What Is Contributing To The API Shortage?

By Anna Levchuk and Molly Bowman, Clarivate

No, you can’t have your cake and eat it, too. In this case, your “cake” is a 6-cents-worth generic pill in your medicine cabinet.

Governments of developed countries have sounded the alarm on the precarious competitive situation with generic drug manufacturing for several years now. At the same time, they cling to the illusion that it is possible to provide low-cost drugs and at the same time keep polluting industries beyond their borders.

Yet, things have hardly changed for the better in the past three years. To illustrate:

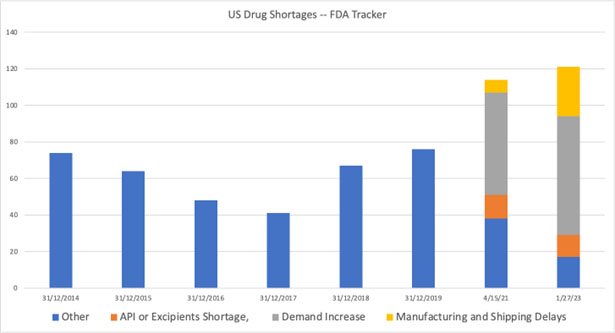

- In 2014, FDA listed 71 medicines on its shortages list; as of the time of this writing, the number reached 121, representing a 70% increase:

Source: FDA, Bain & Co. analysis (2021), Clarivate plc analysis (2023)

- Interestingly, it is usually the oldest, widely used small molecule drugs that are most susceptible to shortages. The shortage of these “simple” APIs underscores the precarious supply of generics, which accounted for 90% of all prescriptions in the U.S. by volume in 2021.

- To complicate the situation further, Clarivate’s proprietary analysis shows that 56% of all API manufacturers are located in China, 20 % in India, 7% in the U.S., and 6% in Europe. These numbers become even more astounding if we take into account that India imports nearly 70% of its APIs from China.

How did our supply chain become so vulnerable and what can we do to strengthen it?

The answer, as it often is, lies in incentive structures. Developed economies have to admit to nearsightedness and the short-term orientation of their policies, which led to the relentless pursuit of the cheapest options on the market. This was coupled with a desire to demonstrate adherence to environmentally sustainable development by shifting the problem offshore, instead of introducing more sustainable manufacturing policies onshore. But of course, eco-friendly drug manufacturing also means higher prices, which goes against the first priority of procuring the cheapest drugs on the market.

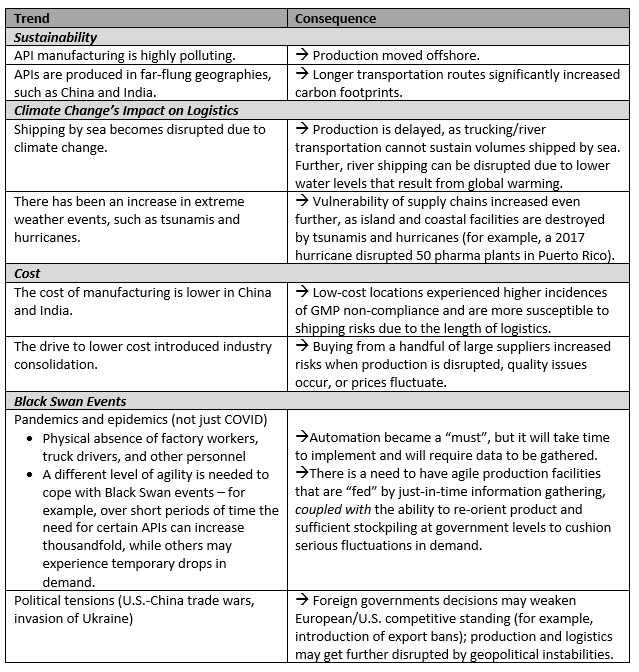

Digging a bit deeper, we can identify the following trends and their impacts on the pharmaceutical supply chain, its cost, volumes, and overall industry sustainability:

A quick scan of the industry news makes it clear that geographic concentration of production is a troubling reality, but not, in any way, the cause of current issues with Western supply chains.

