The Next Decade In Gene Therapy Innovation — 6 Critical Questions (And Answers)

By Kyle M. O’Neil and Brendan J. Wang, Back Bay Life Science Advisors

As the gene therapy field has tackled delivery vectors as described in “An Analysis Of The Gene Therapy Viral Vector Landscape,” several clinical and commercial questions lowered expectations for gene therapy sales, leading sell-side forecasts to fall more than 50% since 2018.1 However, more than $6.5 billion in 2026 projected gene therapy sales remain across Duchenne muscular dystrophy (DMD), hemophilia A/B, sickle cell disease, Fabry disease, Huntington’s disease, and Leber congenital amaurosis type 10 (LCA10) alone, putting pressure on industry-leading gene therapy companies to deliver.2 We highlight six key questions and recommendations for the future of gene therapy.

1. What Technologies Should Gene Therapy Companies Evaluate Beyond Delivery Vehicles?

Despite significant investment in adeno-associated viral (AAV) vector technologies, very few companies have looked beyond modulating the ability of AAV capsids to reach (or be re-dosed to) target organs/cells. An area for future consideration is within the AAV life cycle. Enhancing the AAV life cycle may enable improved efficacy by increasing the number of nuclei infected with AAV encoding the transgene, ultimately increasing sustained gene expression.3 Further, novel gene sequences, such as those created by Codexis’ protein engineering platform (partnered with Takeda in Fabry disease), may enhance efficacy by leading to increased transgene activity. Another approach to increasing transgene activity is highlighted in a 2021 deal between Spark/Roche and Senti Bio for synthetic promoters.4 Both increasing transgene activity and enhancing the AAV life cycle may help lower the AAV doses required for therapeutic benefit, improving safety by preventing potential adverse reactions to large amounts of AAV.

