The ADC Market To Triple By 2030, Driven By Big Pharma Developments

By Kriti Khandelwal and Manjari Palla, DataM Intelligence

After two decades of trial and error in antibody drug conjugates (ADC) development, the field is poised to deliver a plethora of targeted drugs to treat a wide range of tumor types. These are an emerging class of highly potent pharmaceutical drugs that are a combination of immunotherapy and chemotherapy. In ADCs, the most targeted antigens are ERBB2, CD33, CD19, CD22, and MSLN (mesothelin), and over 50 different known antigens have been used in ADCs as a target.1

But the important question here is: Do ADCs have the potential to be a game changer in revolutionizing cancer treatment?

ADCs have been a promising class of targeted cancer therapies for over 20 years, but their development has been challenged by several factors. One key challenge has been the complex nature of ADC design, which requires the combination of a cytotoxic drug, an antibody, a linker, and the conjugation technology that connects the components. Each of these components must be optimized in different ways depending on the cancer types or targets. It can take years to develop an ADC with the desired therapeutic profile.2

Despite these challenges, recent advancements in ADC technology have renewed interest in this field. For example, the development of site-specific conjugation technologies has enabled the creation of more precise and stable ADCs, reducing off-target effects and increasing the concentration of the “magic bullet” available to reach tumor sites. In fact, there are a number of promising ADCs now in late-stage clinical trials, as well as plenty more in preclinical development.

According to DataM Intelligence’s new analysis, the global ADC market size was valued at $5.0 billion in 2022 and is projected to witness lucrative growth by reaching $16.5 billion by 2030. The market is expected to exhibit a CAGR of 16.6% during the forecast period (2023–2030). Some of the major players operating in the ADC market include Takeda Pharmaceutical Company, Hoffmann-La Roche, Pfizer, AstraZeneca, Gilead Sciences, Seagen, Astellas Pharma, Daiichi Sankyo Company, GlaxoSmithKline, and ADC Therapeutics.

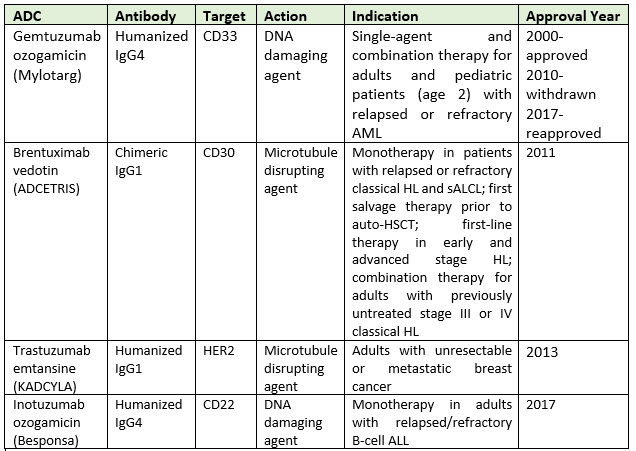

Pfizer launched Mylotarg, the first ADC, in 2000, which seemed to be the long-awaited magic bullet in cancer: a drug that would travel straight to tumors and drop a toxic payload inside them. But despite the excitement and the promise, it took another 11 years for the next ADC, Seagen’s Adcetris, to arrive on the market. Mylotarg was withdrawn from the market in 2010 after a post-marketing trial raised toxicity concerns. It was reintroduced in 2017 after the FDA cleared it at a lower dose for a subset of leukemia patients. A few of the first-developed ADCs are listed below:

Currently, there are approximately 12 ADCs approved by the FDA, the most recent being Elahere in 2022 for ovarian cancer and Tivdak for cervical cancer in 2021. The recent reports show that several ADC drugs, including ADCETRIS by Seagen/Takeda, KADCYLA and POLIVY by Roche, TRODELVY by Gilead, and ENHERTU by Daiichi Sankyo/AstraZeneca, have been granted approval for new indications and are accelerated to seize the oncology market.

Our analysis estimates that more than 30 ADCs are in advanced clinical development, and around 100 to 150 more ADCs are in their preclinical stage of development. Moreover, over 50 distinct recognized antigens have been employed as targets in ADC. The concept of ADCs is to deliver a highly effective payload to its target utilizing the best carrier possible. ADCs are administered intravenously into the circulation to avoid mAb breakdown by stomach acid and proteolytic enzymes.3

There have been encouraging investments by Big Pharma in smaller biotech ADC companies, including major deals between Seagen and Pfizer, as well as GSK and Mersana. With the approval of newer and more effective ADCs, and with the ongoing development of next-generation ADCs consisting of improved targeting, potency, and safety profiles, the field is poised for significant growth.

