Evaluating the impact of novel drug delivery systems - Part 1

By F. Kermani and G. Findlay

CMR International

Table of Contents

Introduction

Novel molecules in development

The outcome of alliances

Managing a collaboration

Guaranteeing returns on R&D

Introduction

Novel drug delivery technologies are now an essential tool for many pharmaceutical and biotech companies. Incorporating drugs into controlled delivery systems can add to the performance and acceptability of drugs, either by increasing efficacy, improving safety, or improving patient compliance.

As a strategic tool for expanding markets and indications, extending product lifecycles and generating opportunities, drug delivery systems are expected to make a significant contribution to global pharmaceutical sales. This is illustrated by the fact that about 13% of the current global pharmaceutical market is accounted for by sales of products incorporating a drug delivery system (1). Some analysts predict that the drug delivery industry will grow at a double-digit rate over the next five years. This has led to the growth of several hundred companies competing to supply drug delivery technologies to pharmaceutical companies.

To gain an insight into the current status of novel drug delivery technologies, parallel surveys of drug delivery and pharmaceutical companies were carried out. More than 60 companies participated in the surveys, including nine pharmaceutical companies that spent in excess of US$1 billion in 1999 (1, 2). These findings set the scene for a closed Workshop held in April 2000 which brought together the participants of the drug delivery and pharmaceutical industry surveys to discuss how they could co-operate more effectively in joint projects, share their experiences and to develop proactive approaches to applying drug delivery systems. The participants discussed the following issues: the novel drug delivery technologies available, business drivers for the drug delivery industry, fostering innovation in research and the management of a partnership. The viewpoints and recommendations of the Workshop participants in conjunction with the findings of the parallel surveys are discussed below.

Novel molecules in development

Pharmaceutical companies are now having to deal with more potent, more selective and more complex molecules than they have had in the past. This situation is likely to continue in the future as advances in biotechnology have led to a large increase in the number of macromolecule drugs over the last several years. Due to their large size and complex biopharmaceutical properties, macromolecules typically have been delivered by injection but other routes of administration are being developed by drug delivery companies. The novelty of these molecules being delivered by the pharmaceutical industry, as a result of new discovery platform technologies, is likely to be a driver of the use of drug delivery systems over the next ten years.

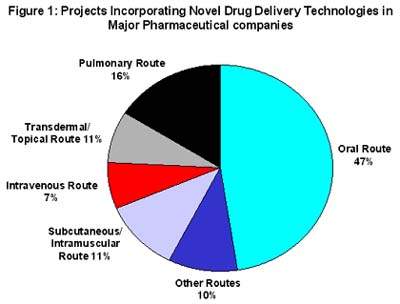

The oral route of delivery remains the preferred option of the consumer, and hence the pharmaceutical industry. It is estimated that 15% of pharmaceutical company R&D budgets in 2001 will be spent on projects incorporating a drug delivery system with nearly 50% of these projects being centred on delivering active substances via the oral route (1). However, the drug delivery technologies on offer now promise more radical solutions. Drug delivery companies have developed or are developing multiple technology platforms, including controlled release, liposomal delivery, intranasal delivery, pulmonary delivery, taste-masking, and transdermal delivery delivery systems.

The outcome of alliances

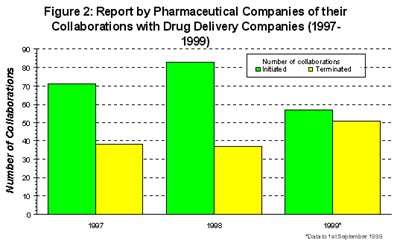

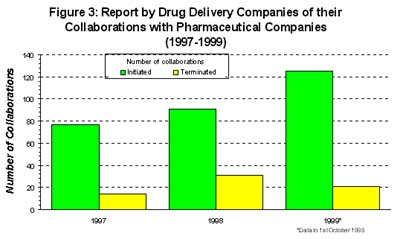

In spite of the high profile deals being made between the pharmaceutical companies and drug delivery companies, the expectations of both sets of companies regarding collaborations are not well aligned (1, 2). Over 210 collaborations with drug delivery companies were initiated by pharmaceutical companies in the period 1997 to 1999, suggesting that the drug delivery industry is thriving from new deals (1). However, examining the outcomes of these collaborations reveals a more worrying picture of the drug delivery industry (2).