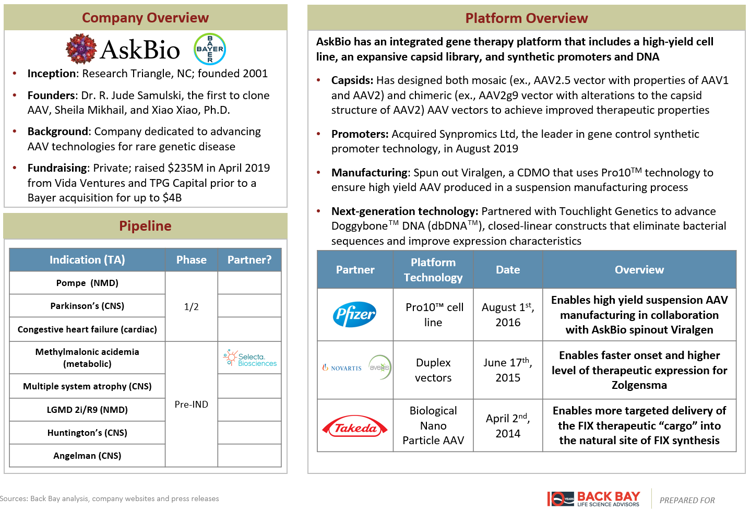

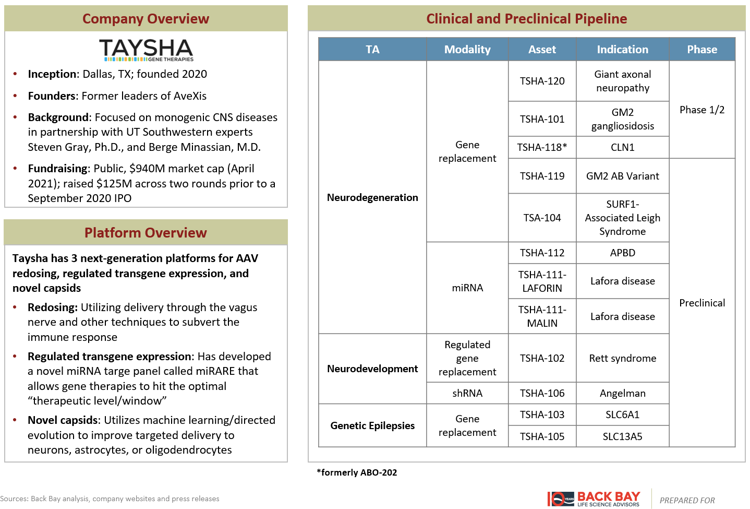

Several additional companies have developed lentiviral and AAV platforms, aiming to improve upon the gene therapy business model beyond simply an improvement in delivery. AskBio and Taysha Gene Therapies have platforms across the three components of an AAV therapeutic: novel vector development, improved gene expression, and optimized manufacturing (Figures 1, 2). Lentiviral companies such as VIVEbiotech and Vectalys have changed the lentiviral life cycle by developing non-integrating lentiviral vectors to reduce the risk of oncogenesis. Sana Biotechnology, Interius BioTherapeutics, and Umoja Biopharma have developed in vivo lentiviral vectors that remove the need for transplant and the associated white blood cell depleting chemotherapy currently required for the delivery of lentiviral gene therapies, while Ensoma is developing Engenious adenoviral vectors for the same purpose. Interius, Ensoma, and Umoja have raised ~$200M across their 2021 Series A fundraising rounds.

Figure 1: AskBio gene therapies.

Figure 2: Taysha gene therapies.

Interest in gene editing technologies such as CRISPR has spurred the need to search for larger and more flexible viral and non-viral vector technologies. With a recent Nobel Prize for CRISPR and early applications advancing toward commercialization, the interest in novel packaging technologies that can deliver all the components of CRISPR is increasing. GenEdit and ProBioGen have struck deals with CRISPR Therapeutics and Editas Medicine, respectively, to explore novel packaging technologies. If gene editing is to become a reality, packaging and delivery of large vectors with multiple components will be required, which is currently not feasible with existing technologies.

2. What Is The Future Of Rare Markets With Launched Gene Therapies?

Under the assumption that gene therapies may cure patients, we must also consider that there are a finite number of patients to be treated. Given that the risk-benefit profile of gene therapies has for now prioritized rarer debilitating diseases, the number of prevalent patients who are amenable to a disease may only support a single gene therapy manufacturer. This issue is exacerbated if there are multiple ongoing clinical trials that further remove treatable patients from the pool.

If there are a significant number of prevalent patients and multiple gene therapies are available, the eventual depletion of the prevalent patient reservoir will quickly lead to only incident patients supporting the commercial case. For some of the more common genetic diseases, such as DMD and sickle cell disease, that may affect several hundred births per year in the U.S.; such a birth incidence may support more than one gene therapy competitor. However, many diseases have much fewer incident patients (e.g., mucopolysaccharidosis IIIA/B) each year, which limits the long-term viability of a single gene therapy, let alone multiple. Further, epidemiology in these populations is often poorly understood, limiting confidence in the commercial opportunity.

Even in indications where gene therapies have been highly successful (e.g., Libmeldy in metachromatic leukodystrophy), clinical data is limited to select patient segments and gene therapy is not fully curative. In the case of Zolgensma in spinal muscular atrophy (SMA), there is clear residual unmet need. Biogen treated the first patient in the RESPOND study in January 2021, which is testing Spinraza (nusinersen) in patients already treated with Zolgensma. Given Zolgensma’s $2.1 million price tag and Spinraza’s yearly cost of approximately $375,000, this approach may be cost prohibitive.

In contrast to the promising efficacy demonstrated by Libmeldy and Zolgensma, gene-targeted therapies in DMD and Huntington’s disease have shown limited clinical benefit.5, 6 This may be because downstream pathways beyond the underlying genetic mutation are contributing to disease progression that replacing the altered gene will not fix. In these indications, scientists and investors should explore combination approaches, as they will likely be needed to halt or reverse disease progression.

