The Landscape Of GLP-1 Receptor Agonists In Diabetes And Obesity Treatment

By Nasim Pourarian and Kamran Zamanian, Ph.D.

Glucagon-like peptide-1 (GLP-1) is an incretin secretory molecule. GLP-1 receptor agonists (GLP-1RAs) are widely used in the treatment of type 2 diabetes (T2DM) due to their attributes such as body weight loss, protection of islet β cells, promotion of islet β cell proliferation, and minimal side effects. Studies have found that GLP-1R is widely distributed on pancreatic and other tissues and has multiple biological effects, such as reducing neuroinflammation, promoting nerve growth, improving heart function, suppressing appetite, delaying gastric emptying, regulating blood lipid metabolism, and reducing fat deposition. Moreover, GLP-1RAs have neuroprotective, anti-infectious, cardiovascular protective, and metabolic regulatory effects, exhibiting good application prospects. Growing attention has been paid to the relationship between GLP-1RAs and tumorigenesis, development, and prognosis in patients with T2DM.

Advancements In GLP-1 Agonist Therapies For Diabetes And Weight Management

GLP-1 agonists and glucose-dependent insulinotropic polypeptide (GIP) agonists mimic naturally occurring incretin hormones to slow gastric emptying, increase the feeling of fullness, promote insulin secretion, and inhibit the inappropriate release of glucagon. GLP-1 agonists were initially approved for treating type 2 diabetes, with subsequent approvals for chronic weight management and reduction of the risk of major cardiovascular events in patients with established cardiovascular disease and type 2 diabetes. More recently, two dual-acting GLP-1/GIP agonists have been approved, Mounjaro (tirzepatide) for type 2 diabetes and Zepbound (tirzepatide) for chronic weight management.5,11

Figure 1: GLP-1 Timeline. Access iData Research for more.

Market Overview

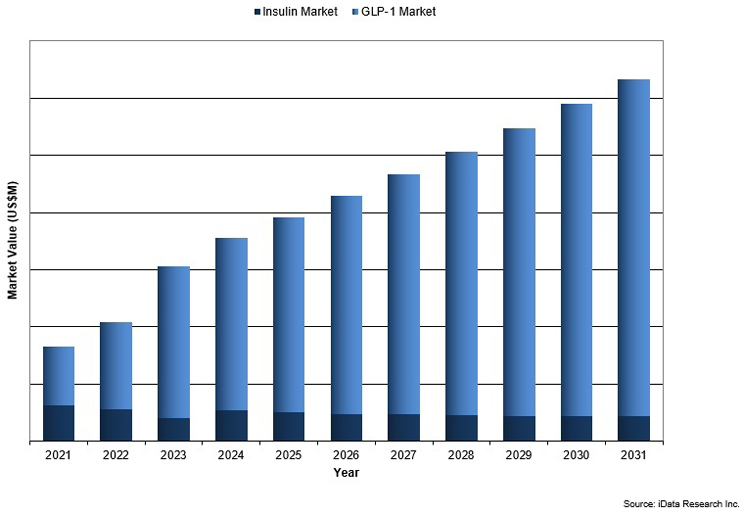

The GLP-1 receptor agonist market has grown in response to the increasing global prevalence of type 2 diabetes and obesity, alongside the rising demand for effective treatments. Medications such as semaglutide and liraglutide have been noted to provide benefits, including improved glycemic control, weight loss, and a reduction in cardiovascular risk. However, like all medications, they may be associated with certain side effects, such as gastrointestinal issues, including nausea, vomiting, diarrhea, and constipation. These side effects can persist for several days and may affect more than one in 10 patients. Additionally, there may be potential risks of pancreatitis. Leading companies such as Novo Nordisk, Eli Lilly, and Sanofi have contributed to market growth with innovative products, including once-weekly formulations to improve patient adherence. Despite challenges like high treatment costs, the market is anticipated to expand further, fueled by increasing clinical evidence, new regulatory approvals for additional indications, and the development of more affordable alternatives.5

Figure 2: Diabetes Drug Market Overview by Segment, 2021–2031. Access iData Research for more.

Market Drivers

Several factors are contributing to the rapid expansion of the GLP-1 receptor agonist market.

Rising Prevalence of Diabetes and Obesity

- The global prevalence of type 2 diabetes, including the in the U.S., is increasing, largely due to rising rates of obesity, aging populations, and sedentary lifestyles.1

- Obesity rates are also climbing. The connection between obesity and metabolic diseases such as diabetes has increased the demand for effective therapies, particularly those that address both conditions simultaneously.1,3

Efficacy in Weight Management

GLP-1 receptor agonists, such as semaglutide and liraglutide, have demonstrated significant efficacy in weight reduction. This has led to expanded use in treating obesity, not just diabetes. For instance, Wegovy’s safety and efficacy were studied in four 68-week trials. Individuals who received Wegovy lost an average of 12.4% of their initial body weight compared to individuals who received a placebo.4

Another trial enrolled adults with type 2 diabetes. In this trial, individuals who received Wegovy lost 6.2% of their initial body weight compared to those who received a placebo.4

