Antibody-Drug Conjugates: Increasing Investment In R&D And Partnership

By Matthew Pillar, Editor, Bioprocess Online

You might say Joe Daccache, takes more than a passing interest in ADCs (Antibody-Drug Conjugates). He studies ADCs and the companies who make them like Tom Brady studies game film. He tracks and categorizes the ADC market in near real-time, to the point that, like Brady, he sees the next moves the space will make before the snap, maybe before the play is even called. That intelligence is gleaned via DeciBio’s internal precision medicine tracker, a platform dubbed TheraTrack, where Daccache meticulously chronicles the R&D, clinical, business, and regulatory activity of ADC developers large and small.

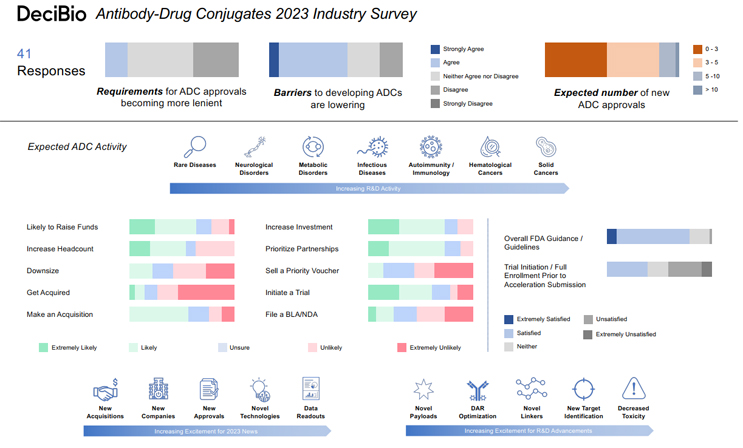

Recently, Joe gave Bioprocess Online a behind-the-scenes tour of the data aggregated in DeciBio’s new Antibody-Drug Conjugates 2023 Industry Survey. The report pulls together responses from executive at more than 40 companies in the ADC development space, who are experts in DeciBio’s expert network called Dexter, including the likes of ADC Therapeutics, miRecule, Mersana Therapeutics, Eisai, Antikor biopharma, Sanofi, AstraZeneca, Pfizer, Gilead Sciences, Astellas, GSK, WuXi AppTec, Exelixis and Genentech. Its findings underscore why Joe is enthusiastic about the modality.

Highlights from DeciBio’s Antibody-Drug Conjugates 2023 Industry Survey point to renewed enthusiasm among antibody-drug conjugate developers.

Though there was some cautious response captured in this year’s survey, it indicates that 2023 is shaping up to be an overall positive year for the advance of ADC technology and investment. Here are some of the bright spots that confirm Joe's and DeciBio’s enthusiasm:

- Regulatory Optimism. Nearly 70% of respondents indicated satisfaction with the current FDA guidance and guidelines regarding development and approval of ADCs, while 20% were neutral. That sponsors and regulators are largely on the same page as far as the path to approval goes is indicative of a maturing market. By comparison, DeciBio’s cell and gene therapy survey, run by Carl Schoellhammer, a Principal with the firm, revealed that just 63% of Cell and Gene execs are only “somewhat satisfied” with FDA guidance and guidelines regarding the development of their CGT modalities. A full quarter expressed neutrality and more than 12% said they were dissatisfied.

- R&D Advances. More than 63% of survey respondents said it’s somewhat-to-extremely likely they’ll prioritize the development of ADCs and/or divert more resources toward ADC R&D in 2023. 55% anticipate that most of their R&D work will focus on solid cancers, followed by hematological cancers (29%). 35% ranked “new target identification” as the advance in ADC R&D they’re most looking forward to, topped only by “decreased toxicity” (40%). That question asked respondents to rank what they’re most looking forward to from five choices. While new target identification and decreased toxicity were most often the top picks, new payloads, novel linkers/linker technology, and DAR (Drug-to-Antibody ratio) optimization earned the highest mean responses at 3.55, 3.48, and 3.40, respectively.

- Capital, M&A Market, Partnership Movement. More ADC developers anticipate a bounce back in valuations and funding (30%) than further devaluation and funding restraints (21%) this year. The cell and gene execs DeciBio surveyed aren’t so bullish. 30% of them expect devaluation and funding constraints, compared to 23% who anticipate a valuation/funding bounce back, but they do believe private companies will be able to raise new financing rounds.

Competition for the funding ADC developers hope to earn should be stout, as 63% of ADC developers indicate they’ll be actively seeking funds in 2023. Nearly 34% anticipate an uptick in M&A activity in the space, but while 56% said they’re somewhat likely to make an acquisition related to ADCs this year, only about 15% they’re likely to be the acquired. In fact, more than three-quarters of respondents said it’s somewhat-to-extremely unlikely they’ll be acquired. On the whole, those stats point to a seller’s market, despite the developer’s intentions. But, the survey indicates an industry that’s perhaps more open to establishing partnerships for asset development than outright acquisitions, with nearly three-quarters of respondents saying they’re somewhat-to-extremely likely to invest in partnerships.

As noted, however, the survey also revealed a few areas where respondent optimism was a bit more cautious. These are their collective thoughts on what could hold the ADC space back.

- Regulatory Stringency. While nearly half of respondents said they anticipate the requirements for ADC approvals to remain the same in the coming year, more sponsors expect those requirements to become “somewhat more stringent” than “somewhat more lenient.” Those expecting more stringent requirements (34%) outnumbered the latter 2:1. There’s also some concern about the FDA’s requirement of initiation/full enrollment of confirmatory trials prior to accelerated approval submission. Slightly more respondents (41%) said they were “somewhat unsatisfied" to “not at all satisfied” with that requirement than those indicating they’re satisfied (39%).

- Workforce Stagnation. While more than half of survey respondents said they’re at least somewhat likely to increase headcount in 2023, nearly 37% said it’s unlikely, and 22% indicated that they may, in fact, downsize.

- More Clinical Than Commercial. More than 60% of survey respondents said they’re likely to initiate at least one ADC clinical trial this year, but more than half said they’re unlikely to file at least one BLA/NDA with the FDA for an ADC asset, and 22% were unsure. That aligns with the 56% who indicated that they’re unlikely to file for at least one accelerated approval this year, and the identical number who said they’re not likely to sell a priority review voucher in 2023. The bulk of respondents anticipate between 0 and 3 ADC approvals this year (46%), about 39% expect 3-5 approvals, 12% say we’ll see between 5 and 10, and one optimistic soul suggests more than 10 ADCs will hit the market in 2023.

Overall, sentiment in the ADC market is positive. While finance, regulatory, and R&D constraints all have the capacity to slow the pace of progress, nearly 59% of respondents to DeciBio’s Antibody-Drug Conjugates 2023 Industry Survey said the barriers to developing ADCs are lowering. That bodes well for Dr. Joe Daccache, who keeps himself busy monitoring their progress.