3. Is There An Opportunity For Gene Therapies In Non-Orphan Markets?

Due to the limited white space (extensive competition) in rare indications, gene therapy companies are beginning to explore non-orphan market opportunities. Parkinson’s disease is one indication being explored by multiple companies. Parkinson’s affects almost 1 million U.S. patients and results in progressive neurodegeneration (primarily from the loss of dopaminergic neurons in the substantia nigra) that shortens life expectancy by five to 10 years. Notably, most gene therapy programs are aiming to restore lost motor function by replacing neurotransmitters with genetic material or promoting cell survival, rather than replacing an altered gene. Examples of clinical-stage programs include Oxford BioMedica’s/Sio Gene Therapies’ AXO-Lenti-PD, AskBio’s/Brain Neuropathy Bio’s AAV2-GDNF, Voyager Therapeutic’s VY-AADC, and MeiraGtx’s AAV-GAD. In contrast, Prevail Therapeutics (recently acquired by Eli Lilly for ~$900 million) has a clinical-stage program aiming to replace the GBA1 gene, which is altered in ~5 to 10% of Parkinson’s patients.

Other indications that have attracted gene therapy interest include Crohn’s disease and multiple sclerosis. Orchard Therapeutics is developing an ex vivo lentiviral gene therapy for NOD2-altered Crohn’s, which affects up to 200,000 patients in the U.S. and EU. Similarly, Sarepta has partnered with the University of Florida for an immune tolerizing gene therapy for multiple sclerosis, which affects 2 million U.S. patients. In these indications, differentiation from the standard of care will be critical due to existing therapies available at prices much lower than gene therapies. Without clinically significant efficacy demonstrated in large trials or savings for the healthcare system, achieving market access will be challenging for expensively priced gene therapies in non-orphan indications.

4. How Should A Gene Therapy Be Priced?

Zolgensma’s price in the U.S. has been set at $2.1 million, commensurate with the level of benefit Novartis believes it provides to patients and the healthcare system. In fact, during its market research prior to product launch, Novartis was considering prices upward of $4 to 5 million per patient, and likely tested prices above that range to understand price sensitivity across U.S. payers. While a price of $2.1 million per patient is in line with the top end of what the Institute for Clinical and Economic Review (ICER) considers reasonable based on its impact to life-years gained, that figure still represents a significant up-front payment for health plans.7

To help reduce the cost burden to payers, several different payment models have been considered, most notably outcomes-based contracts and mortgage-based models. Outcomes-based contracts would involve giving rebates to payers if patients do not meet certain predefined long-term efficacy metrics,7 whereas mortgage-based models would spread smaller, fixed payments to the manufacturer over an extended period. Both models also allow payers to avoid a scenario in which they pay fully up front and then the patient transfers to another plan with the initial plan footing the entire bill.

Novartis currently offers forms of both payment models for Zolgensma, though it is unclear what specific clinical criteria are to be met under the outcomes-based contract.8 According to UBS Equity Research, to this point, payers largely have not used either of these payment models and have instead opted to pay the full cost up front. This is likely reflective of the resources and effort required to implement these payment models and track what amounts to a small number of patients under a specific plan.9

5. What Is The Expected Commercial Lifespan For Gene Therapies?

Given the potentially curative benefit of gene therapies with a limited number of product doses to achieve long-lasting efficacy, a normal pharma sales curve is not expected. Notably, for highly anticipated products that have paradigm-shifting therapeutic potential, time to exceptionally high sales, even if not peak, can be extremely fast. In these cases, we see a “warehousing” effect wherein physicians and patients hold off on treatment in anticipation of a curative or highly effective therapy. The impact on uptake is significant.