Cardiovascular Risk Reduction

In addition to managing blood glucose levels and promoting weight loss, GLP-1 receptor agonists have been found to reduce the risk of cardiovascular events, which is a critical consideration in diabetic patients. This has led to regulatory approvals for cardiovascular indications, further driving the market growth.2

Kidney Disease Risk Reduction

In addition, the FDA has approved semaglutide (Ozempic) to slow the progression of kidney disease and reduce the risk of kidney failure, making it the most widely indicated GLP-1 drug.6 Kidney disease is common among individuals with type 2 diabetes, as high blood sugar damages kidney blood vessels. A major clinical trial with 3,500 participants showed that semaglutide reduces disease progression by 24% and lowers the risk of kidney failure and cardiovascular death by 5%. This breakthrough offers new hope for millions of patients struggling with diabetes-related kidney complications, providing a more effective treatment option to improve long-term health outcomes.

Market Limiters

Production and Supply Constraints

The increasing demand for GLP-1 receptor agonists, particularly due to their expanding indications beyond diabetes (e.g., obesity and kidney disease), puts significant pressure on manufacturing capacities.6 Supply chain limitations, high production costs, and the need for specialized facilities restrict the scalability of these drugs.

Adverse Effects and Long-Term Safety Concerns

While GLP-1 receptor agonists have shown significant benefits, their widespread use is limited by potential side effects such as gastrointestinal distress, pancreatitis risk, and concerns over long-term metabolic effects.9 There is a need for further longitudinal studies to confirm safety, which may slow adoption in broader patient populations.

Healthcare Cost and Insurance Coverage

The high cost of GLP-1 drugs poses a major limitation, especially in healthcare systems with restricted reimbursement policies. Limited insurance coverage and affordability issues create barriers to widespread patient access, particularly in lower-income populations and countries with stringent pricing regulations.5

New Product Launches and Innovations

The market for GLP-1 receptor agonists is also expanding due to continuous innovation in drug formulations and delivery methods. Newer medications with longer half-lives, such as semaglutide (Ozempic), which can be administered once weekly, have improved patient adherence and convenience, which is boosting market adoption.2

Key Players In The GLP-1 Market

Novo Nordisk

Positioning: Novo Nordisk (Novo) is the undisputed leader in the GLP-1 receptor agonist market, largely due to the success of semaglutide, which is marketed as Ozempic for diabetes and Wegovy for weight management. These medications have established Novo as the dominant player, especially considering its broad indications for both type 2 diabetes and obesity. The oral form of semaglutide, Rybelsus, further expands its reach, offering a non-injectable option, which appeals to a larger subset of patients who are hesitant about injections.

Challenges: Despite this strong market position, Novo faces significant challenges. The primary one is competition from other GLP-1 drugs, especially from Eli Lilly’s Mounjaro (tirzepatide), which has shown greater efficacy in weight loss and diabetes control. Additionally, Novo has to manage the supply chain issues that have plagued the production of Ozempic and Wegovy due to the large demand for these products. There is also the issue of price pressures from both public health systems and private insurers as the GLP-1 class continues to grow and more generic versions are introduced.

Advantage: Novo has the advantage of having the first-mover status in both the diabetes and obesity markets, with strong brand recognition. However, it must maintain its edge in clinical data and product differentiation to stay ahead of its competitors.

Eli Lilly

Positioning: Eli Lilly is a close competitor to Novo Nordisk, with its flagship GLP-1 receptor agonist Trulicity (dulaglutide) used for type 2 diabetes. Trulicity’s once-weekly dosing is a significant draw, contributing to ease of use and adherence among patients. Additionally, Eli Lilly’s tirzepatide (Mounjaro) is one of the most exciting products in the GLP-1 class, as it has demonstrated superior efficacy in clinical trials in both weight loss and glycemic control compared to semaglutide. This positions Mounjaro as a potential game changer.

Challenges: A major challenge for Eli Lilly will be to effectively differentiate Mounjaro from semaglutide. While Mounjaro has shown promising results, it is still a newer product with relatively limited market penetration compared to the more established options from Novo. Moreover, adverse effects of tirzepatide, such as gastrointestinal issues, could limit patient tolerance and broader adoption. Furthermore, Eli Lilly will have to manage its supply chain and manufacturing capacity as the demand for Mounjaro grows rapidly, especially with it being positioned as a potential blockbuster.

Advantage: Eli Lilly has the advantage of possessing a next-generation drug (tirzepatide) that has demonstrated impressive results, particularly in the obesity space. The product’s injection device technology and ease of use also offer strong patient compliance.

Sanofi

Positioning: Sanofi is a minor player in the GLP-1 market, offering SOLIQUA, a combination therapy that merges insulin glargine with lixisenatide, a GLP-1 receptor agonist. This combination is aimed at patients who are insulin-dependent and need additional glucose control. However, it has not achieved the same level of success as stand-alone GLP-1 receptor agonists like semaglutide and dulaglutide.