According to the surveyed pharmaceutical companies, the number of collaborations initiated with drug delivery companies is actually on the decline. Moreover, the decrease in new alliances was compounded by an increase in the number of alliances terminated in 1999 compared with previous years (1). Over 50% of collaborations that were terminated were due to a lack of technical performance of the novel drug delivery technology, most often at the pre-clinical phase. Nearly 15% of terminated collaborations were the result of a portfolio review and around 12% of terminated collaborations were due to the availability of an alternative drug delivery technology opportunity (1).

Interestingly, the drug delivery industry has a different perception of the success of its deals. They reported that collaborations initiated with the pharmaceutical industry increased by 18% between 1997 and 1998 and predicted that this would more than double by 1999. Although terminations of alliances had doubled between 1997 and 1998, drug delivery companies felt that this trend had been reversed and that terminations were on the decrease in 1999 (2).

This suggests that drug delivery companies are failing to enter deals with the biggest pharmaceutical companies. Given that 75% of drug delivery companies are not profitable and require financial support from the pharmaceutical industry, this is a worrying scenario for their survival (1).

These findings were a surprise to the drug delivery company participants at the Workshop, including some companies whom already had experience of dealing with big pharmaceutical companies. Some of the drug delivery companies felt that big pharmaceutical companies did not indicate clearly what they required from a drug delivery partner and were not prepared for a an open partnership. For example, in initial discussions, drug delivery companies stated that many pharmaceutical companies were reluctant to reveal any information regarding their products in development as they considered it confidential information. The drug delivery companies found that this made their position difficult in terms of explaining how exactly their technology could benefit a product in development.

Managing a collaboration

It was evident from the Workshop discussions that many pharmaceutical and drug delivery companies continue to underestimate or neglect alliance management, leading to serious problems in the later stages of the project. It was agreed that trust is also key to the success of the project. The partners must have confidence in each other if they are to create an atmosphere where innovation is encouraged. Joint scientific teams are often employed so that there is adequate sharing of information and so that both partners can contribute to the advances made.

One view, expressed by drug delivery companies who had considerable experience of working with big pharma companies, was that both parties would gain simply from working with each other and that a formal contract would not be necessary for intangible benefits. A successful collaboration is dependent on the concept of co-creation where the outcome of the project represents the efforts made by both companies rather than just one partner. Innovation was therefore possible simply from working as a team.

Successfully integrating distinct and often disparate corporate cultures was also highlighted as essential in an alliance. A small drug delivery company will often have a need to seek to make announcements in order to attract investment from the financial community. However, a large pharmaceutical company prefers not to disclose information regarding the progress of a project to protect their intellectual property. The importance of recognising cultural differences was highlighted in the CMR International survey of drug delivery companies (2). Thirty percent of drug delivery company respondents stated that cultural differences led to problems in dealing with their pharmaceutical company partner (2).

Guaranteeing returns on R&D

In 2000, R&D expenditure is expected to reach US$46 billion reflecting the intense pressure within the pharmaceutical industry for new products (3).The future is likely to see pharmaceutical companies becoming even more selective regarding the drug delivery companies they will do business with in order to guarantee sufficient returns on their R&D investment (4). If drug delivery technology is to add value to the pharmaceutical business, it must help address two fundamental R&D problems: not only managing the high attrition rates for active substances, but also in reducing development time (4).

In practice, pharmaceutical companies had not always used these criteria to judge the merits of employing novel drug delivery technologies. Pharmaceutical companies have run into problems in the past when trying to apply drug delivery technologies to their active substances in development, realising only too late that the use of such technology can have a considerable impact on the cost and the time to develop these active substances.

There was general agreement by representatives of the pharmaceutical companies at the Workshop that drug delivery companies would obtain a more favourable reception when contacting pharmaceutical companies, if they had a better understanding of the overall drug development process. Some drug delivery companies were reported to have approached pharmaceutical companies with proposals that were incomplete and did not deal with issues such as proof of principle of the technology being applied to the drug in question, scaling up the procedure for eventual commercial purposes and minimising problems in compiling clinical dossiers. In these instances, drug delivery technology has frequently been turned down on the basis that it would add time to the drug development process and provide little extra in the way of returns once the drug was on the market compared with the standard formulation of the compound being developed within the pharmaceutical company.

End of Part 1. Click here to read Part 2.

For more information: Faiz Kermani, Research Associate, CMR International, Novellus Court, 61 South Street, Epsom, Surrey KT18 7PX, UK. Tel: 44-1372-846-120. Fax: 44-1372-846-101.