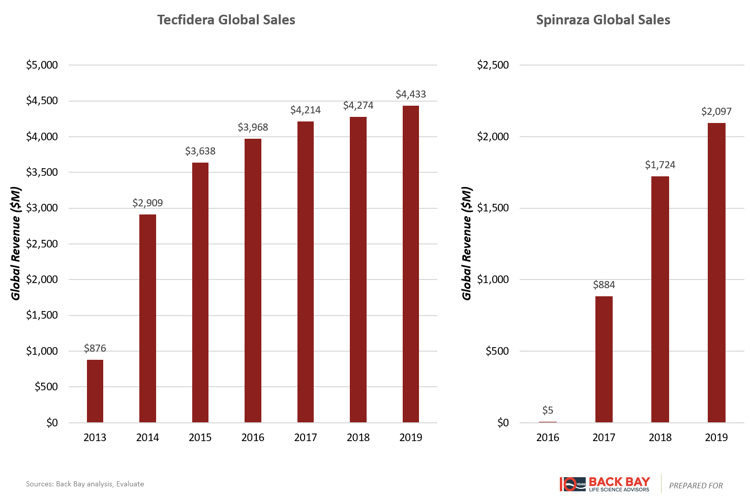

Tecfidera and Spinraza are representative chronic lifetime therapies that had rapid adoption close to time of launch due to such a warehouse effect (Figure 3). Both became blockbusters within two years of launch and are widely considered to be transformative therapies in their respective indications. While the commercial life for Spinraza still has years to play out, the story of Tecfidera has shown that such therapies can maintain high levels of sales for many years before loss of exclusivity and sales erosion are seen.

Figure 3: Highly successful chronic therapies.