Challenges: The key challenge for Sanofi is competition from more established and better marketed GLP-1 drugs, particularly those from Novo Nordisk and Eli Lilly. Additionally, the combined insulin and GLP-1 mechanism of action may not have the same broad appeal in a market dominated by stand-alone GLP-1 drugs. Sanofi is also dealing with the decline in insulin sales due to newer insulin products and biosimilars, which puts pressure on its pipeline.

Advantage: While SOLIQUA has a specific patient demographic, its combination approach can be a selling point for those struggling to manage both insulin needs and blood sugar. However, Sanofi will need to prove its effectiveness in comparison to the newer, more versatile GLP-1 drugs in the market.

Conclusion

The GLP-1 receptor agonist market is poised for significant growth due to the increasing U.S. and global prevalence of type 2 diabetes and obesity, advancements in drug development, and expanding indications for weight loss and cardiovascular health. Key medications like semaglutide, liraglutide, and dulaglutide have demonstrated strong clinical results, helping them become standard treatments for diabetes management and emerging leaders in weight loss.

However, challenges such as the cost of treatment and competition from other therapies must be addressed to maintain growth and accessibility. Additionally, production and supply constraints, including high manufacturing costs and limited scalability, pose significant barriers. Potential adverse effects, such as gastrointestinal issues and long-term safety concerns, also limit widespread adoption. Furthermore, the high price of GLP-1 drugs and restricted insurance coverage create accessibility challenges, particularly in lower-income populations. As the demand for innovative, effective treatments for diabetes and obesity continues to rise, the GLP-1 market is expected to expand further, with new drug approvals and improved treatment options likely to drive continued success.

In conclusion, the GLP-1 receptor agonist market holds immense potential for addressing two of the most prevalent and interrelated global health issues: diabetes and obesity. As patient preferences shift toward effective therapies that offer more than just glucose control, GLP-1 drugs will likely remain central to diabetes care, weight management, and overall metabolic health for years to come.

References

- Abdul Basith Khan, M., Hashim, M., Kwan king, J., Devi Govender, R., Mustafa, H., & Al Kaabi, J. (2020, March). Epidemiology of Type 2 Diabetes – Global Burden of Disease and Forecasted Trends. Retrieved from PubMed Central: https://pmc.ncbi.nlm.nih.gov/articles/PMC7310804/

- Collins, L., & Costello, R. (2024, February 29). Glucagon-Like Peptide-1 Receptor Agonists. Retrieved from National Library of Medicine: https://www.ncbi.nlm.nih.gov/books/NBK551568/

- Emmerich, S., & Fryar, C. (2024, September). Obesity and Severe Obesity Prevalence in Adults: United States, August 2021–August 2023. Retrieved from cdc.gov: https://www.cdc.gov/nchs/products/databriefs/db508.htm

- FDA. (2021, Jun 04). FDA Approves New Drug Treatment for Chronic Weight Management. Retrieved from FDA: https://www.fda.gov/news-events/press-announcements/fda-approves-new-drug-treatment-chronic-weight-management-first-2014

- iData. (2025). U.S. diabetes monitoring, treatment and drug delivery market overview. Vancouver: iData Research.

- Sung, A. (2025). Ozempic FDA-Approved to Lower Kidney Disease Risk in Diabetic Patients. Retrieved from iData Research: https://idataresearch.com/ozempic-fda-approved-to-lower-kidney-disease-risk-in-diabetic-patients/

- Sung, A. (2025). Flash Glucose Monitoring Continues to Grow Despite the Presence of CGM Industry. Retrieved from iData Research: https://idataresearch.com/flash-glucose-monitoring-continues-to-grow-despite-the-presence-of-cgm-industry/

- King, J. K. (2020, March 10). Epidemiology of Type 2 Diabetes – Global Burden of Disease and Forecasted Trends. J Epidemiol Glob Health, pp. 107-111.

- Ayoub, M., Chela, H., Amin, N., Hunter, R., Anwar, J., Tahan, V., & Daglilar, E. (2025, February 1). Pancreatitis Risk Associated with GLP-1 Receptor Agonists, Considered as a Single Class, in a Comorbidity-Free Subgroup of Type 2 Diabetes Patients in the United States: A Propensity Score-Matched Analysis. Retrieved from National Library of Medicine: https://pubmed.ncbi.nlm.nih.gov/39941615/

- Niakan, K., & Schock, B. (2024, January 18). GLP-1 agonists in Medicaid: Utilization, growth and management. Retrieved from Milliman: https://www.milliman.com/en/insight/glp-1-agonists-medicaid-utilization-growth-management

- Zhao, X., Wang, M., Wen, Z., Lu, Z., & Cui, L. (2021, August 22). GLP-1 Receptor Agonists: Beyond Their Pancreatic Effects. Retrieved from frontiersin: https://www.frontiersin.org/journals/endocrinology/articles/10.3389/fendo.2021.721135/full

About The Authors:

Nasim Pourarian works as a research analyst at iData Research, where she is responsible for developing and compiling syndicated research projects focused on the medical device industry.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.