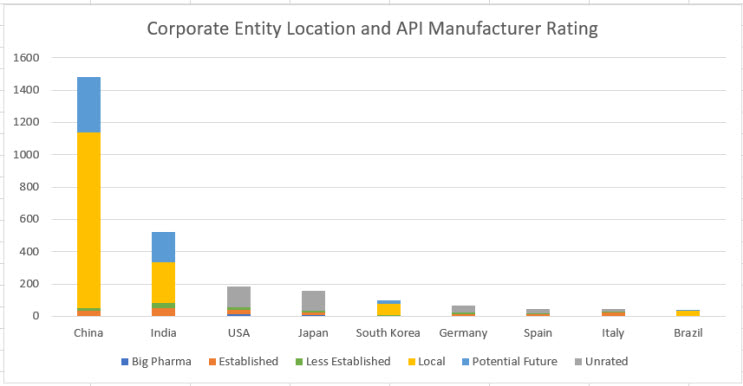

Clarivate’s detailed analysis of 3,000+ API manufacturers illustrates regional nuances and allows us to speculate about regional competitive dynamics, while confirming the shift of the API center of gravity to China:

Source: Clarivate plc analysis (2022)

Corporate API Rating is a proprietary Cortellis Generics Intelligence analytic that indicates how capable the corporate group is of supplying bulk ingredients to regulated markets. The rating is neither product nor site specific and is not a comment on the quality of a supplier's material.

- Established: companies with years of experience supplying active ingredients to a regulated market.

- Less Established: companies that have less of a track record in supplying to regulated markets, either in terms of years of history or number of products supplied. Still considered as capable of supplying regulated markets.

- Potential Future: interest in supplying regulated markets, but with limited or no known performance.

- Local: supplying only to their local and other less-regulated markets; do not currently have the capability of passing inspections by regulatory bodies like the U.S. FDA.

- Unrated: companies for which Cortellis Generics Intelligence has not assigned a rating.

- Big Pharma: innovative companies with at least $1.0B in annual R&D expenditures.

The largest category is the “local” supplier type based in China – this category alone accounts for 41% of all API manufacturers. While China, undoubtedly, pursues its own strategic goals with development of its API industry, it can only do it as a result of Western desire to acquire the lowest cost drugs while keeping a polluting industry as far away from home as possible.

Therefore, the root cause of the present supply chain troubles is a misaligned set of incentives at home. Today, we are seeing recognition of this fact by the U.S., European, and Indian governments. Each has researched the issue, provided a set of strategic recommendations, and (in some cases) started implementing those. While it would be impossible to cover all the developments, it is worth noting that France has a stake in EuroAPI, the second largest API manufacturer in Europe, and it was rumored that the Swiss government was going to bid for Sandoz, Novartis’ generic unit if and when it goes up for sale. In the U.S., President Biden’s administration included the issue of API availability in its Executive Order on America’s Supply Chains, and has since allocated $2 billion for the development of API manufacturing. The recommendations produced under this initiative emphasize the following:

- boost local production

- build emergency capacity

- promote international cooperation and partner with allies.

By all accounts, the recommendations and details behind them are excellent (you can read the report here). Currently, supply shortages are managed by the FDA from a reactive standpoint (i.e., shortages are reported late, very few details are provided as to why they occur, and it takes a lot of time and manpower to correct them). The report aims to eradicate the root cause of the issue, and, once the changes are implemented, they should change the situation dramatically. Only one question remains: when will this happen?

The answer is deceptively simple: when we accept that we cannot have extra-low-cost pills and an absence of pollution while enjoying the benefits of reliable and agile drug supplies.

About The Authors:

Anna Levchuk is vice president of product at Clarivate. Molly Bowman is director of generics content at Clarivate.