Warner-Pfizer Marriage Made in Heaven, Says Datamonitor

By Howard Miller, Datamonitor

According to pharmaceutical industry analyst Datamonitor, it would be unwise for Warner-Lambert to link up with American Home Products (AHP) when Pfizer has so much more to offer. Pfizer's forecast strong revenue growth complements that of Warner-Lambert, while the combined company will generate significant cost savings from portfolio synergies.

Revenue Growth

Geographic Strategy

Portfolio Synergies

Revenue Growth (Back to Top)

American Home Products revenues declined by 5.2% in 1998 to $13.5 billion, and Datamonitor forecasts they will continue to decline in 1999. However, Pfizer's revenues increased by 18.1% in 1998 to $12.7 billion and are forecast to continue their strong growth in 1999. With Warner-Lambert's 1998 revenue growth of 24.9% to $10.2 billion in 1998 and strong growth forecast for 1999, the combination of Pfizer and Warner-Lambert would create the strongest and one of the fastest growing pharmaceutical companies in the world, dwarfing all competitors.

Geographic Strategy (Back to Top)

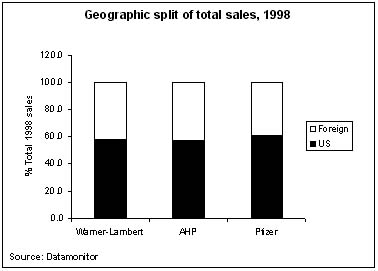

Warner-Lambert has stated its desire to expand globally, reducing its dependence on its domestic market, the U.S., which accounted for 57.6% of the company's total sales in 1998. Neither of the potential mergers will offer Warner-Lambert this opportunity.

Like Warner-Lambert, AHP has a strong focus on the U.S. market, although for a company of its size, with total sales of $13,463m in 1998, its global presence is weak. In 1998, sales in foreign markets only accounted for 33.9% of AHP's total sales. AHP has stated its desire to increase its global expansion, even attempting to merge with SmithKline Beecham (SB) in 1998, in an effort to increase its global presence. The failure of the merger left AHP in stasis. Unlike with SB, its merger with Warner-Lambert would not provide it with the global coverage that it seeks, although would provide it with an ethical portfolio that could drive future global expansion, in particular as a result of global sales of Lipitor.

Pfizer's interest in Warner-Lambert is not driven by the company's desire to expand globally, as Pfizer's dependence on the U.S. is greater than that of Warner-Lambert or AHP. In 1998, 60.9% of Pfizer's total sales were generated in the U.S. Despite this, the acquisition of Warner-Lambert's ethical portfolio would help to drive Pfizer's global expansion program, building upon its co-marketing agreement for Lipitor.

Portfolio Synergies (Back to Top)

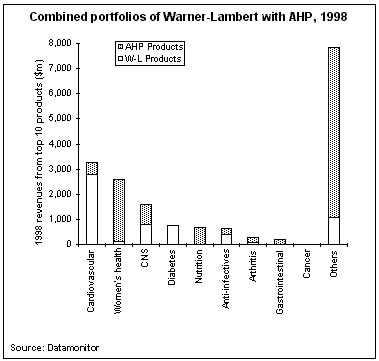

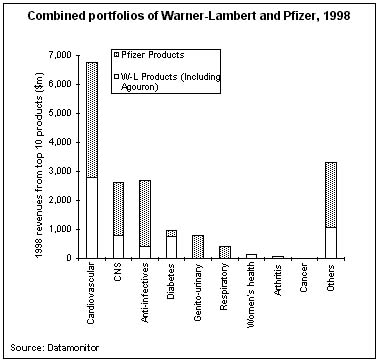

In terms of portfolio fit, Warner-Lambert would benefit most from choosing Pfizer over AHP. Although Warner-Lambert's product portfolio will generate some synergies with either company, the following diagram illustrates its close match with Pfizer. Not only is Pfizer Warner-Lambert's marketing partner for the double blockbuster Lipitor, but the two companies both have strong cardiovascular portfolios, which will create synergies between their sales and R&D infrastructures.

By comparison, AHP's strongest therapy area is women's health, in which Warner-Lambert has comparatively little expertise. Pfizer and Warner-Lambert also complement each other in their clinical R&D pipelines, in which both companies are strong in CNS, cardiovascular and cancer products, while AHP's R&D focus lies in cardiovascular, women's health, and vaccines.

For more information: Elisabeth Freeman, Global Product Manager, Datamonitor, 1 Park Ave., 14th Floor, New York, NY 10016-5802. Tel: 212 686 7400, ext. 165. Fax: 212 686 2626.