insured patients able to access it on tier one. For comparison, only 1 percent of commercially insured lives in the U.S. had access to Advair on tier one at that time. The most-recent coverage data from April 2018 shows the salmeterol/fluticasone generic is now available to approximately 88 percent of all commercially insured patients in the U.S., with over 40 percent having access to the generic on tier one, suggesting coverage compared with branded LABA/ICS FDCs continues to improve one year post-launch.

The main reason for such a fast and favorable adoption of Teva’s generic into commercial formularies lies in its low price. Launched at an approximate 70 percent discount to AirDuo — which in turn is priced similarly to branded LABA/ICS FDCs — the generic is the most cost-effective option for payers, likely even when manufacturer rebates and discounts are taken into account. A pharmacy director interviewed by DRG explains, “We cover LABA/ICS FDC brands on tier three, and we have competitive contracts for each, but we cover the generic on tier two. We don’t need a contract for the generic because its price is so low, only around $90 per month.”

Is The Strategy Working? The Physician Perspective

Physician adoption of Teva’s salmeterol/fluticasone generic largely follows the same trend as its formulary coverage. The majority of pulmonologists interviewed three months post-launch were not aware of AirDuo or its generic. However, the landscape changed considerably one year post-launch, with many pulmonologists now reporting use of the generic product, especially for patients who may have difficulty paying the relatively high out-of-pocket costs for branded LABA/ICS FDC agents. Interviewed physicians indicated they prefer to avoid unnecessary switching between different LABA/ICS FDC products and, thus, typically prescribe the salmeterol/fluticasone generic to patients who are new to LABA/ICS combination treatment. Nevertheless, physicians are also comfortable switching patients from a branded LABA/ICS FDC to the generic if out-of-pocket costs are an issue.

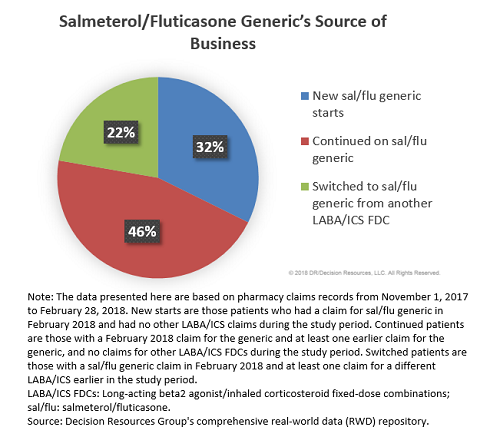

Analysis of pharmacy claims data for November 2017 to December 2018 — sourced from DRG’s robust real-world data repository — reveals almost one-half of patients (46 percent) receiving the generic in February 2018 were continuing treatment with the generic (having started earlier in 2017). Approximately one-third of patients on the generic in February 2018 (32 percent) were those new to the LABA/ICS FDC class (i.e., they had not received another LABA/ICS combination during our study period), while 22 percent were patients who switched to the generic from another LABA/ICS combination.

These findings support the notion that although the majority of business for Teva’s generic comes from patients who are new to LABA/ICS FDC treatment, a sizable proportion of patients on the generic were switched from a branded LABA/ICS FDC. (Worth noting: Our observation period included the transition from December 2017 to January 2018, a time when many MCOs adjust their formularies, which could result in a higher switching rate compared with other times of the year. Thus, a similar analysis performed outside of the January 1st timeframe may yield a lower proportion of switched patients.)

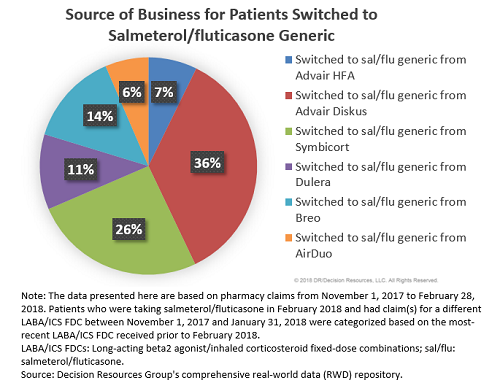

Although the highest percentage of patients switched to the generic were, not surprisingly, former Advair patients (43 percent), more than one-quarter of patients were switched from Symbicort, 14 percent were switched from Breo, and 11 percent from Dulera. Thus, the launch of Teva’s generic is not only negatively impacting Advair’s market share but also that of other branded LABA/ICS FDCs.

What Is The Future Of Teva’s Salmeterol/Fluticasone Generic?