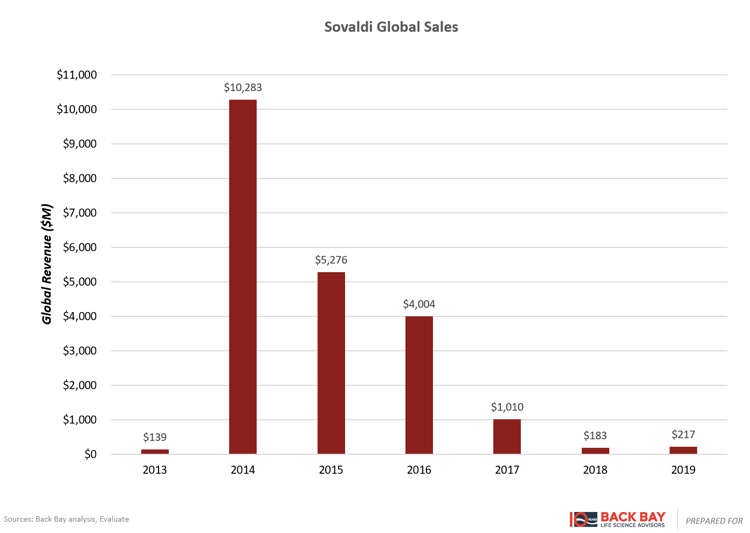

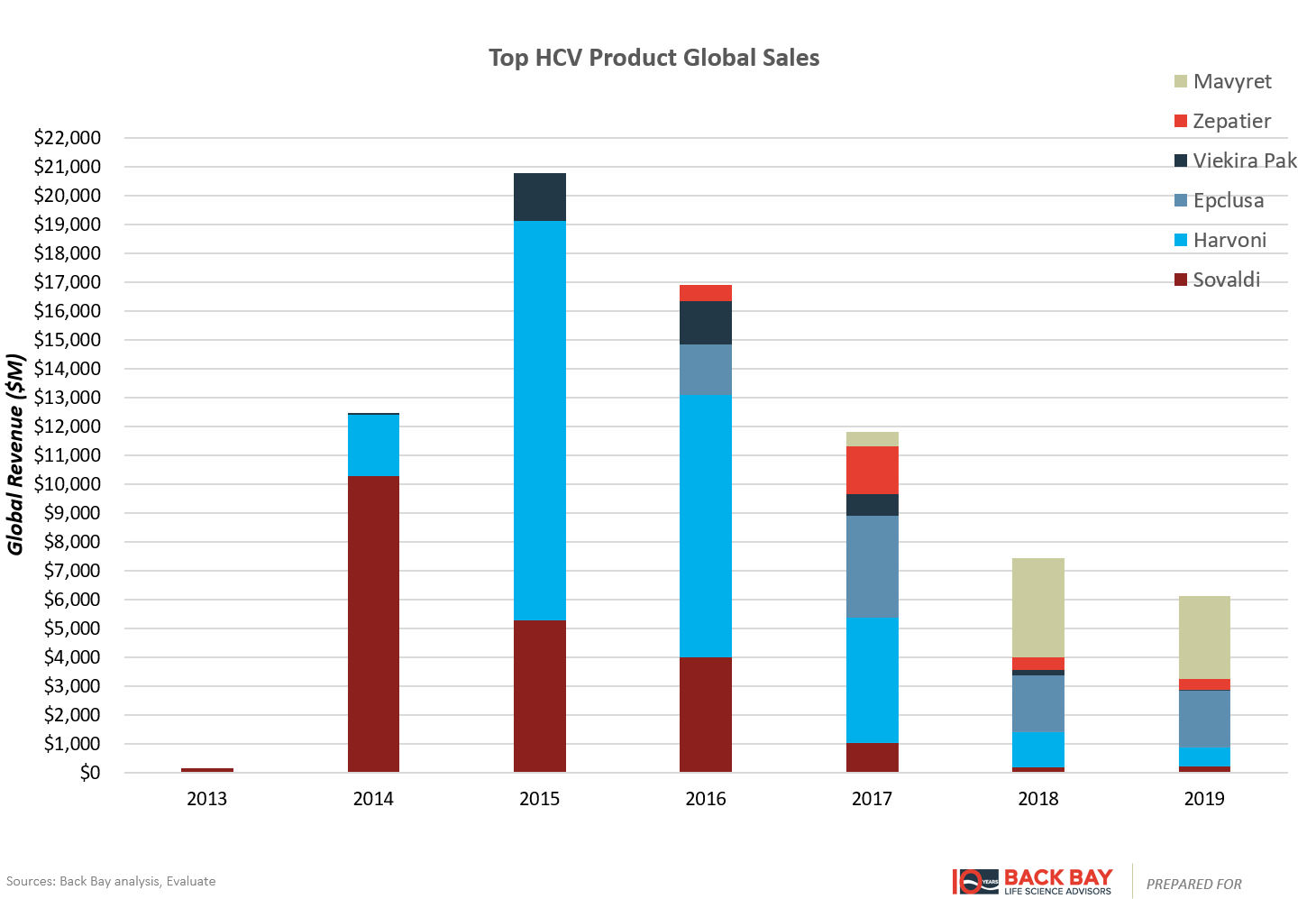

However, for products with curative potential such as Sovaldi and gene therapies, the entire product life cycle is condensed into a handful of years. Raising much controversy with a cost per course of therapy at $84,000, Sovaldi (Gilead) cured many patients of hepatitis C virus (HCV) and was rapidly adopted (Figure 4). In its first full year after launch, it captured over $10 billion in sales and then dropped precipitously within several years after the initial bolus of patients was cured. Despite several other factors at play, including additional competitors in the HCV space, follow-on fixed-dose combinations from Gilead, and aggressive contracting strategies, this rapid uptake followed by subsequent rapid decline is illustrative of the shortened commercial lifespan of curative therapies. The entire HCV market peaked within two to three years of launch and has substantially contracted in the years since (Figure 5). Ultimately, this limits the valuation of gene therapy programs in indications without large incident or prevalent patient populations, as rapid time to and at peak potentially leads to lower valuations than expected with chronically dosed products.

Figure 4: Sovaldi sales.

Figure 5: HCV market sales.

6. How Does The Commercial Lifespan Of Gene Therapies Impact A Product Portfolio?

While there are several smaller pure-play gene therapy biotechnology companies, larger companies with both existing marketed products and substantial gene therapy pipelines face a unique set of challenges. Namely, when maintaining a portfolio, the traditional drug development model of chronically dosed non-gene therapies with seven to 10 years of meaningful sales potential turns into one in which a company is likely to capture gene therapy sales within a two- to five--year window, followed by a period of lower maintenance sales from the incident population.

