100% U.S. Drug Tariffs: Implications For Pharma And Outsourcing

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

On October 1, 2025, the U.S. government imposed a 100% tariff on imported branded or patented pharmaceuticals, unless companies are actively building facilities in the U.S. Under a mid-2025 trade deal, European Union and Japanese–sourced products will instead face a tariff capped at ~15%, while the U.K. and Switzerland remain fully exposed. Generic medicines are exempt1,2,3,7.

This policy is more than a price shock. It introduces structural disruption across the drug development life cycle, affecting global supply chains, multinational pharma firms, and critical partners such as CROs, CDMOs, and central labs.

Impact Across The Drug Development And Manufacturing Value Chain

The following life cycle analysis is derived from procurement-focused interpretation of U.S. tariff announcements, trade data, and company disclosures.

1. Research & Early Development

- Risk: Branded reagents and assay kits imported for research may face tariffs.

- Procurement Response: Secure long-term contracts with origin declarations; prioritize U.S. or EU-based suppliers (≤15% tariff).

2. Preclinical & Translational Research

- Risk: Comparator drugs for toxicology studies face tariffs (100% from Switzerland, the U.K., and Singapore; 15% from EU). Analytical reagents are also exposed.

- Procurement Response: Qualify multiple comparator suppliers; ensure CRO stockpiles; add tariff-protection clauses.

3. Clinical Development (Phases 1-3)

- Risk: U.S. trials depend on imported comparator drugs and investigational materials. Tariffs raise these costs, inflating trial budgets and delaying starts. Higher drug import prices and customs bottlenecks strain site funding and slow patient recruitment.

- Procurement Response: Map products by origin and finishing site; shift packaging and release to U.S.; reserve domestic logistics capacity.

4. Regulatory, Safety, & Market Access

- Risk: Relocating finishing or packaging to the U.S. requires new chemistry, manufacturing, and controls (CMC) filings. Post-approval patient-support programs may also face cost increases.

- Procurement Response: Negotiate bundled regulatory services with CDMOs, budget for additional compliance costs, and require vendors to use tariff-protected supply routes.

5. Drug Substance & Formulation

- Risk: Most APIs are off-patent and exempt, but branded intermediates and biologics are tariff-sensitive. Biosimilars remain exempt, creating competitive substitution opportunities.

- Procurement Response: Confirm patent status of inputs; diversify sourcing; push biologics finishing into U.S. sites; expand biosimilar procurement.

6. Drug Product & Packaging

- Risk: High-value injectables, sterile products, and imported packaging components are tariff-exposed. U.S. fill/finish and packaging capacity will be under pressure.

- Procurement Response: Secure U.S. parenteral filling and lyophilization slots; move secondary packaging into U.S.; favor suppliers with local capacity.

7. Advanced Therapies & Components

- Risk: Proprietary viral vectors, single-use technologies, and purification resins are often imported and patented, making them high-risk.

- Procurement Response: Lock in long-term agreements with tariff clauses; dual-source consumables; demand transparency from suppliers on patent and origin status.

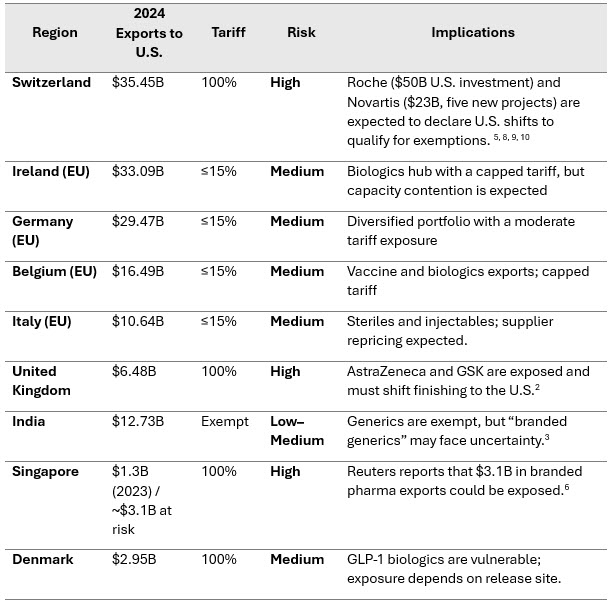

Regional Exposure And Trade Dynamics

The U.S. imported $212.67 billion in pharmaceuticals in 20244. Exposure varies significantly across regions:

Table 1 - Regional Pharma Export Risk Profile

Sources: UN Comtrade (HS-30 pharmaceutical trade data, 2024)4 and Reuters.6

Strategic Procurement Priorities

Full Value Chain Mapping: Build SKU-level mapping of all imports across sponsors, CROs, CDMOs, and central labs, capturing country of origin, branded/generic status, and finishing site.

Why it matters: Tariffs are applied based on very specific classifications. Without visibility, high-risk SKUs from Switzerland and the U.K. could slip into trials or supply chains unnoticed.

Supplier Declarations: Require formal attestations from CROs, CDMOs, and lab partners confirming exemption eligibility, branded vs. generic classification, and packaging/release locations.

Why it matters: Large firms may qualify for exemptions, but only at the product level. Written proof reduces the risk of hidden costs at customs.

Secure Capacity in U.S. and EU (Cap-Protected) Facilities: Lock in slots for fill/finish, packaging, release testing, and central labs in both U.S. sites and EU countries benefiting from the 15% tariff cap.

Why it matters: With multiple multinationals shifting production, domestic CDMO and packaging capacity will tighten within 12 to 18 months.

Tariff-Proof Contracts: Insert tariff trigger clauses into contracts with CROs, CDMOs, and central labs to cap pass-through costs and allow rerouting from high-tariff origins (e.g., Switzerland) to lower-tariff regions (e.g., Ireland).