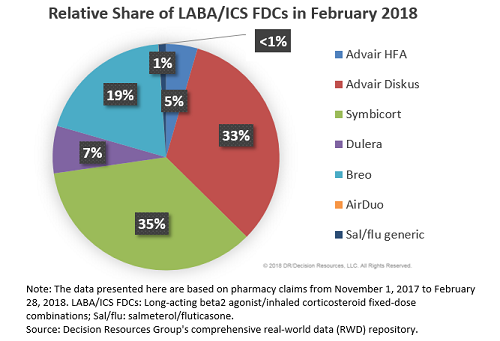

Given its relatively recent market entry, Teva’s salmeterol/fluticasone generic is not currently viewed as a major threat to Advair or other branded LABA/ICS FDCs. Its market share is still low; only 1 percent of all LABA/ICS FDC prescriptions filled in February 2018 were attributed to the generic, while 38 percent and 35 percent were Advair and Symbicort, respectively.

However, we believe Teva’s generic can still put up a fight, although the outcome will largely be decided by the two main factors, both of which are not directly in Teva’s control: (1) when will the first substitutable generic of Advair launch and (2) at what price? It is clear from our physician and payer analysis that at this point in time, Teva’s generic is viewed positively by all stakeholders and the agent is poised to have respectable uptake, but the launch of a substitutable Advair generic could change these prospects as it would have a substantial impact on the LABA/ICS FDC competitive landscape.

The best-case scenario for Teva — if all three substitutable Advair generics are further delayed by the FDA — would give the company more time to build a larger market presence, further entrenching its competitively priced product at the expense of the branded LABA/ICS FDC agents. With a bit of luck, Teva’s generic will slowly chip away a share of the branded LABA/ICS FDC market and the company will be rewarded well for its strategic ingenuity.

However, if, in the next several months, one of the contenders manages to secure FDA approval and launch an AB-rated Advair generic, Teva’s success would likely be determined by the price of the substitutable generic. Under the least-favorable scenario — if the AB-rated Advair generic launches at a price comparable to Teva’s generic — many MCOs are likely to respond by placing the substitutable Advair generic on the same tier as Teva’s agent, causing Teva’s product to lose its main advantage over other agents in the class (i.e., more-favorable formulary tiering), potentially resulting in the bulk of Advair switches going directly to its substitutable generic. However, in a scenario we view as more conceivable, the first substitutable generic of Advair will likely launch at a more modest 10 to 30 percent discount to Advair. This could prompt many MCOs to renegotiate more-favorable contracts with GSK, preserving Advair’s formulary position at the expense of the substitutable generic. As a part of negotiations, the AB-rated Advair generic could be excluded from the formulary altogether, thus preserving Teva’s tiering advantage. There is a precedent supporting this scenario in the anti-TNF-alpha market in the U.S., where the launch of the first infliximab biosimilar, Pfizer’s Inflectra, prompted many payers to renegotiate more-favorable contracts for Janssen’s Remicade, allowing the branded agent to preserve its preferred coverage, instead of giving more-favorable coverage to Inflectra. Given the complexity of both biologics and drug-device combinations, we think the anti-TNF-alpha market is a reasonable analogue for the LABA/ICS FDC drug class. DRG continues to closely monitor developments in the LABA/ICS FDC market and is eager to see whether Teva’s strategy to launch a branded-generic/generic duo will yield commercial success for the company.

References:

- https://www.gsk.com/media/4626/fy-2017-us-dollar-translation.pdf

- https://www.fda.gov/downloads/drugs/guidancecomplianceregulatoryinformation/guidances/ucm367643.pdf

- https://blogs.fda.gov/fdavoice/index.php/2017/10/reducing-the-hurdles-for-complex-generic-drug-development/

- Redbook Online: http://www.micromedexsolutions.com/home/dispatch, accessed on April 12, 2016.

- https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2017/annualreport2017.pdf

- http://investors.merck.com/news/press-release-details/2018/Merck-Announces-Fourth-Quarter-and-Full-Year-2017-Financial-Results/default.aspx

About The Author:

Elena Kozhemyakina, Ph.D., is a principal business insights analyst at Decision Resources Group (DRG), specializing in pharmaceutical market analysis of immune system disorders with expertise in asthma, chronic obstructive pulmonary disease, systemic lupus erythematosus, and other related conditions. Prior to joining DRG in 2014, she completed a postdoctoral fellowship at Harvard Medical School, where she investigated molecular mechanisms involved in limb patterning, cartilage formation and pathogenesis of osteoarthritis. Kozhemyakina has authored multiple peer-reviewed publications focused on molecular signaling of developmental disorders

Elena Kozhemyakina, Ph.D., is a principal business insights analyst at Decision Resources Group (DRG), specializing in pharmaceutical market analysis of immune system disorders with expertise in asthma, chronic obstructive pulmonary disease, systemic lupus erythematosus, and other related conditions. Prior to joining DRG in 2014, she completed a postdoctoral fellowship at Harvard Medical School, where she investigated molecular mechanisms involved in limb patterning, cartilage formation and pathogenesis of osteoarthritis. Kozhemyakina has authored multiple peer-reviewed publications focused on molecular signaling of developmental disorders