Well-sequenced gene therapy programs are needed to maintain relatively stable revenues across an entire portfolio and avoid cannibalization of chronic therapies. Further, resources must be allocated to consider if chronic therapies become obsolete once gene therapies launch or if they are likely to be used in combination. It is likely that chronic and gene therapies will coexist in indications and investments will need to be made in both to fully “win” any given indication. However, messaging this approach while still pitching the “curative” potential of gene therapy to both stakeholders and investors requires careful planning.

Conclusion

With new gene therapy delivery technologies and payment models approaching proof of concept following large investments, there are significant implications for the viability of the gene therapy business model. Key questions remain around the therapeutic benefit and value offered by gene therapies, with a “cure” unlikely to be achieved for most indications due to the challenges of complex biology. Nonetheless, multiple paradigm-shifting blockbuster gene therapies are likely to reach market over the next decade. With a multitude of companies large and small hoping to commercialize these winners, finding white space (use cases) in larger indications and technologies to control transgene expression and the viral life cycle may be crucial for differentiation. Assuming the science can meet these critical challenges, a series of commercial questions and considerations must equally be met to ensure a viable business. With most of Big Pharma already invested in gene therapy technologies, the clinical and commercial potential of gene therapy is clear. If the value proposition of gene therapies is realized widely across more diseases, these investments will pay off and usher in a new era of genomic medicine, transforming patient care.

References

- https://www.evaluate.com/vantage/articles/news/snippets/uniqure-tries-restore-gene-therapy-calm

- Evaluate

- Hum Mol Genet. 2019 Oct 1;28(R1):R3-R1

- https://www.globenewswire.com/news-release/2021/04/13/2209120/0/en/Senti-Bio-Enters-Collaboration-with-Spark-Therapeutics-to-Develop-Next-Generation-Precision-Gene-Therapies.html

- https://www.businesswire.com/news/home/20210322005754/en/Genentech-Provides-Update-on-Tominersen-Program-in-Manifest-Huntingtons-Disease

- https://www.globenewswire.com/news-release/2021/01/07/2155237/0/en/Sarepta-Therapeutics-Announces-Top-line-Results-for-Part-1-of-Study-102-Evaluating-SRP-9001-its-Investigational-Gene-Therapy-for-the-Treatment-of-Duchenne-Muscular-Dystrophy.html

- https://icer-review.org/wp-content/uploads/2018/07/ICER_SMA_Final_Evidence_Report_052419.pdf

- https://www.novartis.com/news/media-releases/avexis-announces-innovative-zolgensma-gene-therapy-access-programs-us-payers-and-families

- “Future of Gene Therapy I: Scoping therapeutic challenges and demystifying manufacturing.” UBS Global Research, March 9, 2020

About The Authors:

Kyle M. O’Neil is a consultant at Back Bay Life Science Advisors, where he supports biotech, pharmaceutical, and medical device companies across an array of therapeutic areas. He is passionate about entrepreneurship, science, and the application of technology to medicine and frequently supports clients developing novel therapeutics. Contact him at info@bblsa.com or on LinkedIn.

Kyle M. O’Neil is a consultant at Back Bay Life Science Advisors, where he supports biotech, pharmaceutical, and medical device companies across an array of therapeutic areas. He is passionate about entrepreneurship, science, and the application of technology to medicine and frequently supports clients developing novel therapeutics. Contact him at info@bblsa.com or on LinkedIn.

Brendan J. Wang is an engagement manager at Back Bay Life Science Advisors. He supports projects across a wide range of therapeutic areas, from rare and orphan disease indications to novel oncology and immuno-oncology therapies. He frequently supports clients on commercial opportunity assessments for novel therapeutics and prioritization of indications and assets for further development. Contact him at info@bblsa.com or on LinkedIn.

Brendan J. Wang is an engagement manager at Back Bay Life Science Advisors. He supports projects across a wide range of therapeutic areas, from rare and orphan disease indications to novel oncology and immuno-oncology therapies. He frequently supports clients on commercial opportunity assessments for novel therapeutics and prioritization of indications and assets for further development. Contact him at info@bblsa.com or on LinkedIn.