Why it matters: Without such provisions, suppliers are likely to push full tariff burdens onto sponsors.

Comparator and Critical Material Governance: Centralize sourcing of comparators, diagnostic kits, and trial-critical materials to reduce fragmented exposure across CROs and projects.

Why it matters: Comparator drugs often represent a disproportionate share of trial budgets and are among the most tariff-exposed inputs.

Scenario Budgeting: Stress-test financials against three cases - 0% tariffs (U.S./exempt products), 15% (EU and Japan)7, and 100% (Switzerland, the U.K., and Singapore) - plus a “branded generics” case until final rules are published.

Why it matters: Portfolio-level planning requires anticipating multiple outcomes to prevent mid-trial or launch budget shocks.

Supplier Diversification: Rebalance the supplier base to reduce reliance on high-tariff countries. Push CROs and CDMOs to dual-source critical materials such as biologics components and single-use technologies.

Why it matters: Spreading demand across EU (cap-protected) and exempt regions such as India (generics) mitigates concentration risks.

Cross-Functional Tariff Task Forces: Create governance teams that link procurement, clinical operations, regulatory, finance, and legal.

Why it matters: Tariff-driven changes (e.g., shifting finishing sites) often require regulatory filings and trial design updates; coordinated decision-making avoids delays.

Conclusion

The 100% tariff policy marks a turning point for global pharma supply chains. Big Pharma must secure U.S. and EU capacity, enforce transparency, and adjust finishing strategies to safeguard launches. At the same time, CROs, CDMOs, central labs, and other outsourced partners will be pulled into the ripple effects of tariff-driven changes. This analysis is derived from U.S. tariff announcements, global trade data, and company disclosures.

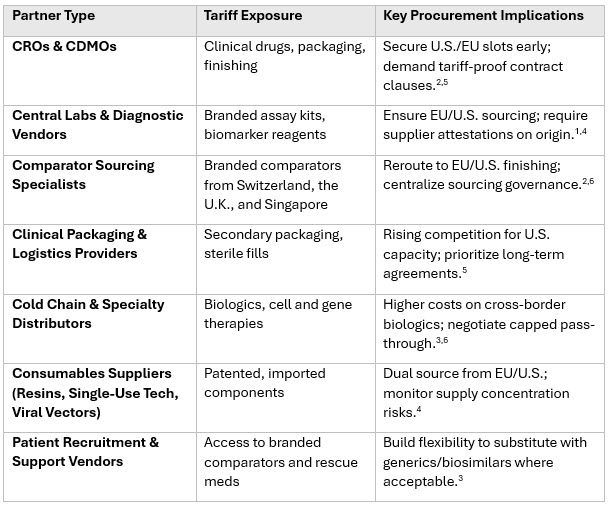

Table 2 - Impact on Outsourced Partners

By acting quickly on mapping, supplier declarations, and diversification across this extended network, the industry can mitigate tariff shocks, protect clinical trial timelines, and reinforce launch readiness — turning a compliance challenge into a resilience advantage.

References:

- New York Times, “Trump Tariffs Could Raise Drug Prices, Spur Manufacturing Moves,” Sep. 26, 2025. Available: https://www.nytimes.com/2025/09/26/health/trump-tariffs-drug-prices-manufacturing.html

- Reuters, “Britain would face 100% tariff on pharmaceuticals under latest Trump plan,” Sep. 26, 2025. Available: https://www.reuters.com/business/britain-would-face-100-tariff-pharmaceuticals-under-latest-trump-plan-sources-2025-09-26/

- The Hindu, “Donald Trump’s drug tariff spares generics but India braces for fallout,” Sep. 27, 2025. Available: https://www.thehindu.com/news/international/donald-trumps-drug-tariff-spares-generics-but-india-braces-for-fallout/article70096294.ece

- UN Comtrade, “International Trade Statistics Database: U.S. Imports of Pharmaceutical Products (HS-30), by partner country, 2024.”

- Reuters, “Roche, Novartis underline U.S. plans after Trump pharma tariff announcement,” Sep. 26, 2025. Available: https://www.reuters.com/business/healthcare-pharmaceuticals/roche-points-us-plans-after-trump-pharma-tariff-announcement-2025-09-26/

- Reuters, “Singapore pharma firms seek clarity on U.S. tariff exemption, Deputy PM says,” Sep. 27, 2025. Available: https://www.reuters.com/business/healthcare-pharmaceuticals/singapore-pharma-firms-seek-clarity-us-tariff-exemption-deputy-pm-says-2025-09-27/

- Financial Times, “EU and Japan secure tariff cap deal with U.S. on branded drugs,” Sep. 2025. Available: https://www.ft.com/content/62e92784-1811-4a26-b8a3-1e48ec04f787

- CNBC-TV18, “Switzerland’s Roche flags U.S. plans after Trump pharma tariff announcement,” Sep. 26, 2025.Available: https://www.cnbctv18.com/world/switzerlands-roche-flags-us-plans-after-trump-pharma-tariff-announcement-19692194.htm

- BioPharma Dive, “Roche to spend $50B in U.S. over next decade to expand manufacturing footprint,” Sep. 2025. Available: https://www.biopharmadive.com/news/roche-50-billion-us-drug-diagnostics-manufacturing/745973/

- Novartis Press Release, “Novartis announces $23B U.S. expansion across five new facilities,” Sep. 2025. Available: https://www.novartis.com/us-en/news/media-releases/novartis-plans-expand-its-us-based-manufacturing-and-rd-footprint-total-investment-23b-over-next-5-years

About The Author:

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.