The rising incidence of cancer globally is a significant driver for the market. As the number of cancer cases continues to grow, there is a growing need for more effective and targeted therapies, which ADCs can provide. ADCs offer a personalized approach to cancer treatment by targeting specific antigens expressed on cancer cells. This targeted therapy approach allows for greater efficacy and reduced toxicity compared to traditional chemotherapy, making ADCs an attractive option for both patients and healthcare providers.4

Challenges Associated With ADCs

One of the major challenges with ADCs is off-target toxicities that are a result of the cytotoxic small molecules released into the blood circulation prematurely. The risk increases depending on the toxicity profile linked to the cytotoxic small molecules. Furthermore, ADCs are also prone to aggregation, which causes structural modification that can hinder its binding ability to the antigen. ADC aggregation is an obstacle in the initial stages of the development of an ADC. Apart from this, degradation by aggregation presents a major challenge in terms of meeting the guidelines for stability testing in order to gain eligibility for registration of the medicine.

Another factor that presents a challenge is drug resistance. ADCs are still subject to resistance and thus have a limited duration of effectiveness. Resistance to ADCs has been one of the problems limiting these medications’ clinical success. ADCs’ modular nature allows for the modification of some of its components in order to create novel compounds that are able to overcome resistance. Increased expression of drug efflux pumps is one of the most common mechanisms of ADC resistance.5

The Latest ADC Developments

- In July 2023, AstraZeneca and Daiichi Sankyo’s datopotamab deruxtecan was considered to be the next big ADC program. But the TROP2-targeted drug scared investors with a report of “some” patient deaths from its first Phase 3 trial. The study itself hit its goal by showing the drug improved progression-free survival over standard chemotherapy in second-line non-small cell lung cancer.

- In May 2023, Sony Corporation and Astellas Pharma Inc. entered into a collaborative research agreement to discover a novel Antibody-Drug Conjugate (ADC) platform in oncology based on Sony's unique polymeric material, KIRAVIA ADC is expected to selectively deliver anti-cancer drugs to target cells, thereby increasing efficacy and reducing side effects caused by anti-cancer drugs attacking normal cells.

- In April 2023, Germany's BioNTech signed a deal with Chinese biotech company DualityBio to co-develop and commercialize two cancer antibody drug candidates, DB-1303 and DB-1311, as a combination therapy in solid tumors. DualityBio will retain commercial rights for mainland China, the Hong Kong Special Administrative Region, and the Macau Special Administrative Region, while BioNTech will hold commercial rights in the rest of the world.

- In January 2023, Bridge Biotherapeutics and Pinotbio signed a memorandum of understanding (MoU) to develop new therapeutic cancer candidates using antibody drug conjugates platform technology. Bridge Biotherapeutics will provide private anticancer targets, while Pinotbio will provide linkers and drugs.

- In August 2022, GSK paid $100 million in cash to Mersana Therapeutics to add a second ADC to its portfolio, which currently consists of approved multiple myeloma drug Blenrep. The deal encompasses XMT-2056, Mersana’s preclinical ADC asset aimed at treating a range of HER-2 cancers. The global agreement gives GSK an exclusive option to co-develop and commercialize XMT-2056.

Conclusion

The development of ADCs was a significant breakthrough in the field of cancer treatment. While most approved ADC therapies have targeted liquid cancers, the focus is now shifting toward solid tumors. As personalized medicine gains traction, ADCs tailored to specific cancer subtypes hold great promise in the fight against cancer.

As research and innovation continue to advance, the potential for ADCs to revolutionize cancer treatment remains unparalleled. As such, the question of whether ADCs are the answer to unmet medical needs holds tremendous hope and optimism for patients, caregivers, and the medical community alike. Embracing this cutting-edge technology, ADCs embark on a journey of progress and promise in the relentless pursuit of defeating cancer and improving patients' lives.

References:

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9834242/

- https://cancerci.biomedcentral.com/articles/10.1186/s12935-022-02679-8

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4613712/

- https://www.researchgate.net/publication/331371806_Antibody Drug_Conjugates_Possibilities_and_Challenges

- https://www.nature.com/articles/s41573-023-00709-2

About The Authors:

About The Authors:

Kriti Khandelwal is a research analyst Level-2 at DataM Intelligence, a market research and consulting firm. She has been a part of the research industry for over five years and is skilled in market research, team management, quantitative and qualitative data collection, forecasting, and providing strategic insights. She has primarily worked in the healthcare domain, including pharmaceuticals and medical devices.

Manjari Palla is the co-founder of DataM Intelligence. She has a global perspective and extensive knowledge of decisive market insights across diverse industries.

Manjari Palla is the co-founder of DataM Intelligence. She has a global perspective and extensive knowledge of decisive market insights across diverse industries.